Interactive editor

Interactive code sections look like this. Make changes in the text box and click on the green “Run Code” button to see the results. Sometimes there will be a tab with a hint or solution.

- Run selected code:

- macOS: ⌘ + ↩︎/Return

- Windows/Linux: Ctrl + ↩︎/Enter

- To run the entire code cell, you can simply click the “Run code” button, or use the keyboard shortcut:

- Shift + ↩︎

If you’re curious how this works, each interactive code section uses the amazing {quarto-webr} package to run R directly in your browser.

Overview

Terminology

- Univariate data analysis - distribution of single variable

- Bivariate data analysis - relationship between two variables

- Multivariate data analysis - relationship between many variables at once, usually focusing on the relationship between two while conditioning for others

- Numerical variables can be classified as continuous or discrete based on whether or not the variable can take on an infinite number of values or only non-negative whole numbers, respectively.

- If the variable is categorical, we can determine if it is ordinal based on whether or not the levels have a natural ordering.

Data: Lending Club

Thousands of loans made through the Lending Club, which is a platform that allows individuals to lend to other individuals

Not all loans are created equal – ease of getting a loan depends on (apparent) ability to pay back the loan

Data includes loans made, these are not loan applications

Take a peek at data

library(openintro)

library(tidyverse)

glimpse(loans_full_schema)Rows: 10,000

Columns: 55

$ emp_title <chr> "global config engineer ", "warehouse…

$ emp_length <dbl> 3, 10, 3, 1, 10, NA, 10, 10, 10, 3, 1…

$ state <fct> NJ, HI, WI, PA, CA, KY, MI, AZ, NV, I…

$ homeownership <fct> MORTGAGE, RENT, RENT, RENT, RENT, OWN…

$ annual_income <dbl> 90000, 40000, 40000, 30000, 35000, 34…

$ verified_income <fct> Verified, Not Verified, Source Verifi…

$ debt_to_income <dbl> 18.01, 5.04, 21.15, 10.16, 57.96, 6.4…

$ annual_income_joint <dbl> NA, NA, NA, NA, 57000, NA, 155000, NA…

$ verification_income_joint <fct> , , , , Verified, , Not Verified, , ,…

$ debt_to_income_joint <dbl> NA, NA, NA, NA, 37.66, NA, 13.12, NA,…

$ delinq_2y <int> 0, 0, 0, 0, 0, 1, 0, 1, 1, 0, 0, 0, 0…

$ months_since_last_delinq <int> 38, NA, 28, NA, NA, 3, NA, 19, 18, NA…

$ earliest_credit_line <dbl> 2001, 1996, 2006, 2007, 2008, 1990, 2…

$ inquiries_last_12m <int> 6, 1, 4, 0, 7, 6, 1, 1, 3, 0, 4, 4, 8…

$ total_credit_lines <int> 28, 30, 31, 4, 22, 32, 12, 30, 35, 9,…

$ open_credit_lines <int> 10, 14, 10, 4, 16, 12, 10, 15, 21, 6,…

$ total_credit_limit <int> 70795, 28800, 24193, 25400, 69839, 42…

$ total_credit_utilized <int> 38767, 4321, 16000, 4997, 52722, 3898…

$ num_collections_last_12m <int> 0, 0, 0, 0, 0, 0, 0, 0, 0, 0, 0, 0, 0…

$ num_historical_failed_to_pay <int> 0, 1, 0, 1, 0, 0, 0, 0, 0, 0, 1, 0, 0…

$ months_since_90d_late <int> 38, NA, 28, NA, NA, 60, NA, 71, 18, N…

$ current_accounts_delinq <int> 0, 0, 0, 0, 0, 0, 0, 0, 0, 0, 0, 0, 0…

$ total_collection_amount_ever <int> 1250, 0, 432, 0, 0, 0, 0, 0, 0, 0, 0,…

$ current_installment_accounts <int> 2, 0, 1, 1, 1, 0, 2, 2, 6, 1, 2, 1, 2…

$ accounts_opened_24m <int> 5, 11, 13, 1, 6, 2, 1, 4, 10, 5, 6, 7…

$ months_since_last_credit_inquiry <int> 5, 8, 7, 15, 4, 5, 9, 7, 4, 17, 3, 4,…

$ num_satisfactory_accounts <int> 10, 14, 10, 4, 16, 12, 10, 15, 21, 6,…

$ num_accounts_120d_past_due <int> 0, 0, 0, 0, 0, 0, 0, NA, 0, 0, 0, 0, …

$ num_accounts_30d_past_due <int> 0, 0, 0, 0, 0, 0, 0, 0, 0, 0, 0, 0, 0…

$ num_active_debit_accounts <int> 2, 3, 3, 2, 10, 1, 3, 5, 11, 3, 2, 2,…

$ total_debit_limit <int> 11100, 16500, 4300, 19400, 32700, 272…

$ num_total_cc_accounts <int> 14, 24, 14, 3, 20, 27, 8, 16, 19, 7, …

$ num_open_cc_accounts <int> 8, 14, 8, 3, 15, 12, 7, 12, 14, 5, 8,…

$ num_cc_carrying_balance <int> 6, 4, 6, 2, 13, 5, 6, 10, 14, 3, 5, 3…

$ num_mort_accounts <int> 1, 0, 0, 0, 0, 3, 2, 7, 2, 0, 2, 3, 3…

$ account_never_delinq_percent <dbl> 92.9, 100.0, 93.5, 100.0, 100.0, 78.1…

$ tax_liens <int> 0, 0, 0, 1, 0, 0, 0, 0, 0, 0, 0, 0, 0…

$ public_record_bankrupt <int> 0, 1, 0, 0, 0, 0, 0, 0, 0, 0, 1, 0, 0…

$ loan_purpose <fct> moving, debt_consolidation, other, de…

$ application_type <fct> individual, individual, individual, i…

$ loan_amount <int> 28000, 5000, 2000, 21600, 23000, 5000…

$ term <dbl> 60, 36, 36, 36, 36, 36, 60, 60, 36, 3…

$ interest_rate <dbl> 14.07, 12.61, 17.09, 6.72, 14.07, 6.7…

$ installment <dbl> 652.53, 167.54, 71.40, 664.19, 786.87…

$ grade <ord> C, C, D, A, C, A, C, B, C, A, C, B, C…

$ sub_grade <fct> C3, C1, D1, A3, C3, A3, C2, B5, C2, A…

$ issue_month <fct> Mar-2018, Feb-2018, Feb-2018, Jan-201…

$ loan_status <fct> Current, Current, Current, Current, C…

$ initial_listing_status <fct> whole, whole, fractional, whole, whol…

$ disbursement_method <fct> Cash, Cash, Cash, Cash, Cash, Cash, C…

$ balance <dbl> 27015.86, 4651.37, 1824.63, 18853.26,…

$ paid_total <dbl> 1999.330, 499.120, 281.800, 3312.890,…

$ paid_principal <dbl> 984.14, 348.63, 175.37, 2746.74, 1569…

$ paid_interest <dbl> 1015.19, 150.49, 106.43, 566.15, 754.…

$ paid_late_fees <dbl> 0, 0, 0, 0, 0, 0, 0, 0, 0, 0, 0, 0, 0…Selected variables

loans <- loans_full_schema %>%

select(loan_amount, interest_rate, term, grade,

state, annual_income, homeownership, debt_to_income)

glimpse(loans)Rows: 10,000

Columns: 8

$ loan_amount <int> 28000, 5000, 2000, 21600, 23000, 5000, 24000, 20000, 20…

$ interest_rate <dbl> 14.07, 12.61, 17.09, 6.72, 14.07, 6.72, 13.59, 11.99, 1…

$ term <dbl> 60, 36, 36, 36, 36, 36, 60, 60, 36, 36, 60, 60, 36, 60,…

$ grade <ord> C, C, D, A, C, A, C, B, C, A, C, B, C, B, D, D, D, F, E…

$ state <fct> NJ, HI, WI, PA, CA, KY, MI, AZ, NV, IL, IL, FL, SC, CO,…

$ annual_income <dbl> 90000, 40000, 40000, 30000, 35000, 34000, 35000, 110000…

$ homeownership <fct> MORTGAGE, RENT, RENT, RENT, RENT, OWN, MORTGAGE, MORTGA…

$ debt_to_income <dbl> 18.01, 5.04, 21.15, 10.16, 57.96, 6.46, 23.66, 16.19, 3…Selected variables

| variable | type | description |

|---|---|---|

loan_amount |

numerical, continuous | Amount of the loan received, in US dollars |

interest_rate |

numerical, continuous | Interest rate on the loan, in an annual percentage |

term |

numerical, discrete | The length of the loan, which is always set as a whole number of months |

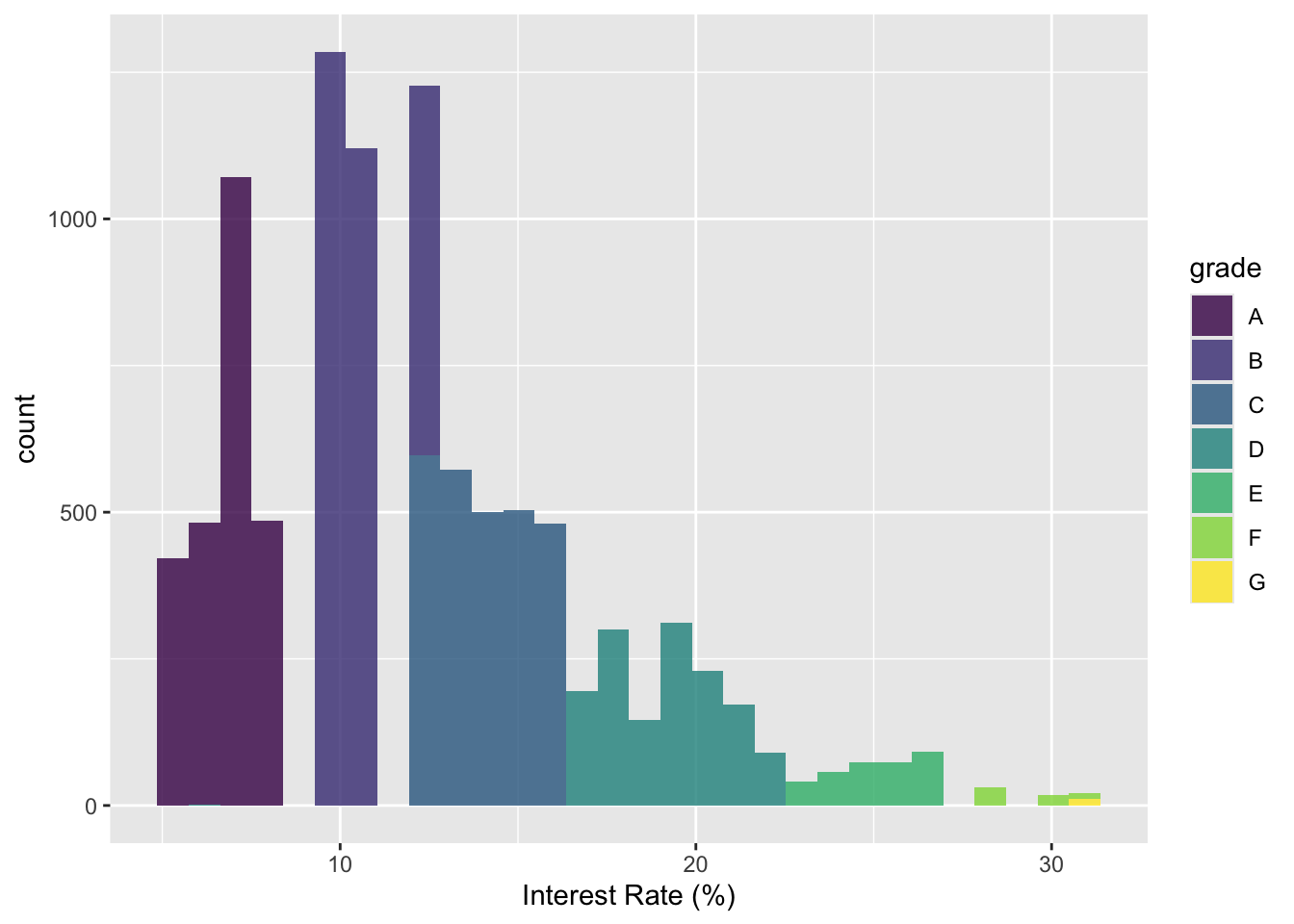

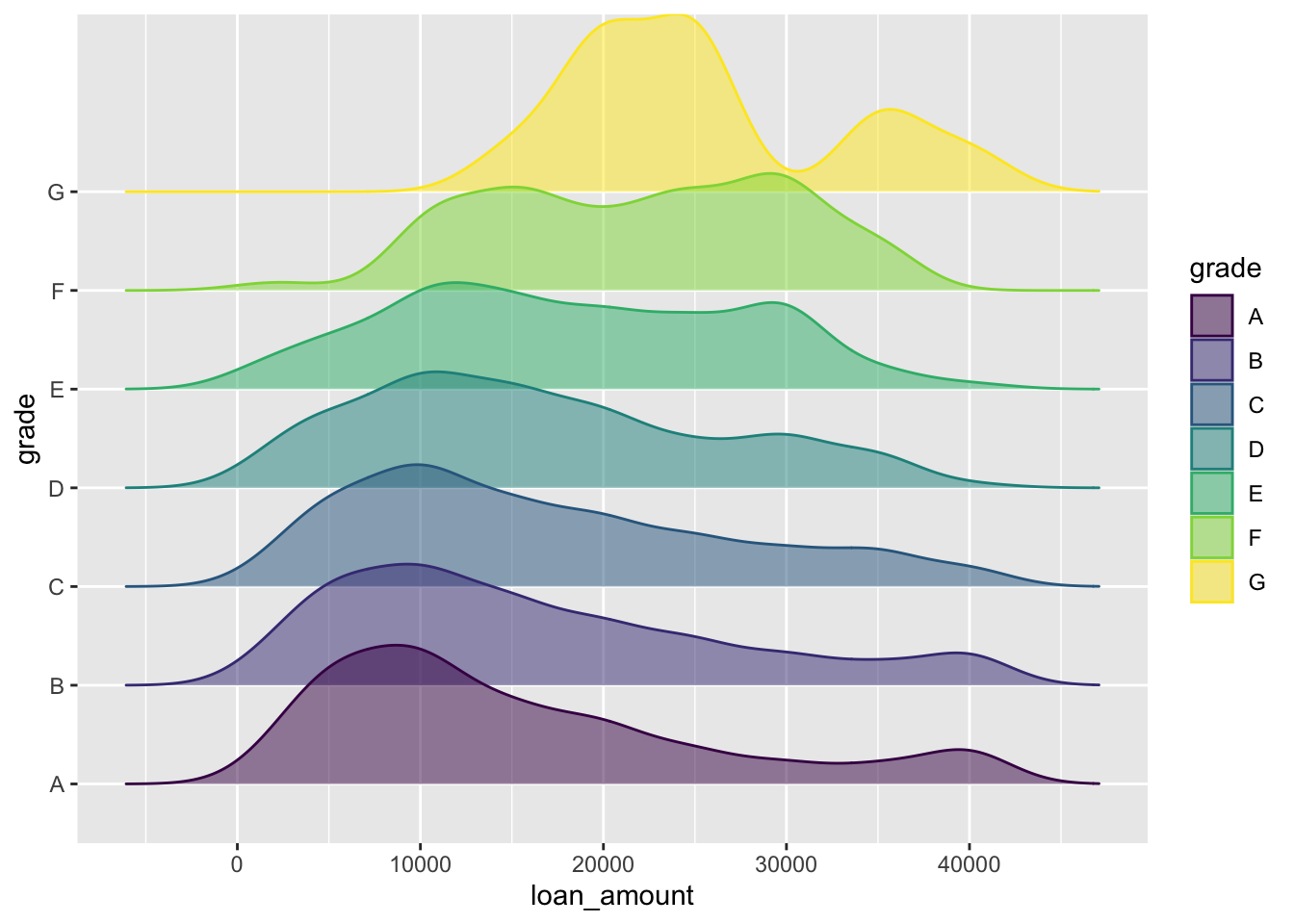

grade |

categorical, ordinal | Loan grade, which takes a values A through G and represents the quality of the loan and its likelihood of being repaid |

state |

categorical, not ordinal | US state where the borrower resides |

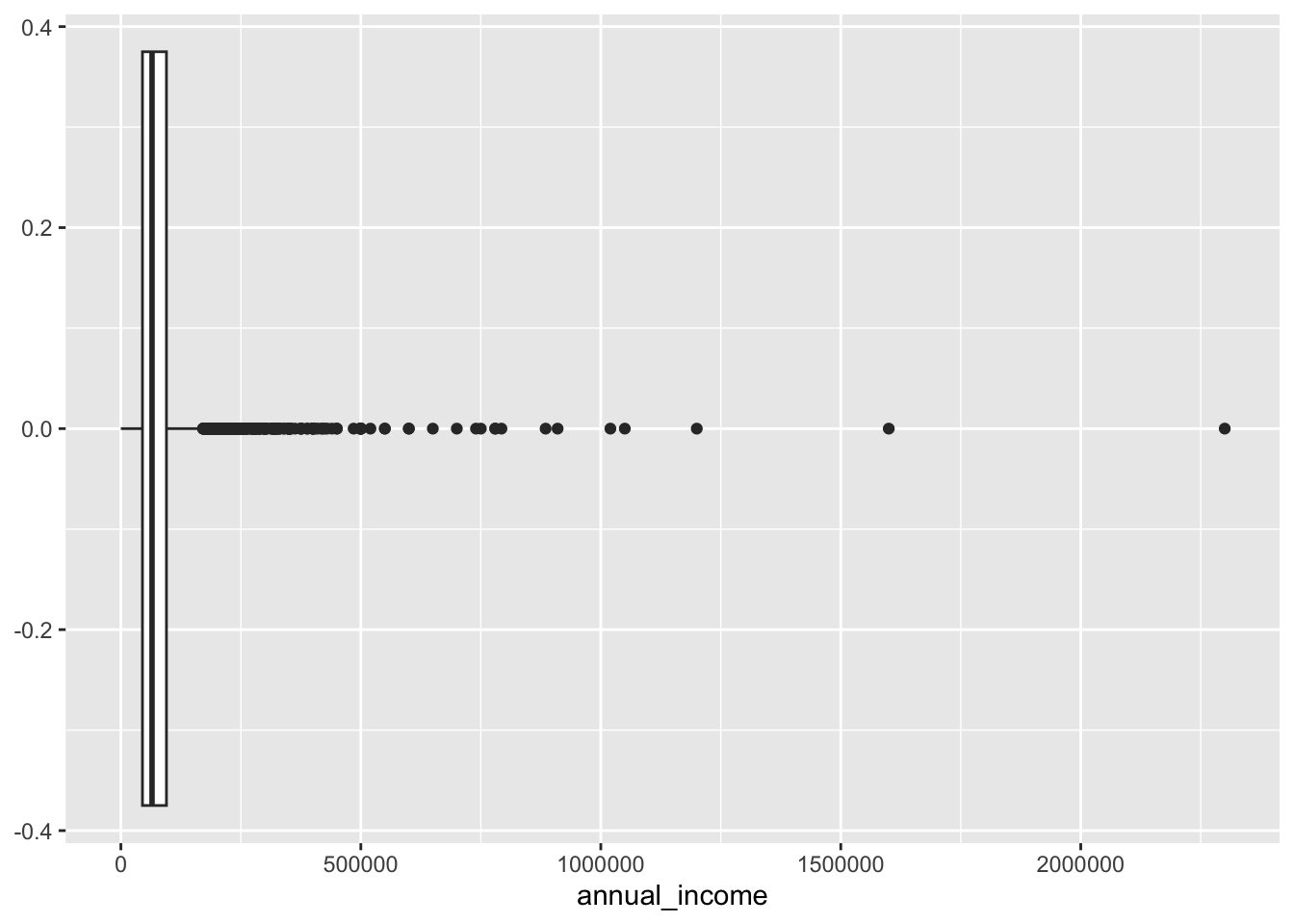

annual_income |

numerical, continuous | Borrower’s annual income, including any second income, in US dollars |

homeownership |

categorical, not ordinal | Indicates whether the person owns, owns but has a mortgage, or rents |

debt_to_income |

numerical, continuous | Debt-to-income ratio |

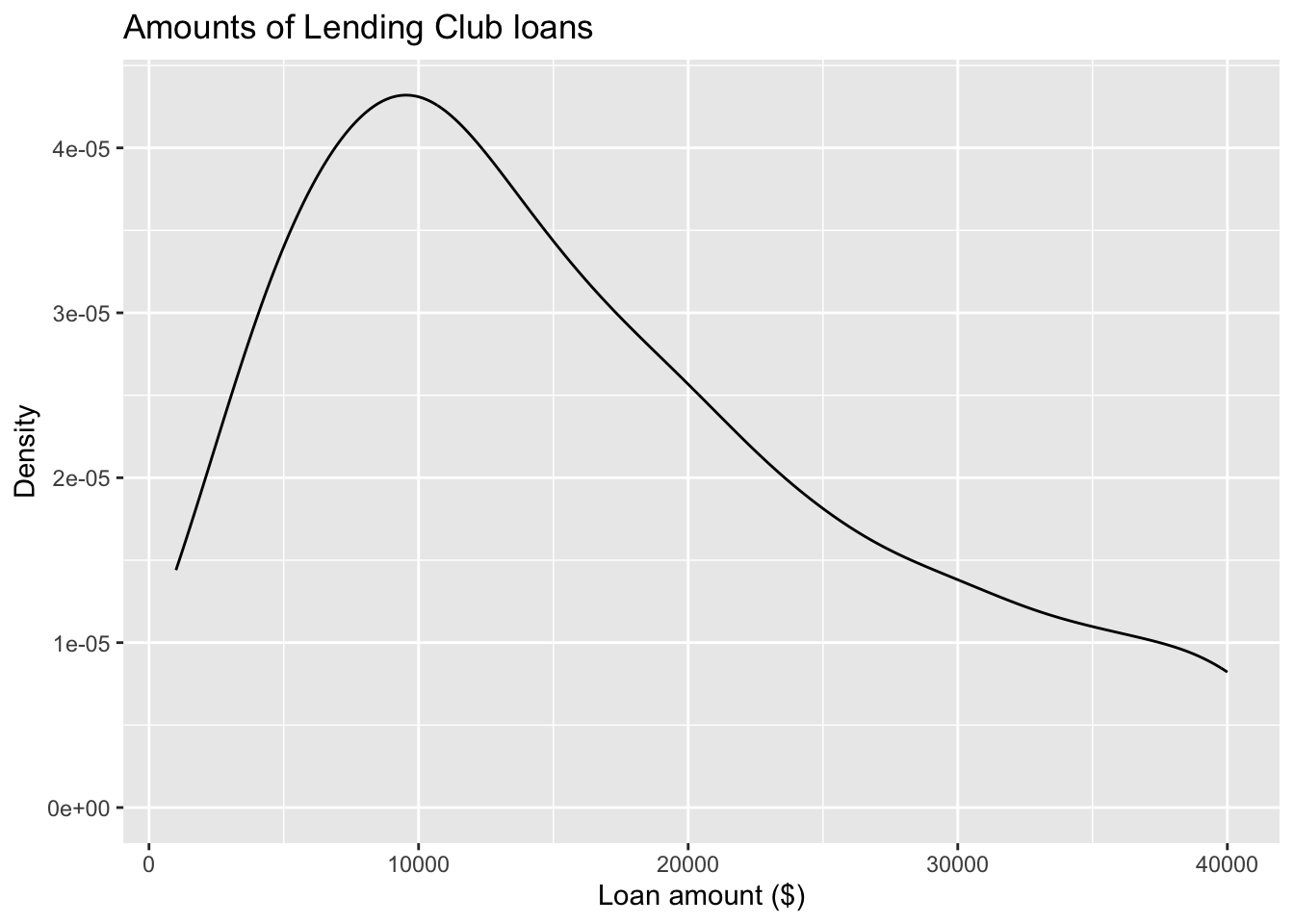

Visualizing Continous data

Describing shapes of numerical distributions

- shape:

- skewness: right-skewed, left-skewed, symmetric (skew is to the side of the longer tail)

- modality: unimodal, bimodal, multimodal, uniform

- center: mean (

mean), median (median), mode (not always useful) - spread: range (

range), standard deviation (sd), inter-quartile range (IQR) - unusual observations

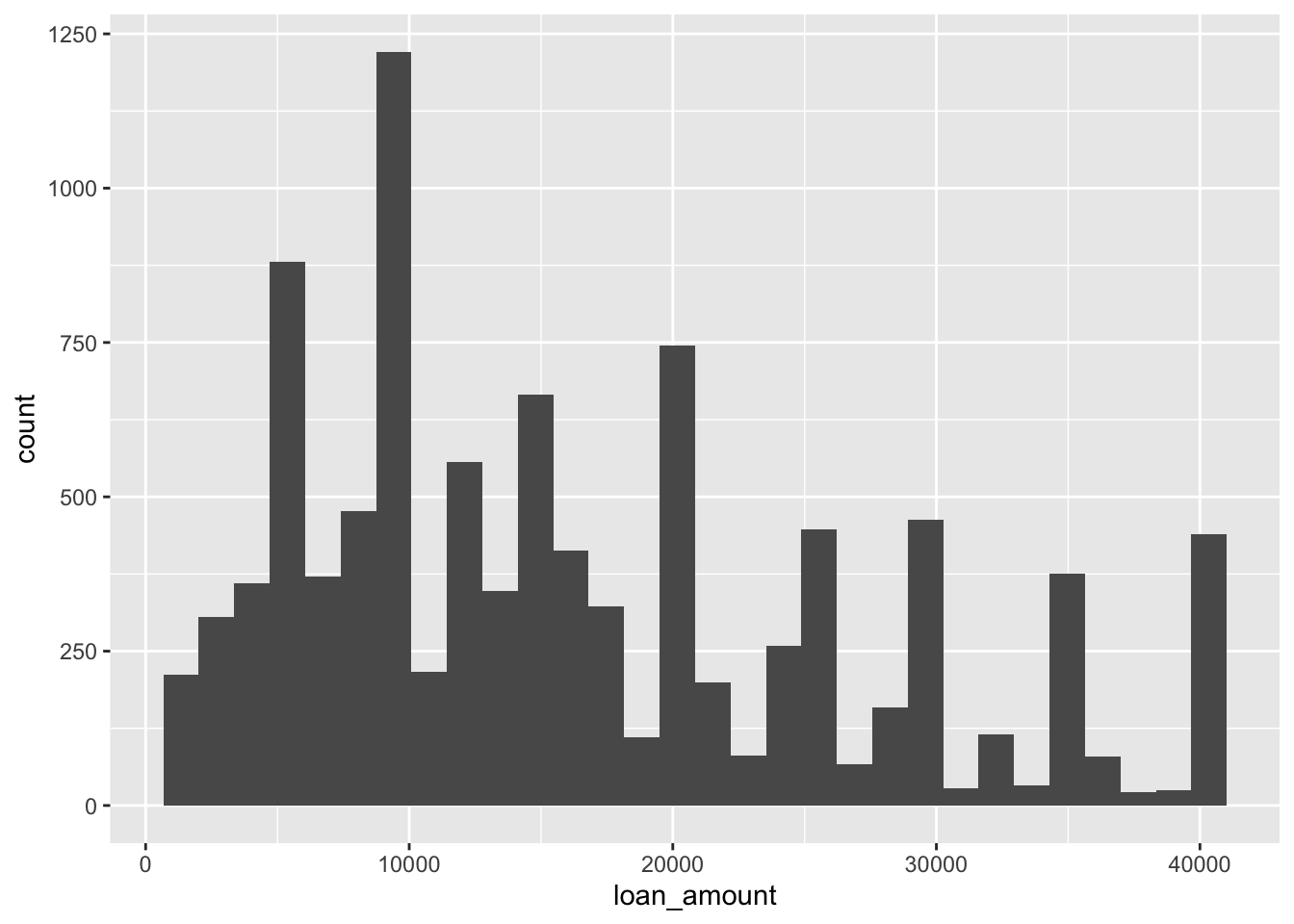

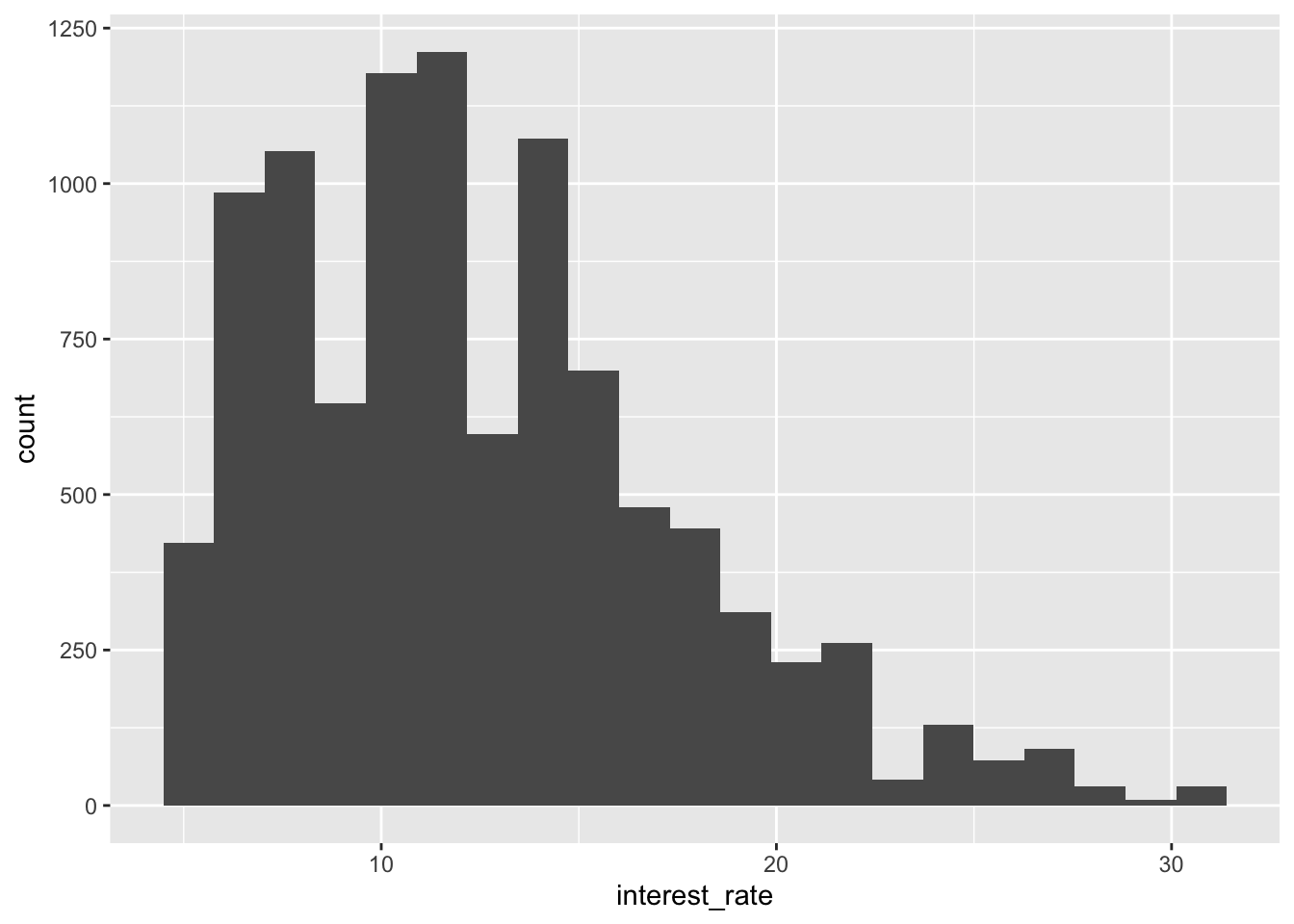

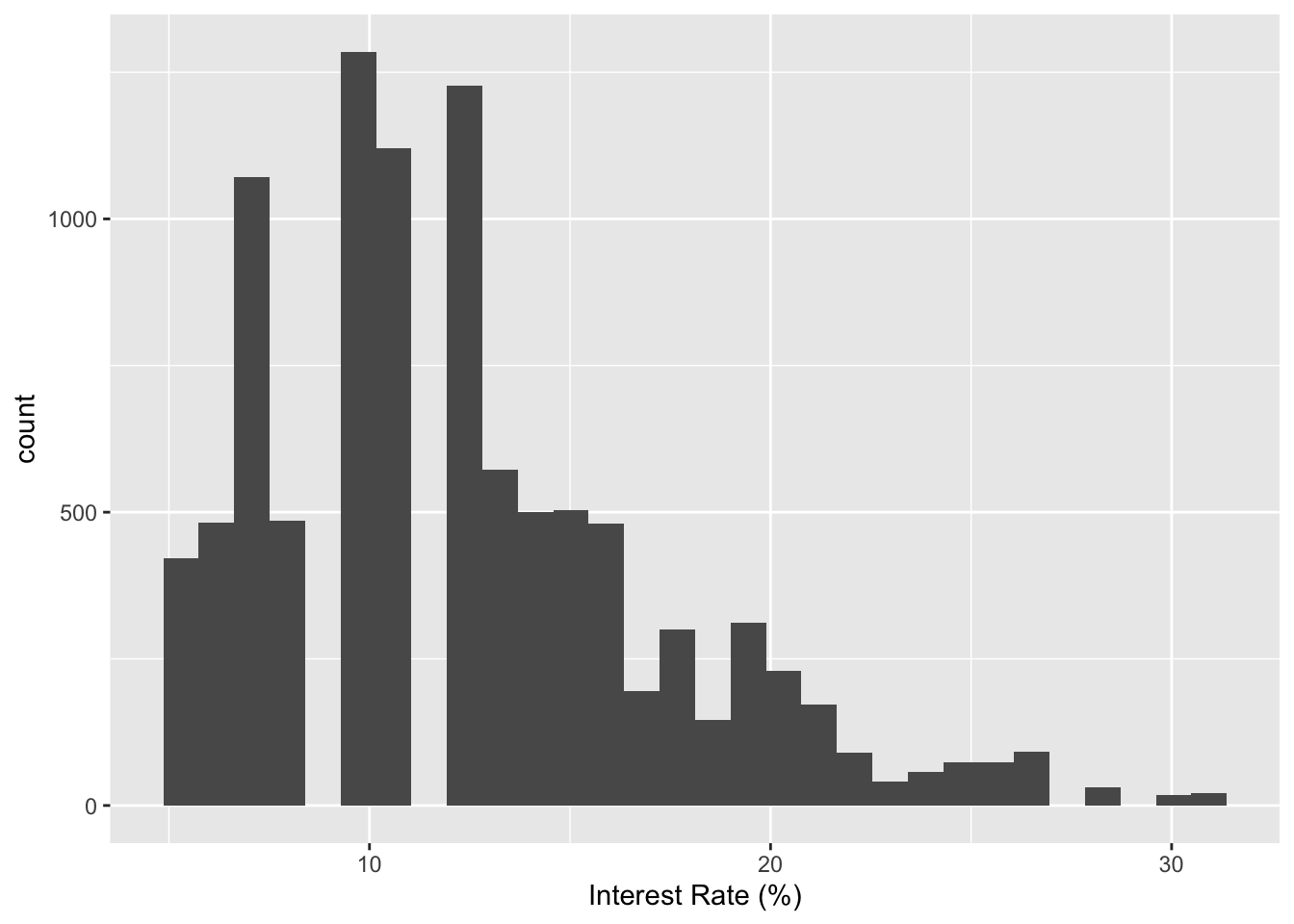

Histogram

Histogram

summary(loans$loan_amount) Min. 1st Qu. Median Mean 3rd Qu. Max.

1000 8000 14500 16362 24000 40000 ggplot(loans, aes(x = loan_amount)) +

geom_histogram()`stat_bin()` using `bins = 30`. Pick better value with `binwidth`.Create a histogram for the interest_rate variable.

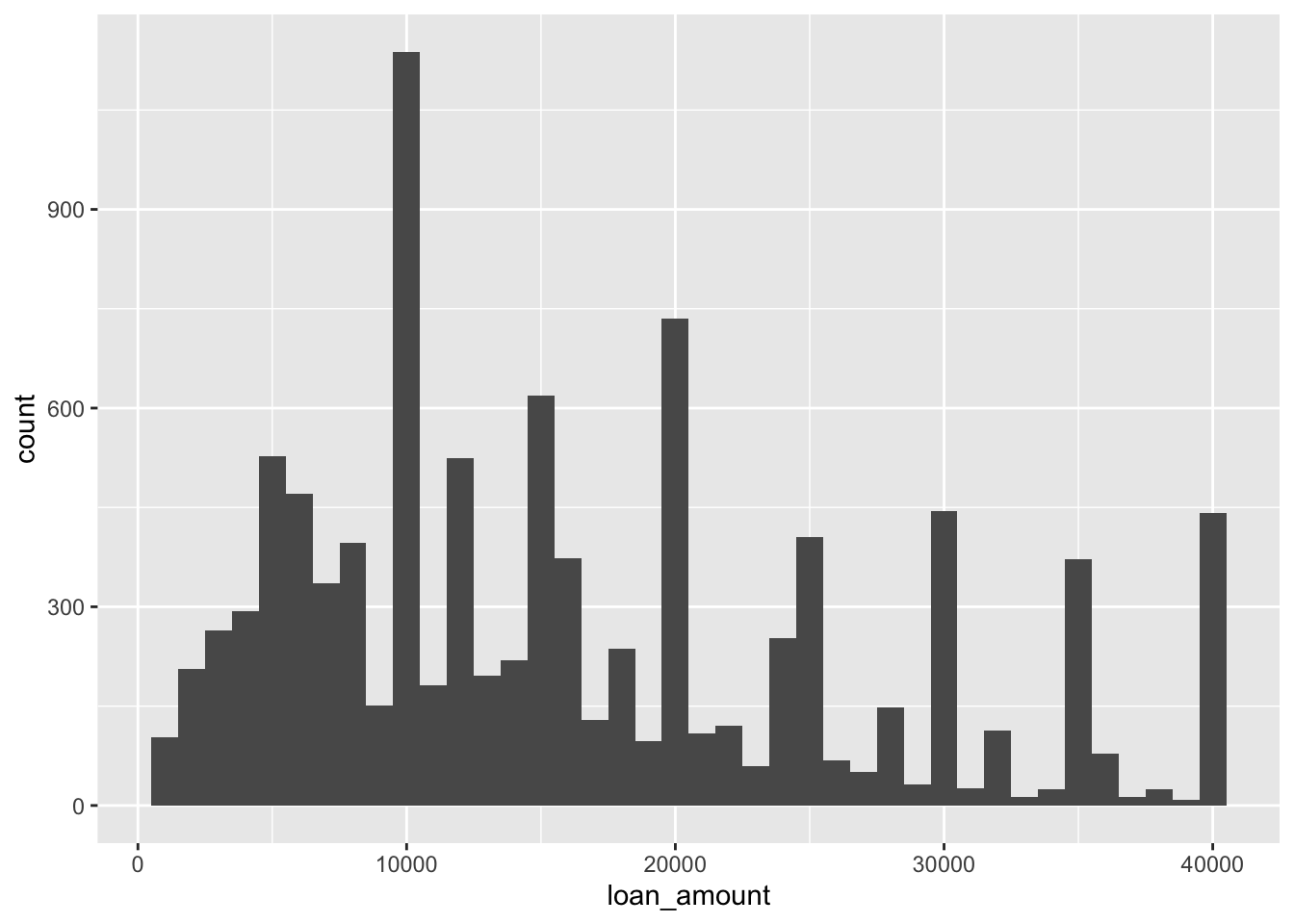

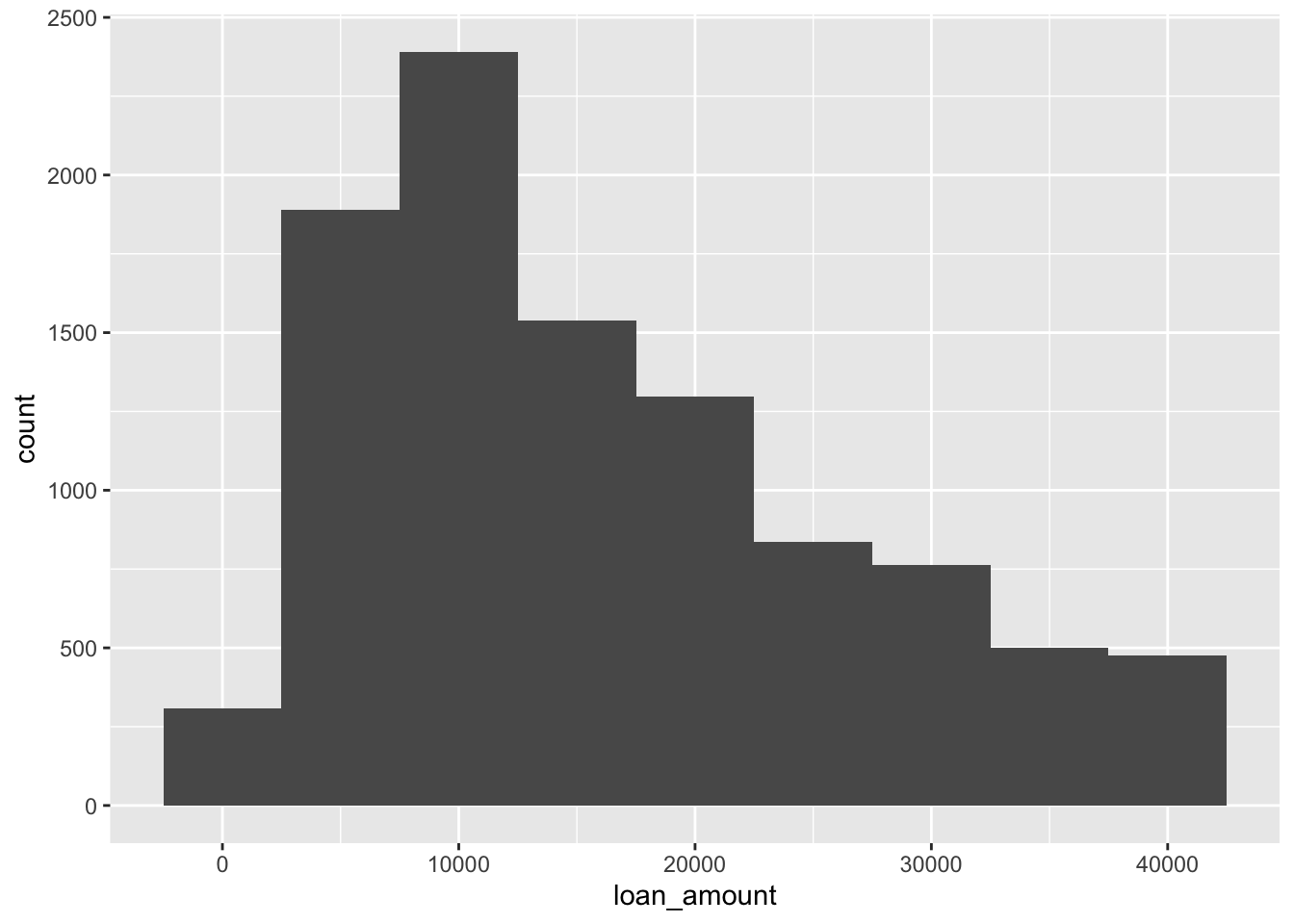

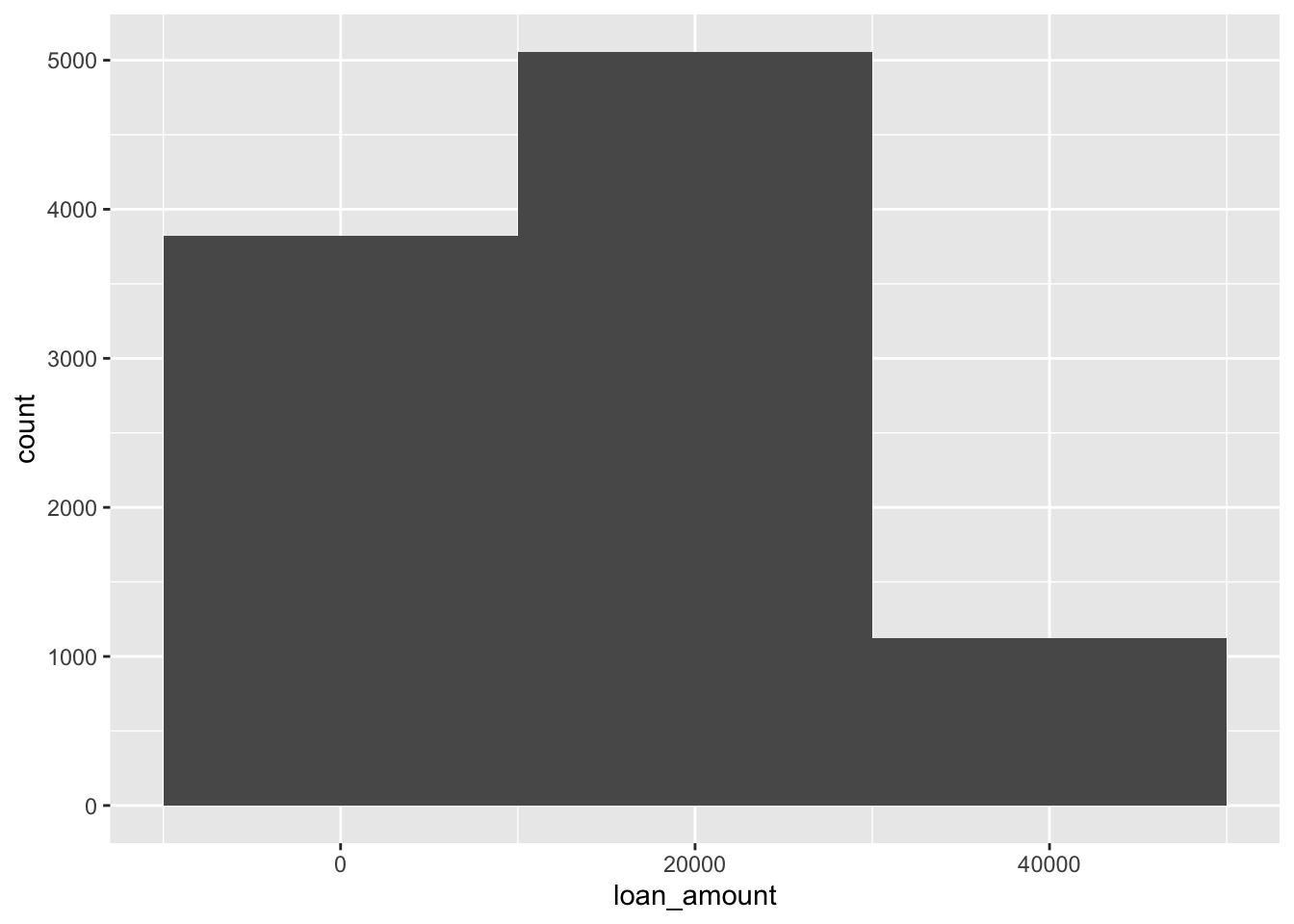

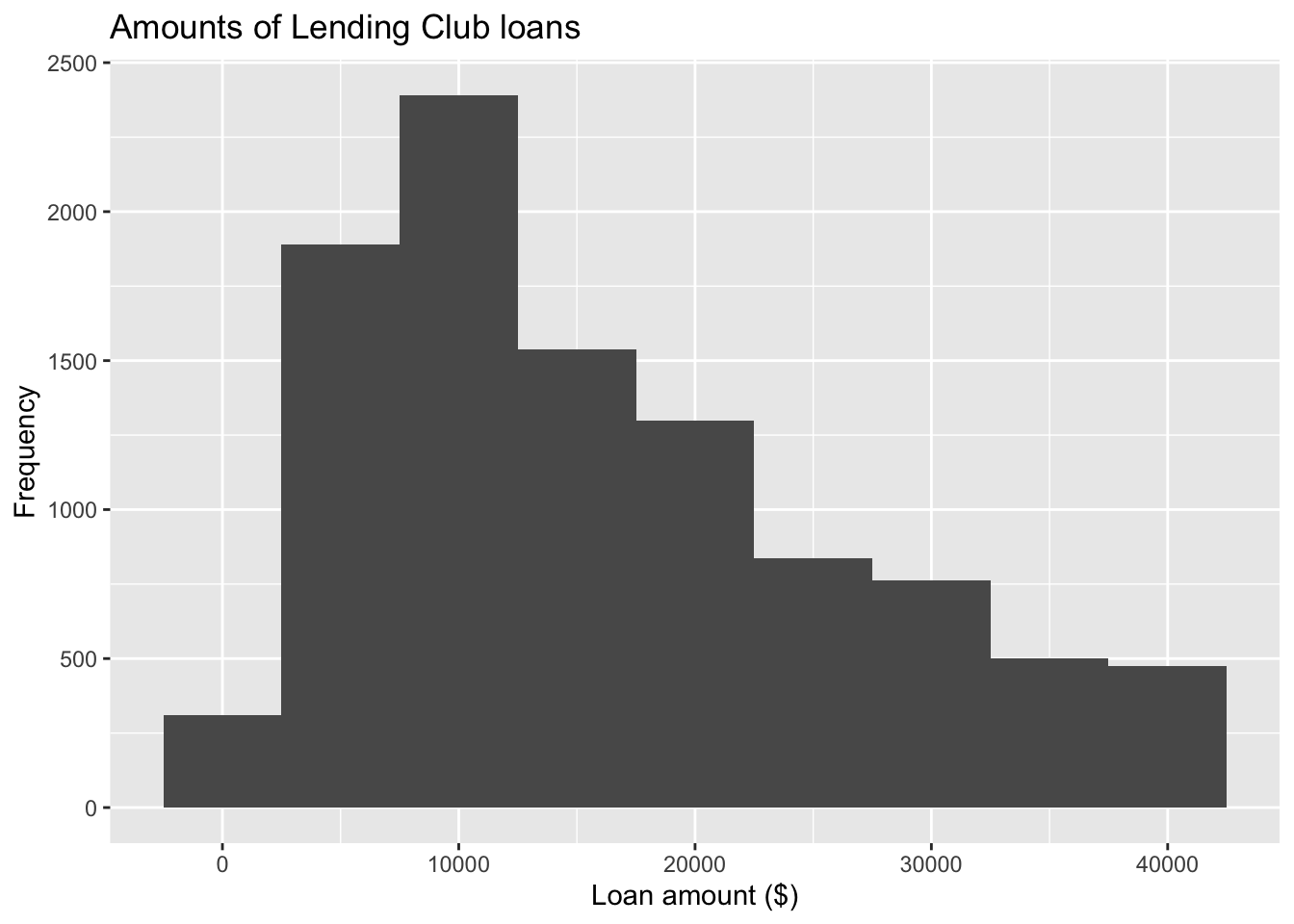

Histograms and binwidth

Customizing labels of histograms

ggplot(loans, aes(x = loan_amount)) +

geom_histogram(binwidth = 5000) +

1 labs(

x = "Loan amount ($)",

y = "Frequency",

title = "Amounts of Lending Club loans"

) - 1

-

labs()can modify axis, legend, and plot labels. You can also usexlabandylabto modify labels for x and y axis, respectively.

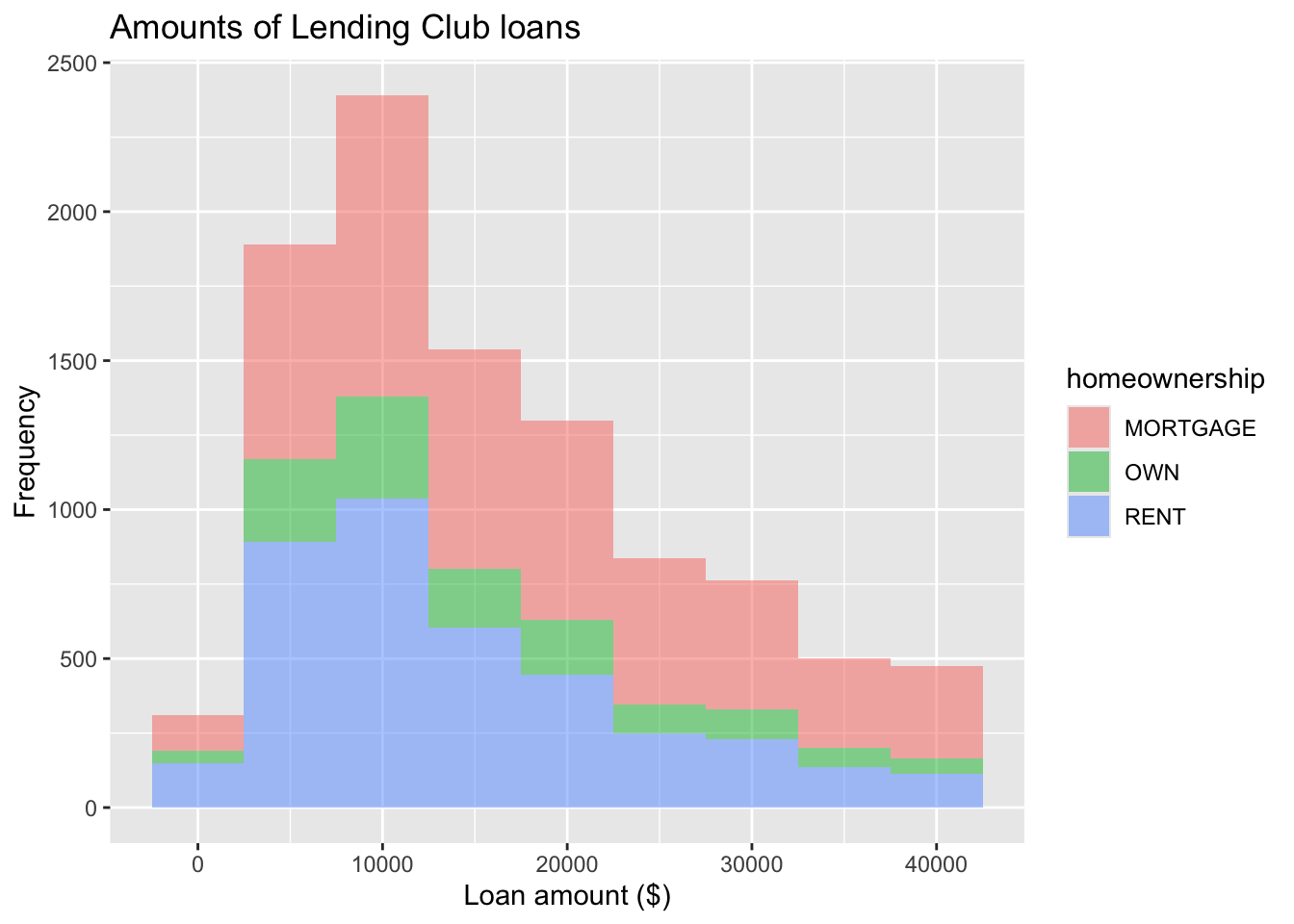

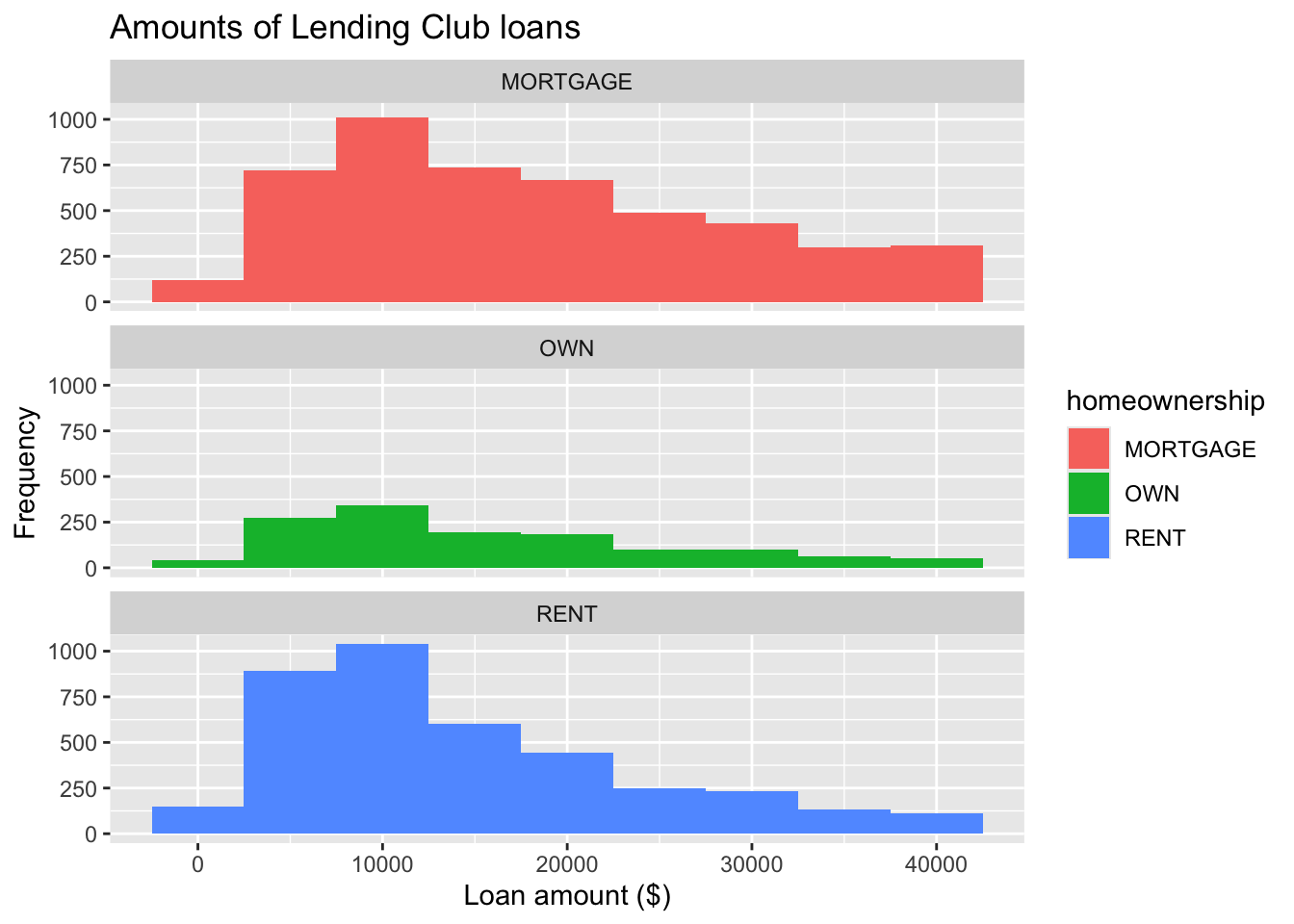

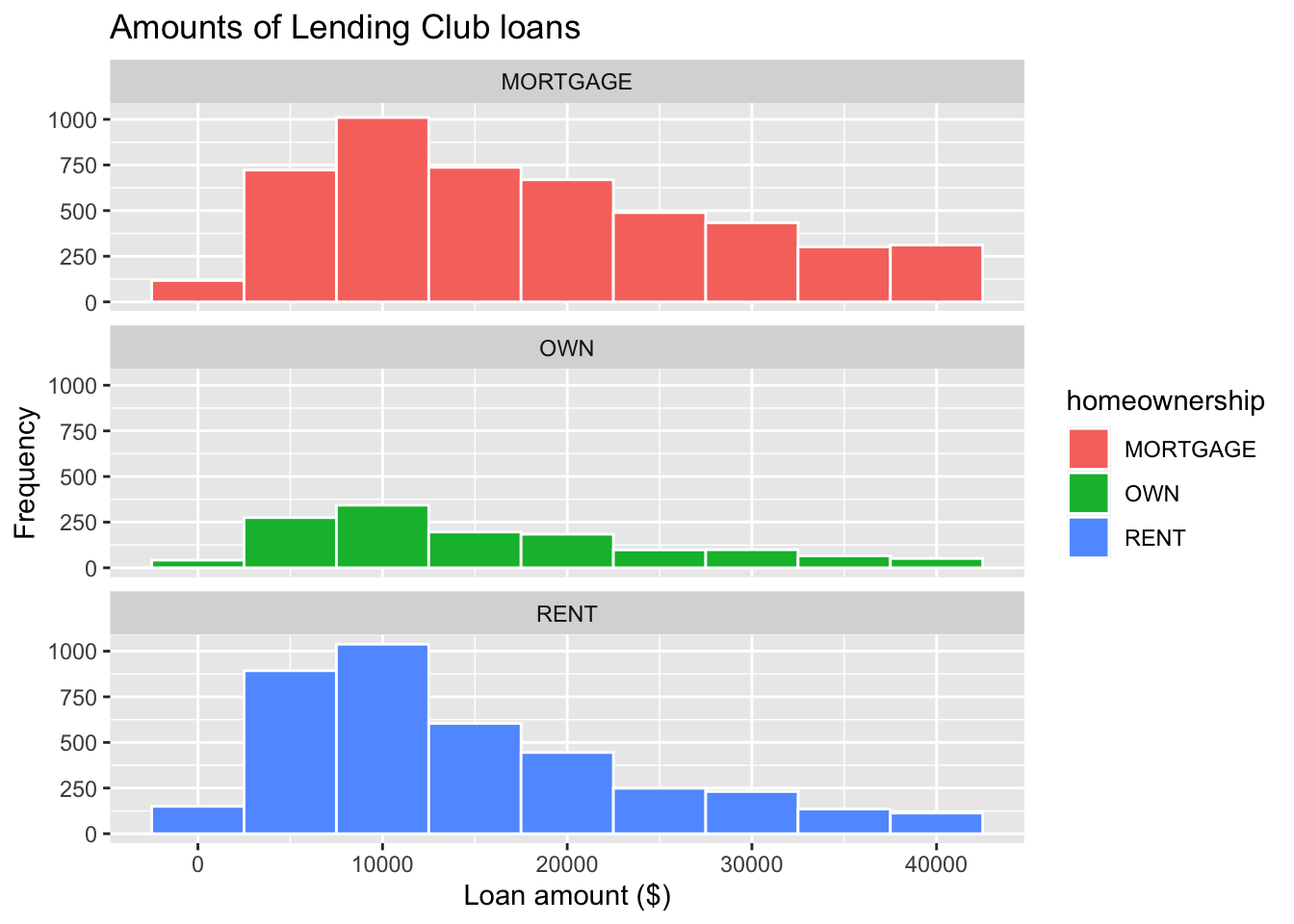

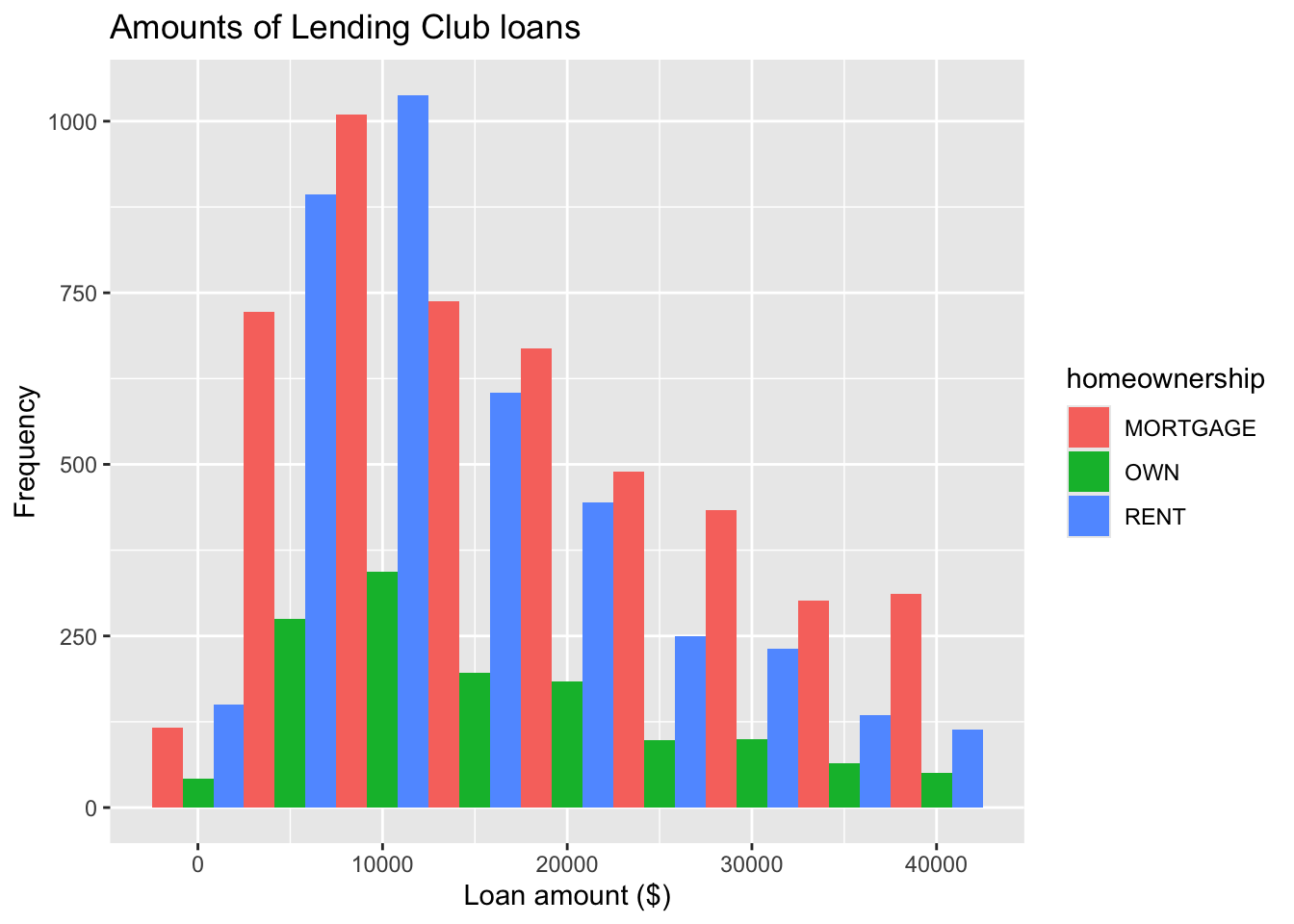

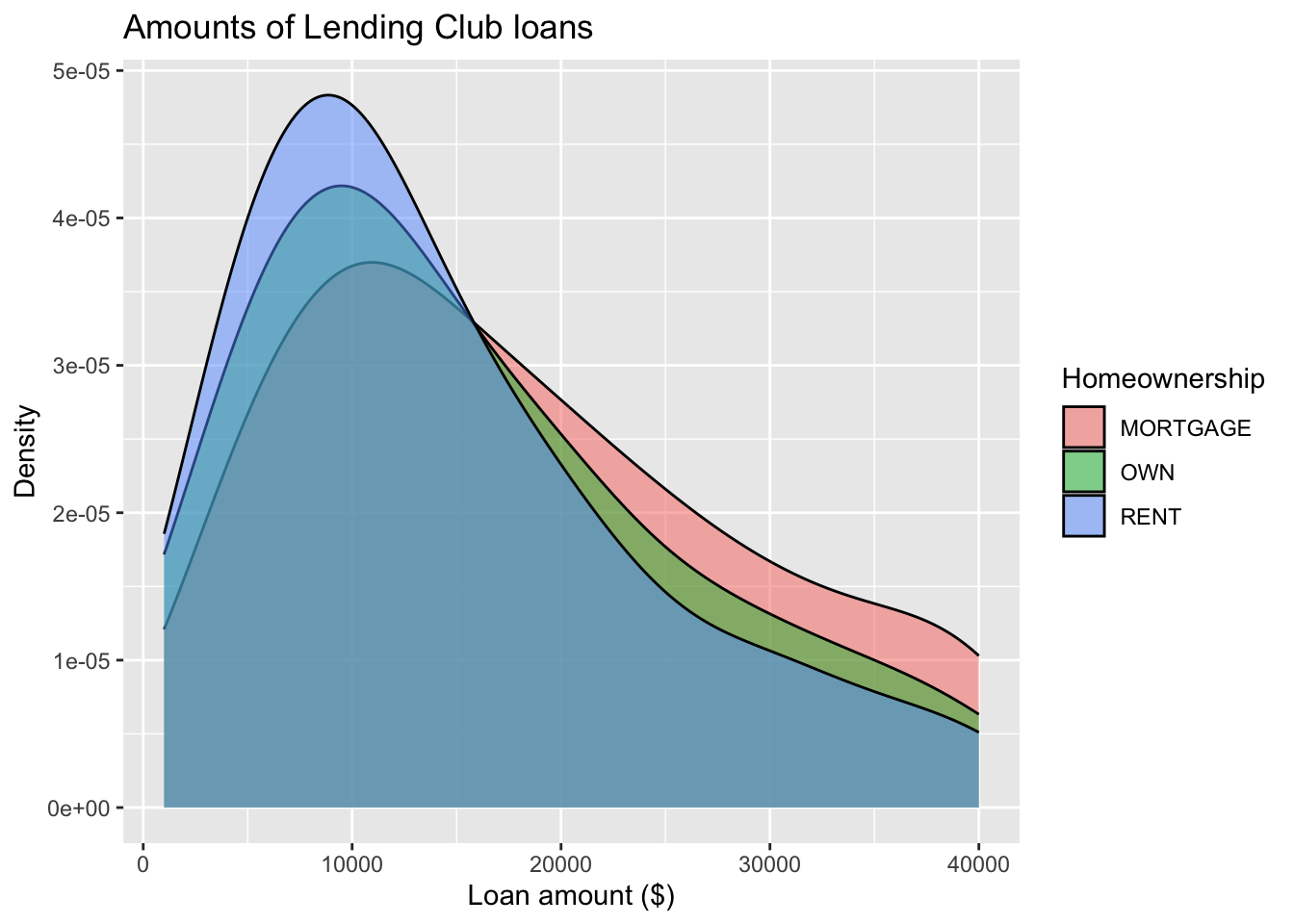

Fill with a categorical variable

ggplot(loans, aes(x = loan_amount,

1 fill = homeownership)) +

geom_histogram(binwidth = 5000,

2 alpha = 0.5) +

labs(

x = "Loan amount ($)",

y = "Frequency",

title = "Amounts of Lending Club loans"

)- 1

-

Add

homeownershipto fill with certain category - 2

-

Add

alpha=argument to set up transparency for the figure

Facet with a categorical variable

Color of bar borders

Position of Histogram Bars

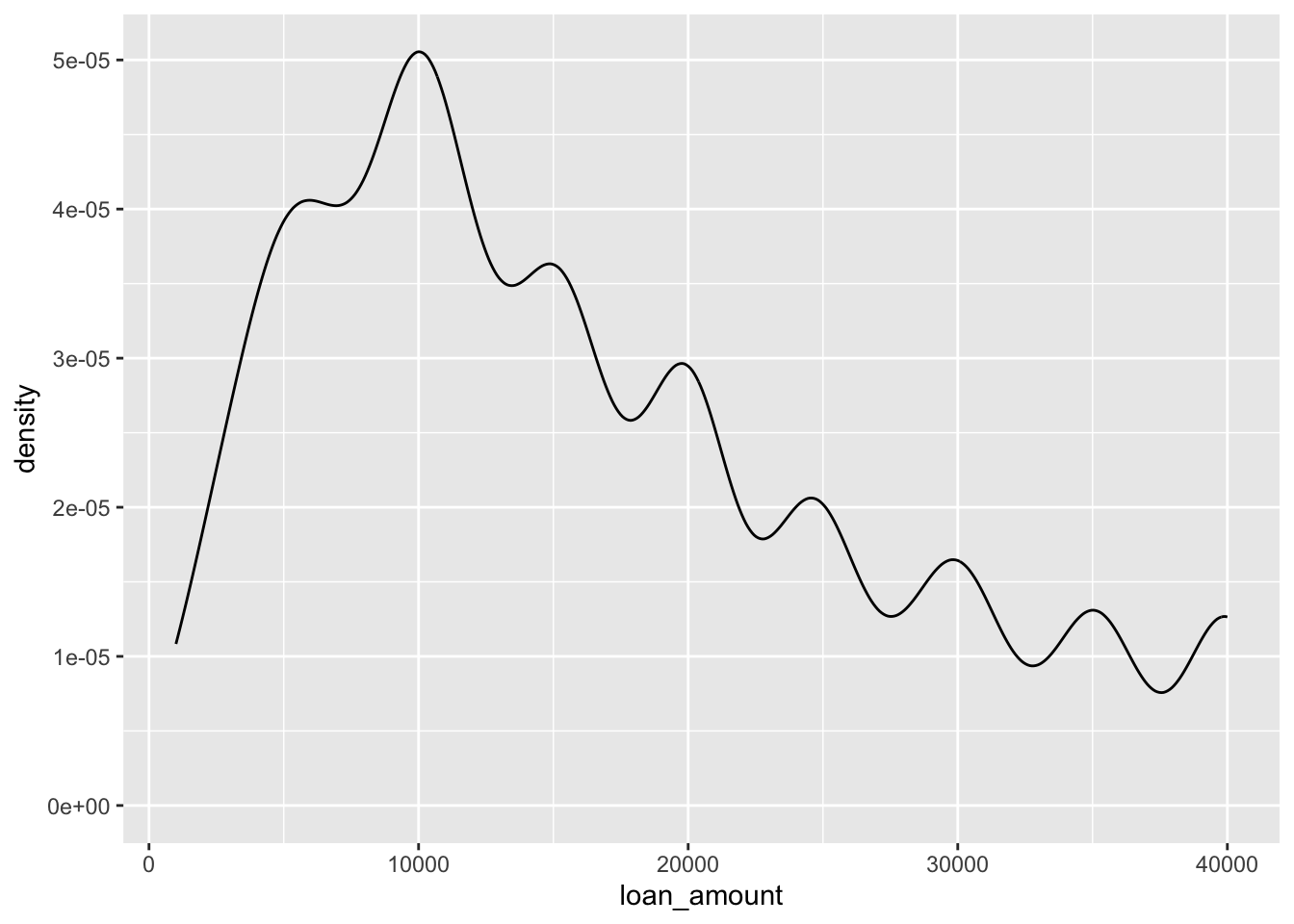

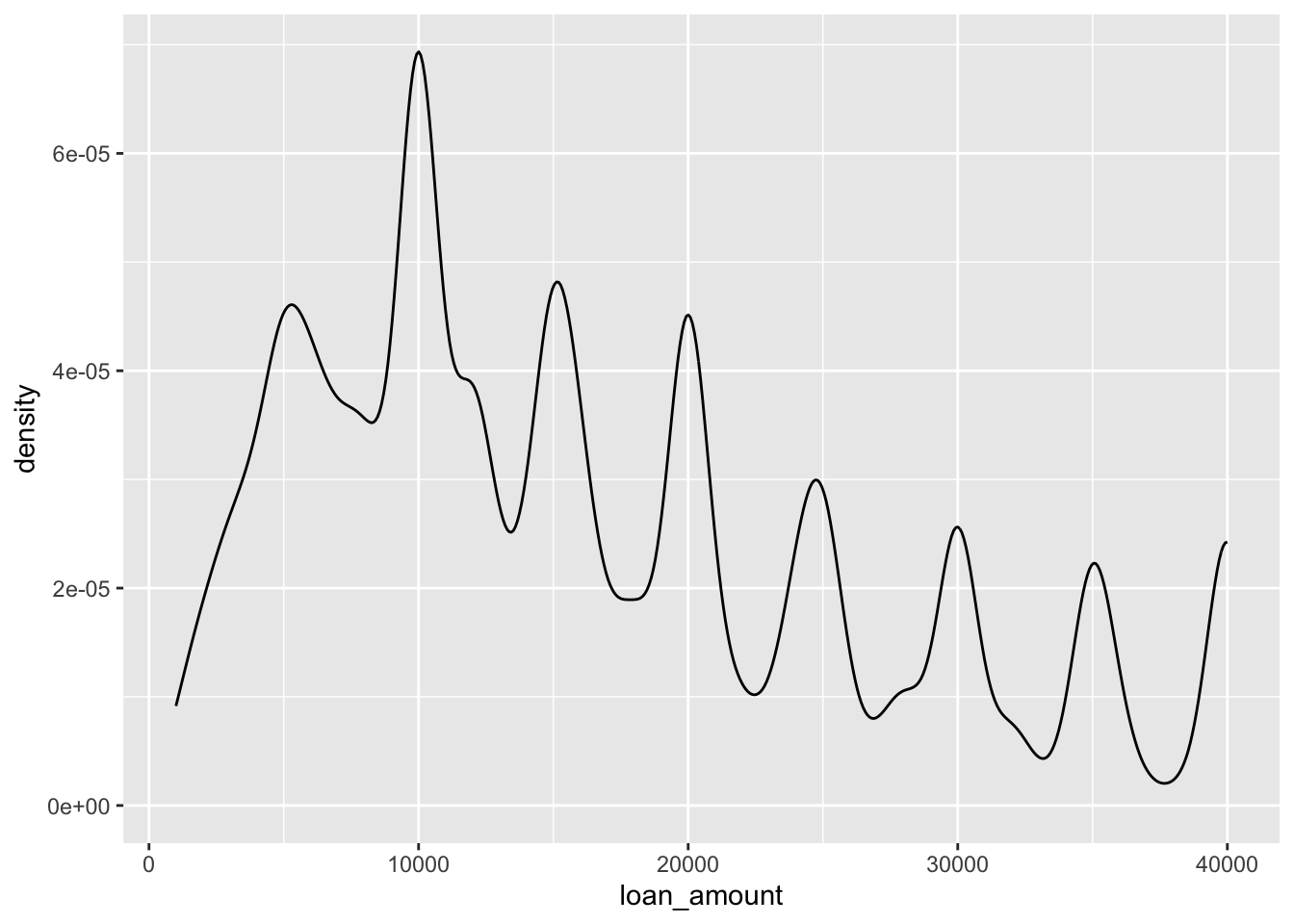

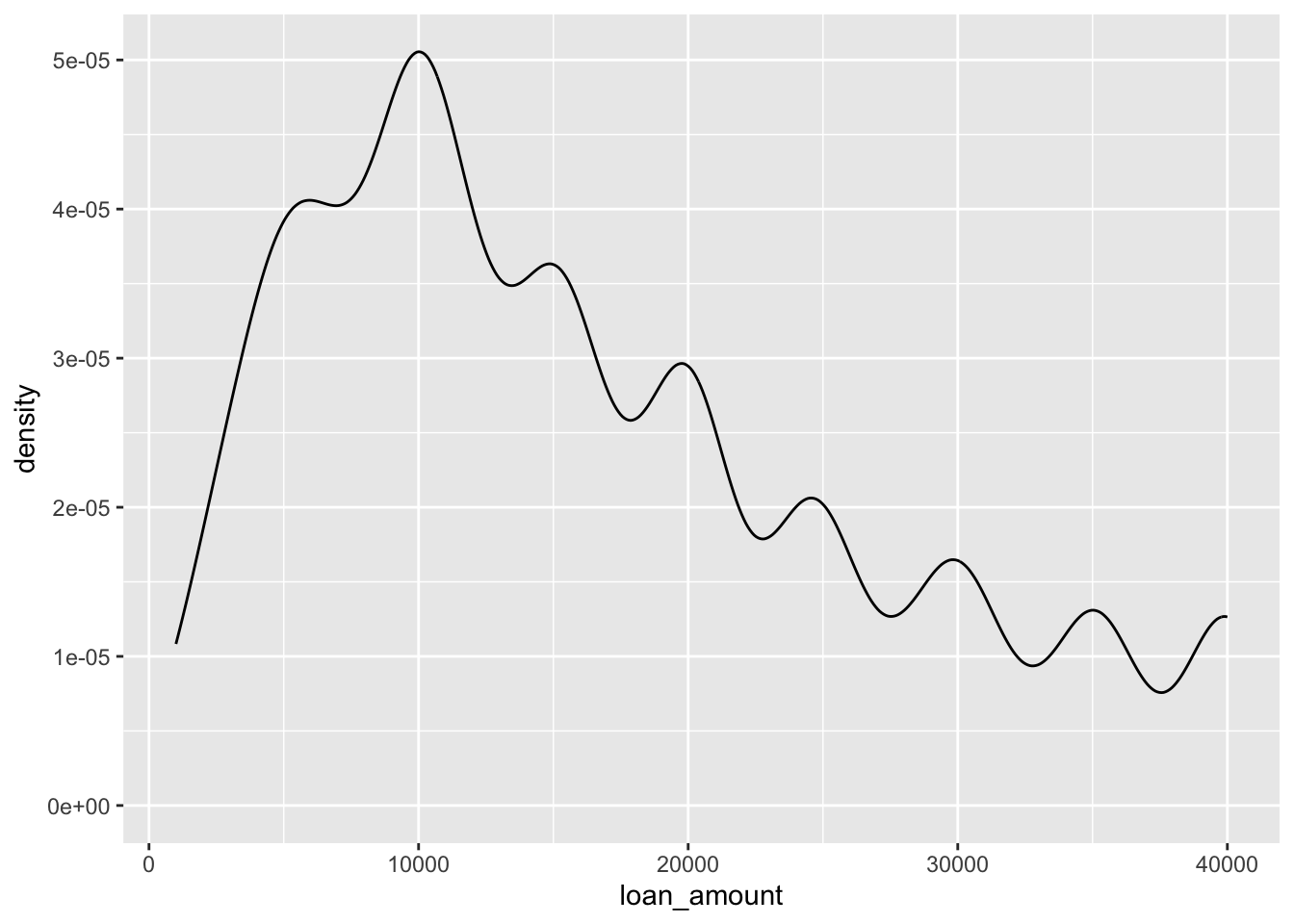

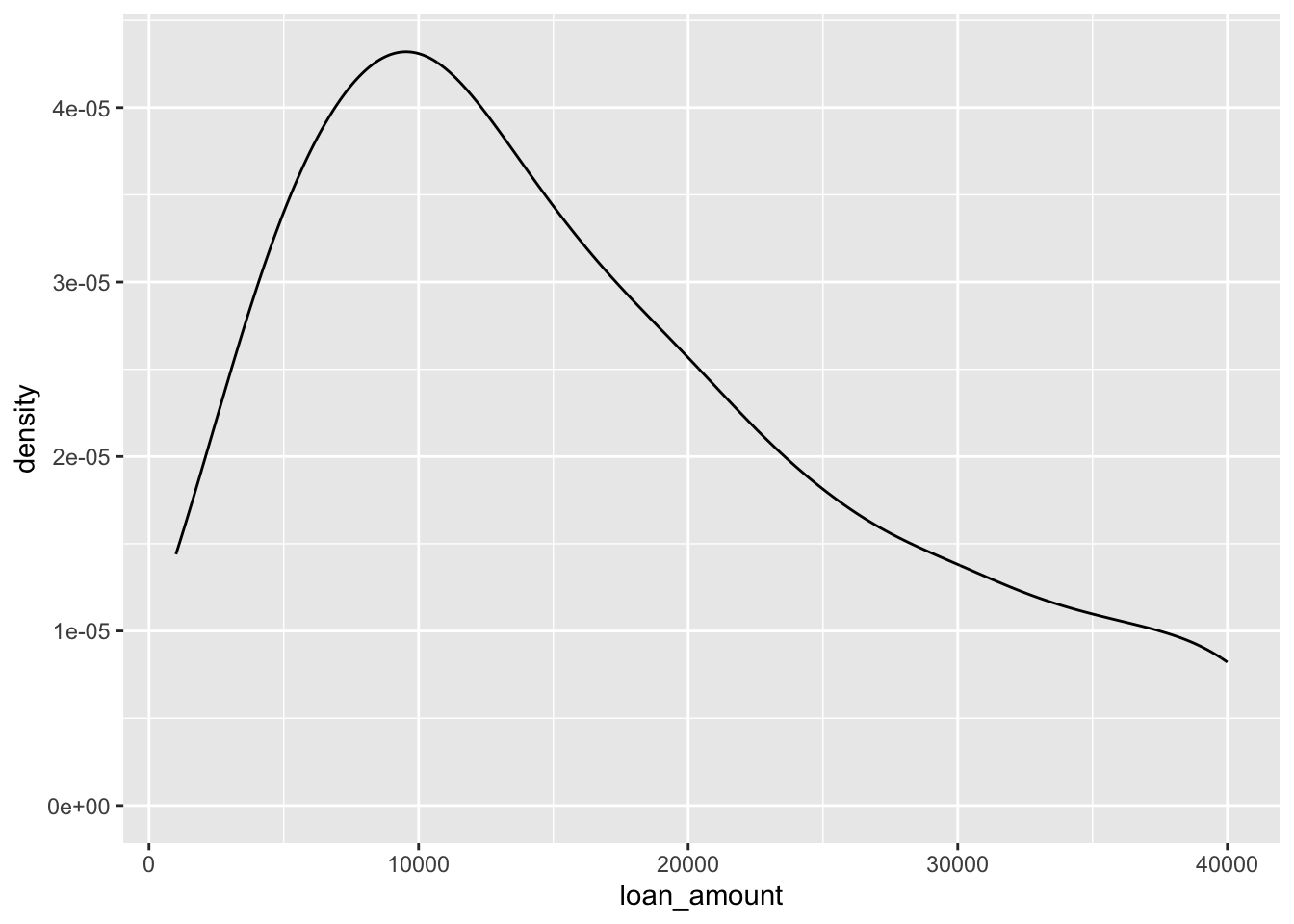

Density plot

Density plot

Density plots and adjusting bandwidth

Customizing density plots

Adding a categorical variable

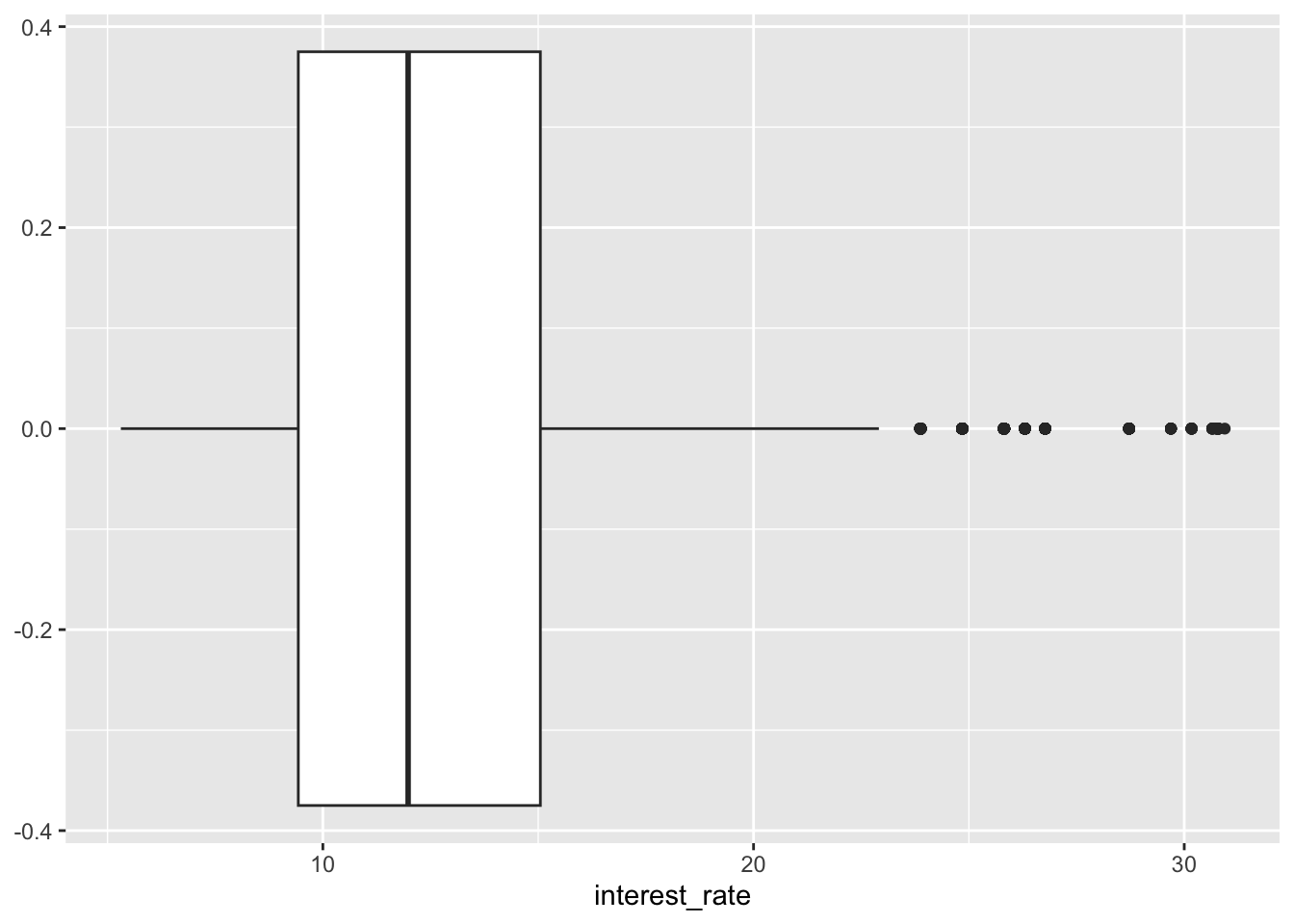

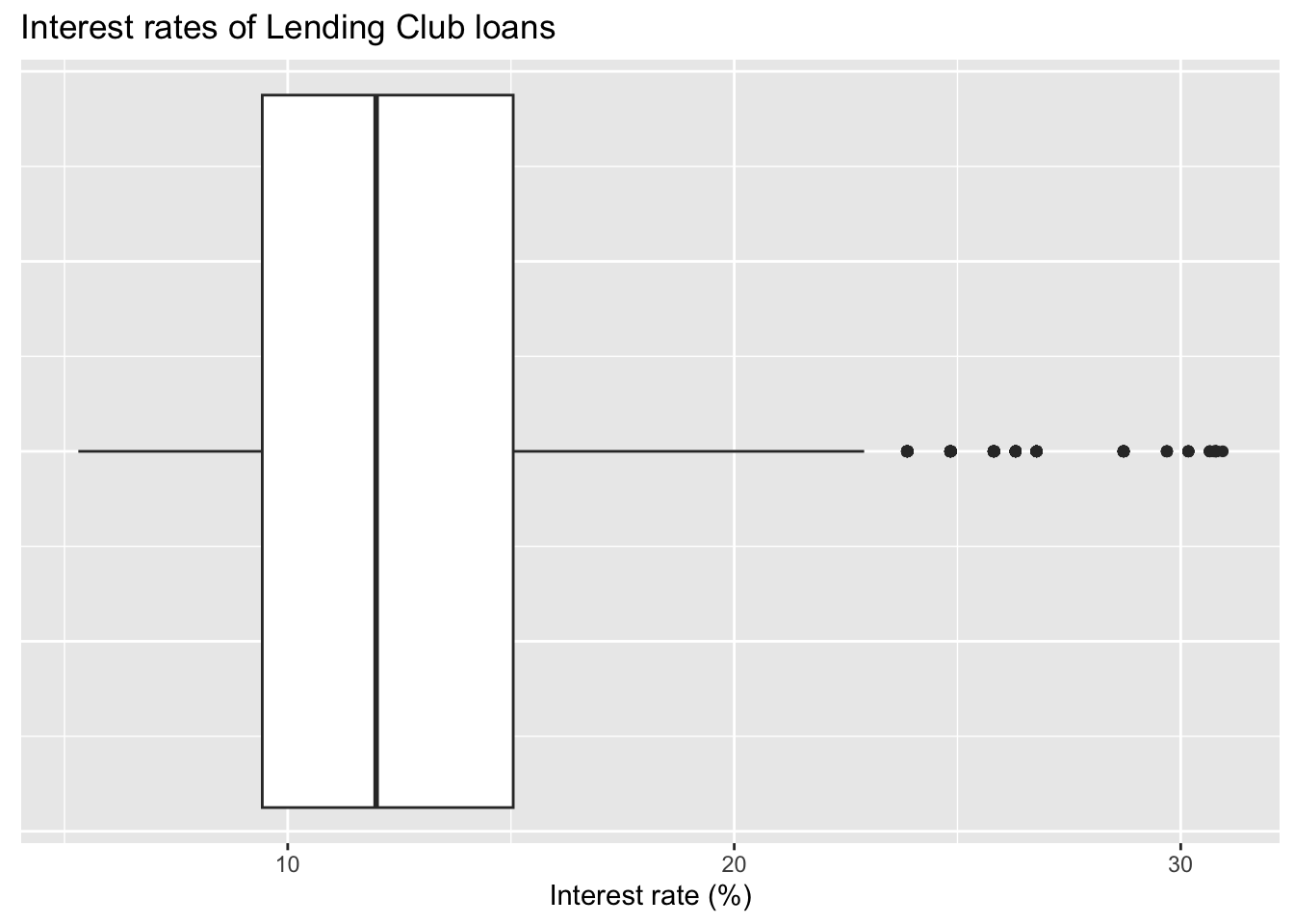

Box plot

Box plot

- Boxplot visualises five summary statistics (the median, two hinges and two whiskers), and all “outlying” points individually.

- The lower and upper hinges correspond to the first and third quartiles (the 25th and 75th percentiles).

- The whiskers extend from the hinge to the smallest and largest value no further than 1.5 * IQR from the hinge (where IQR is the inter-quartile range, or distance between the first and third quartiles).

Box plot and outliers

Customizing box plots

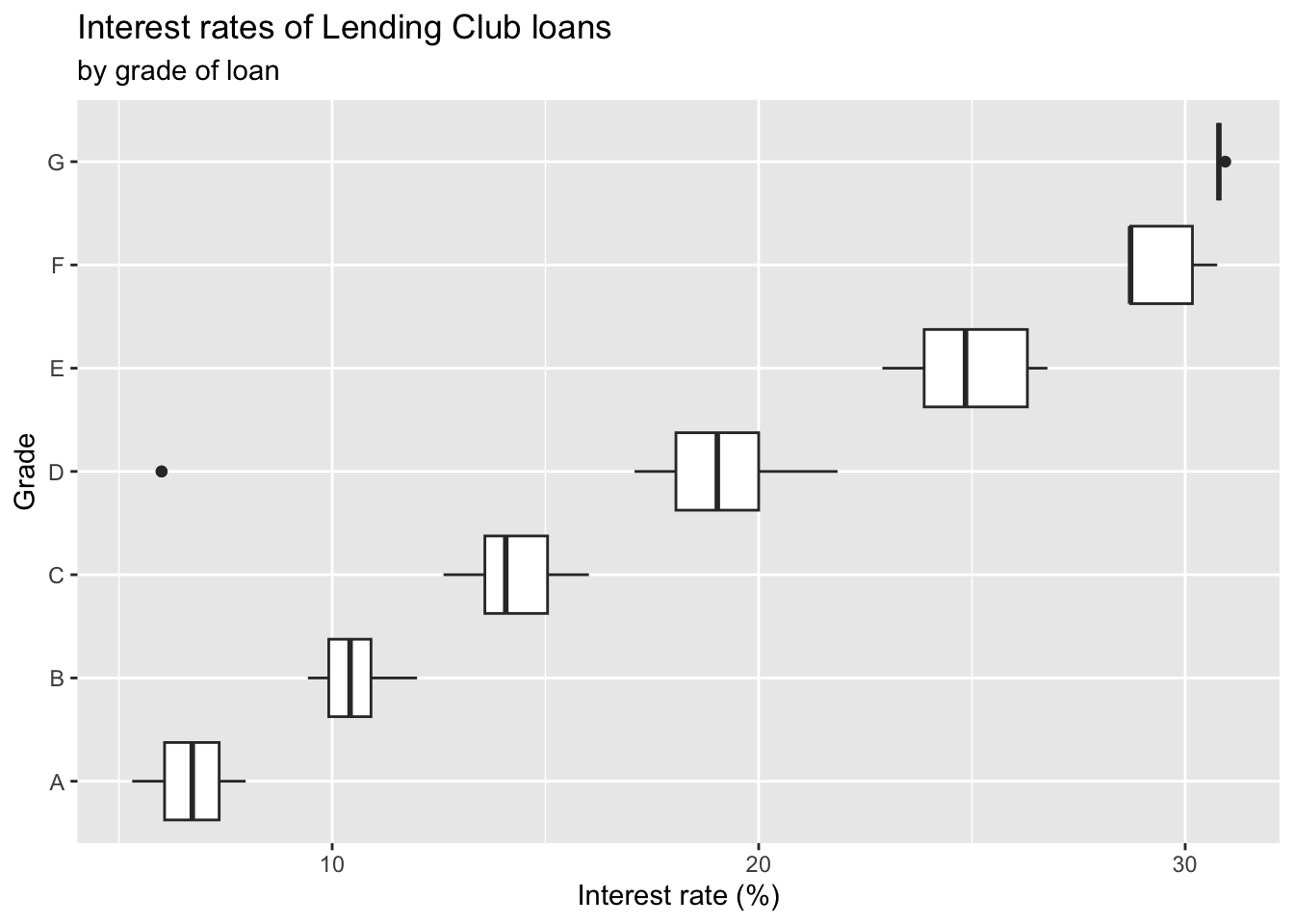

Adding a categorical variable

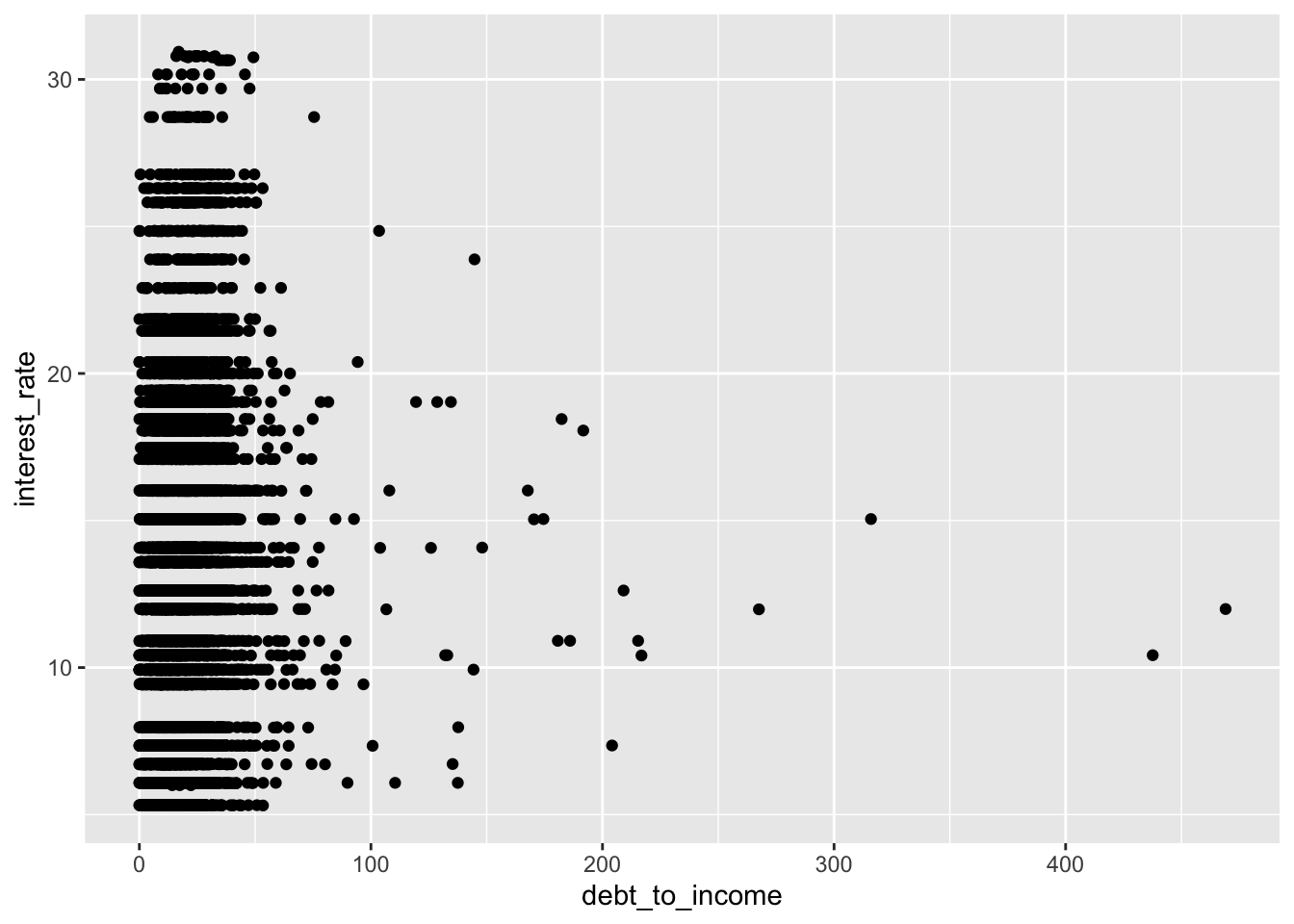

Relationships numerical variables

Scatterplot

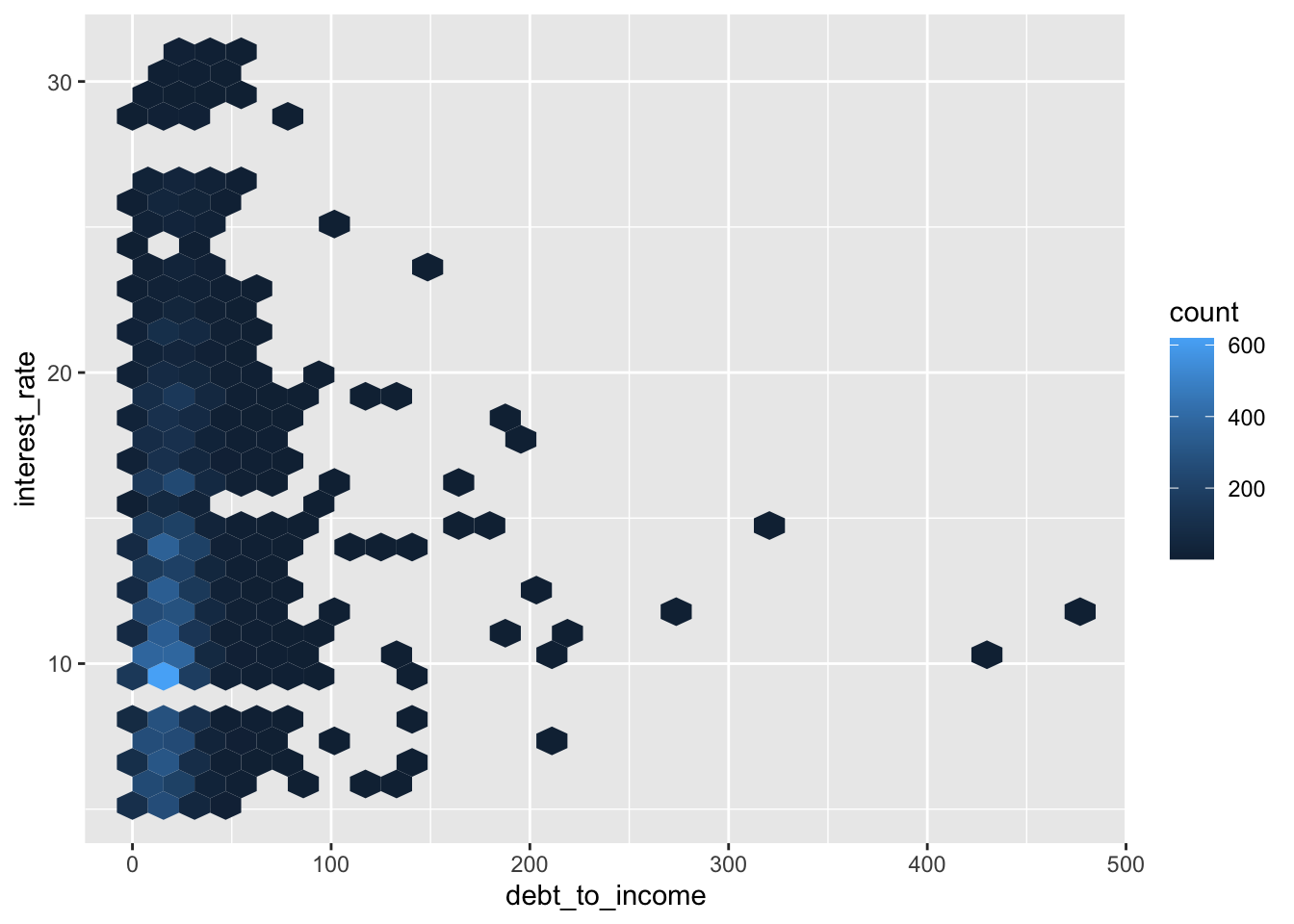

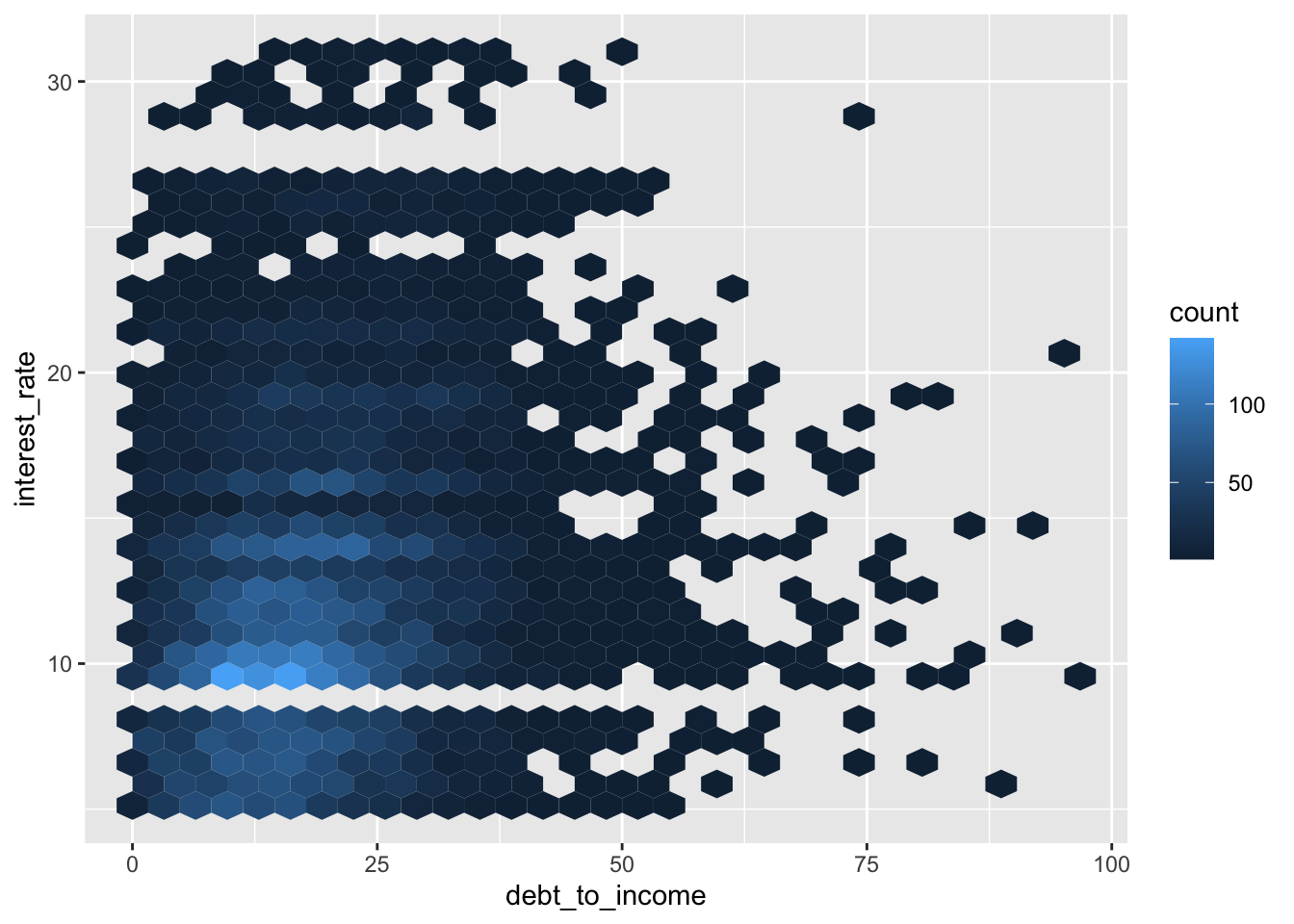

Hex plot

Hex plot

Visualize Categorical Variable

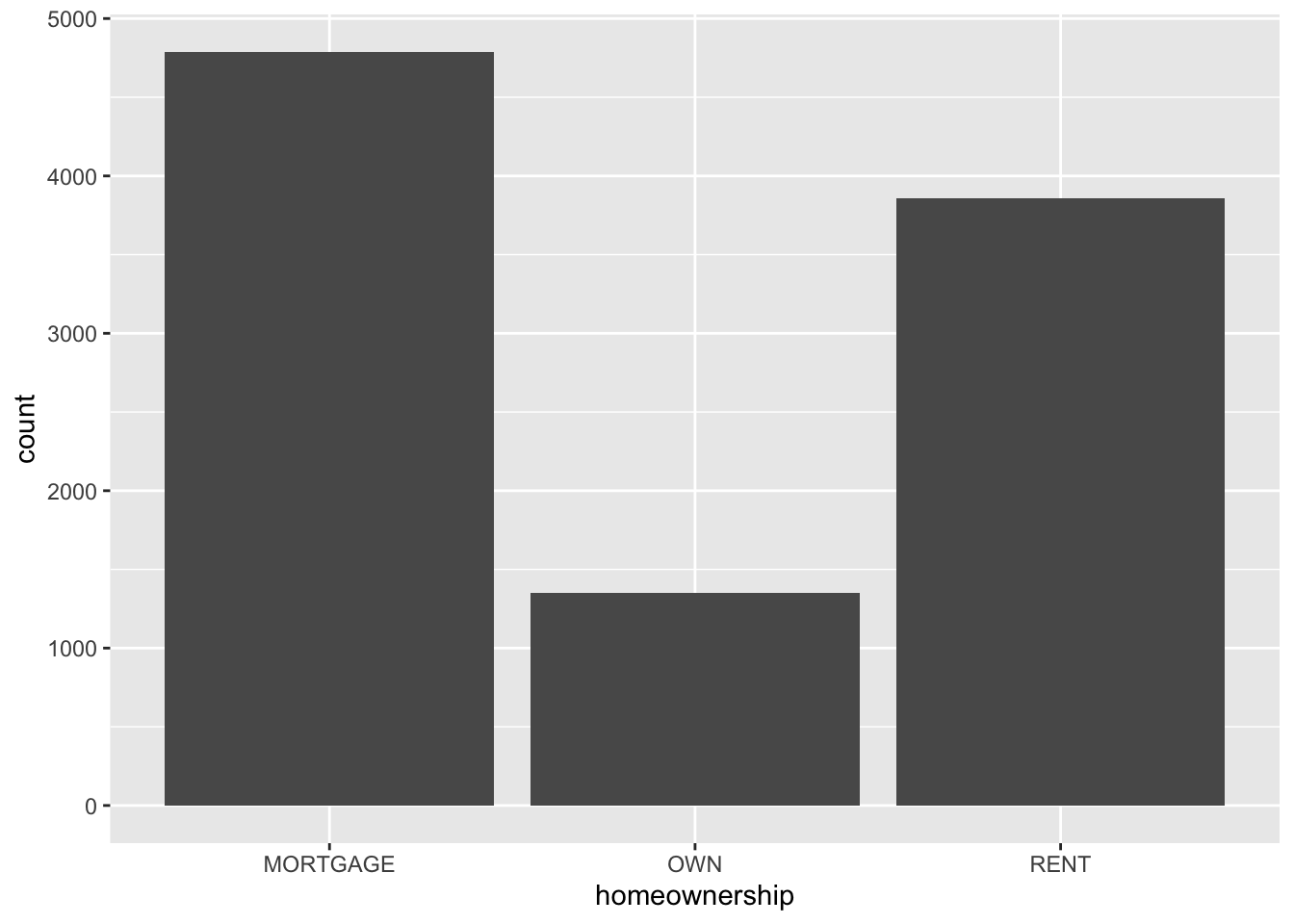

Bar plot

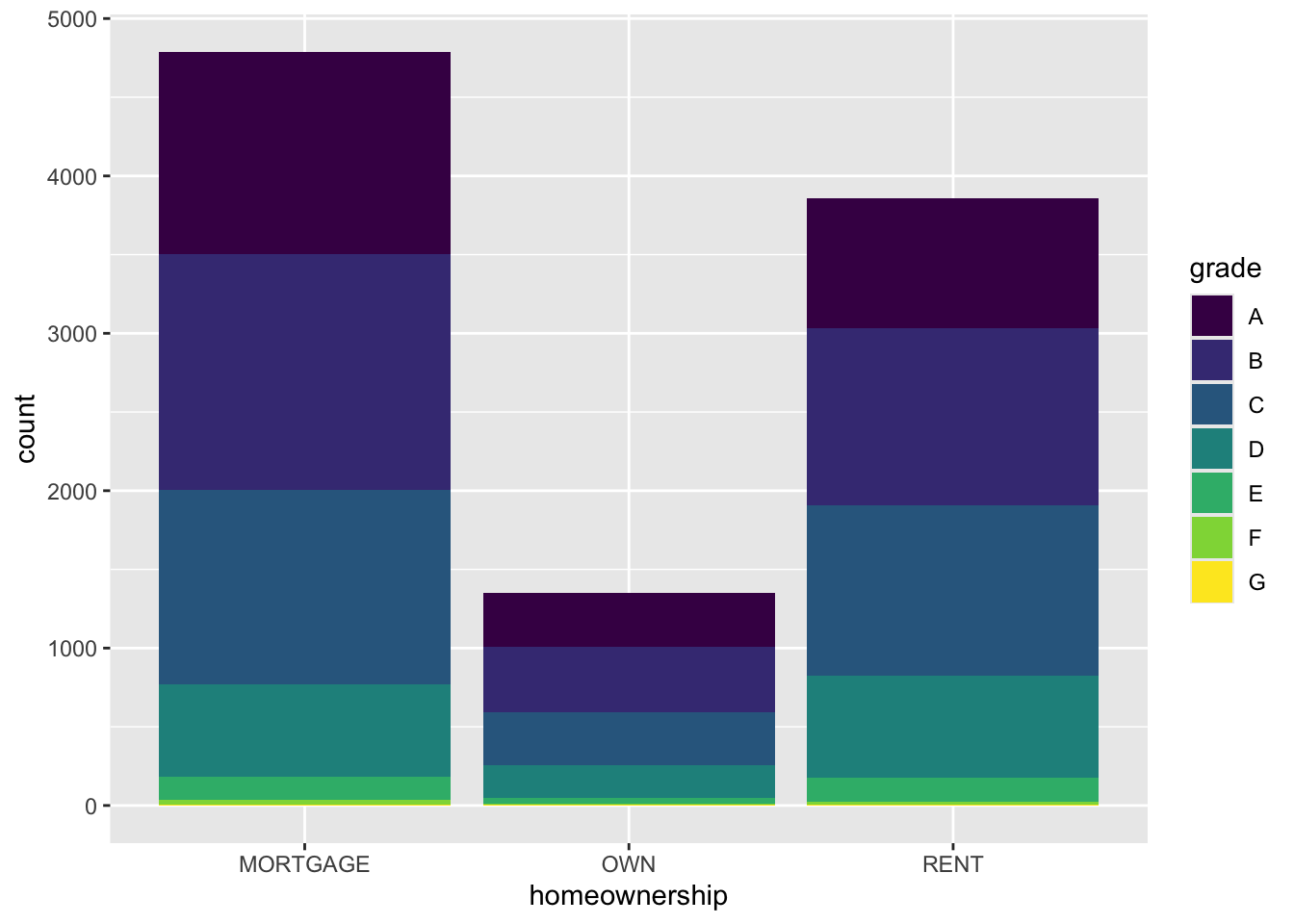

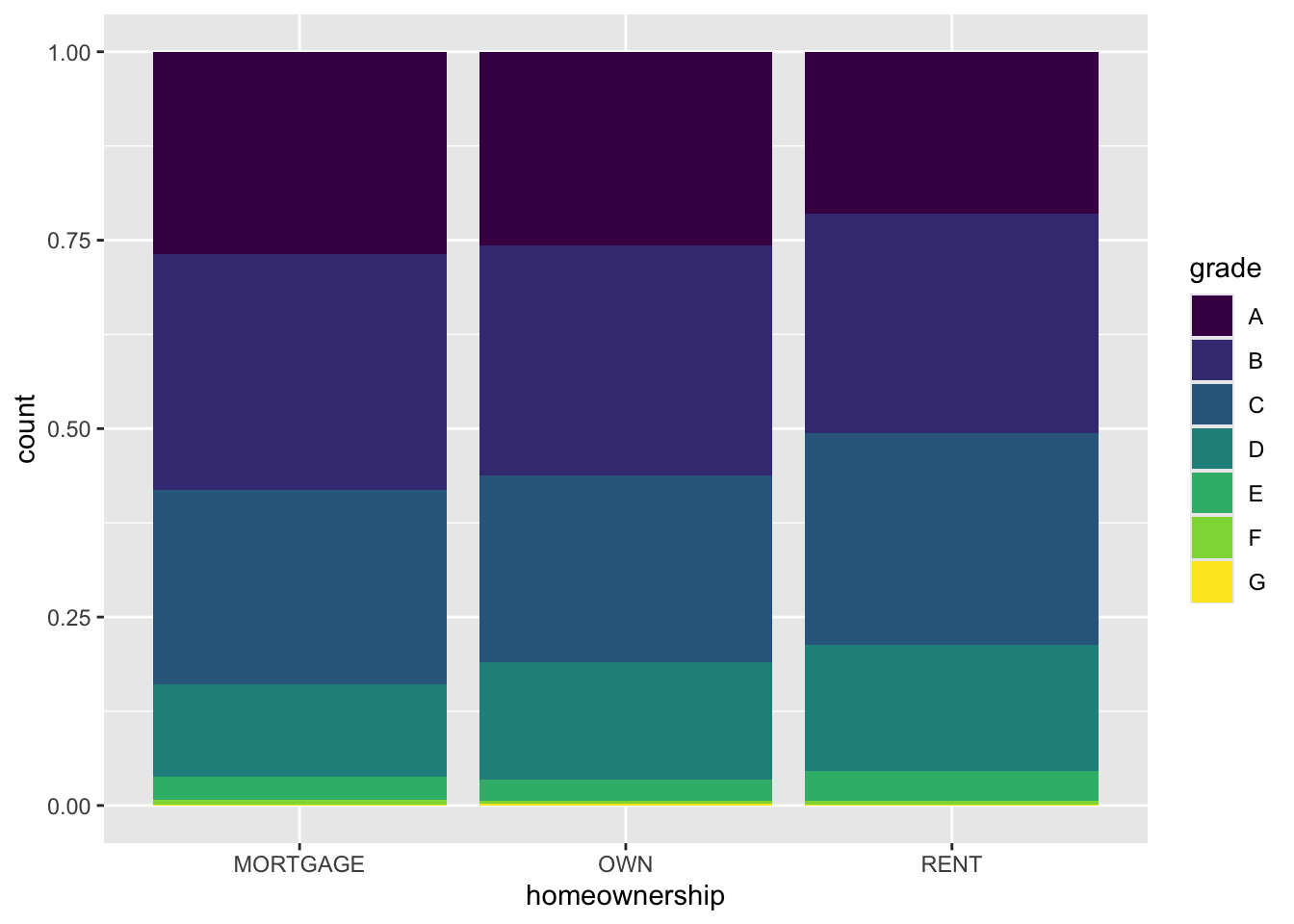

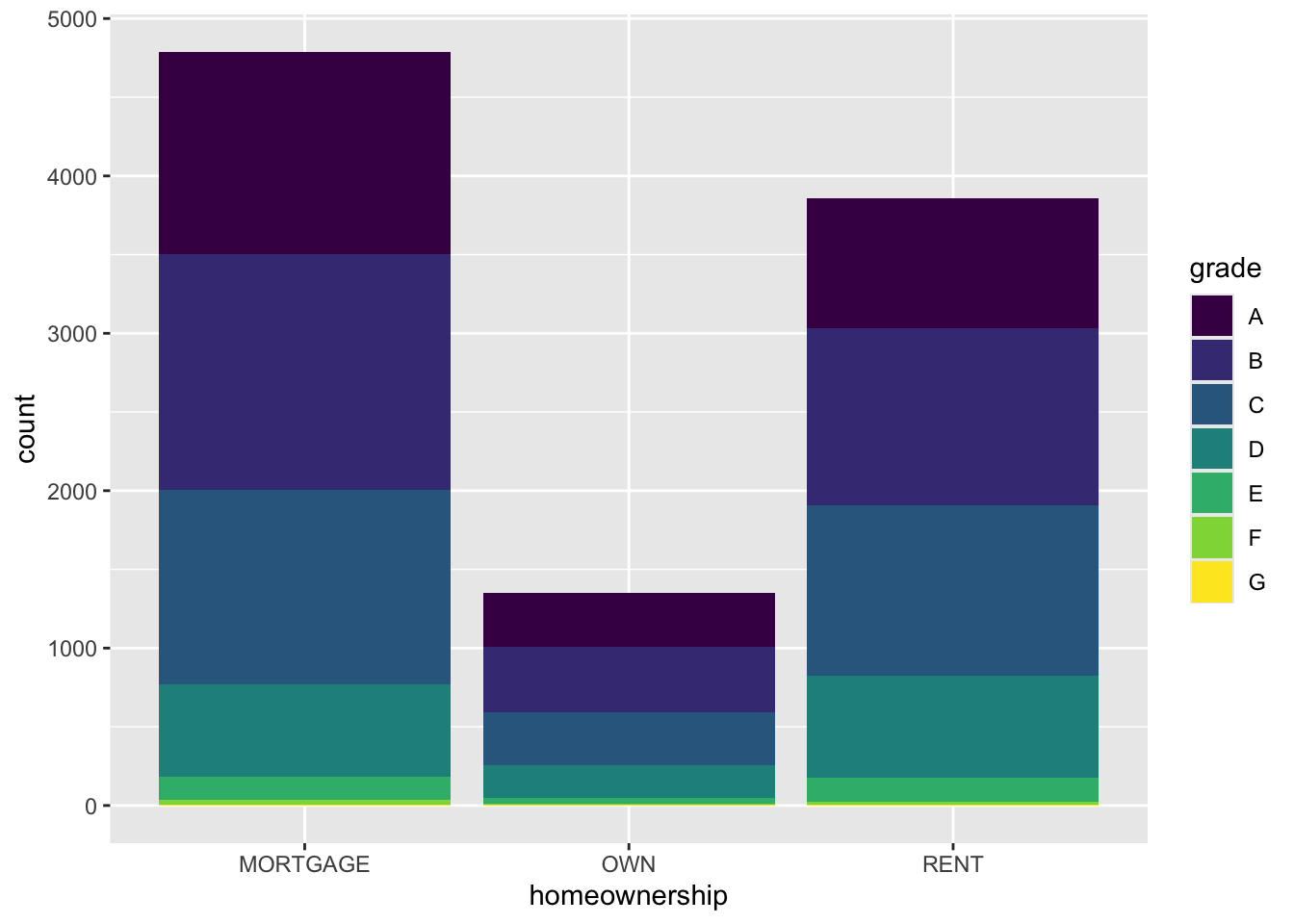

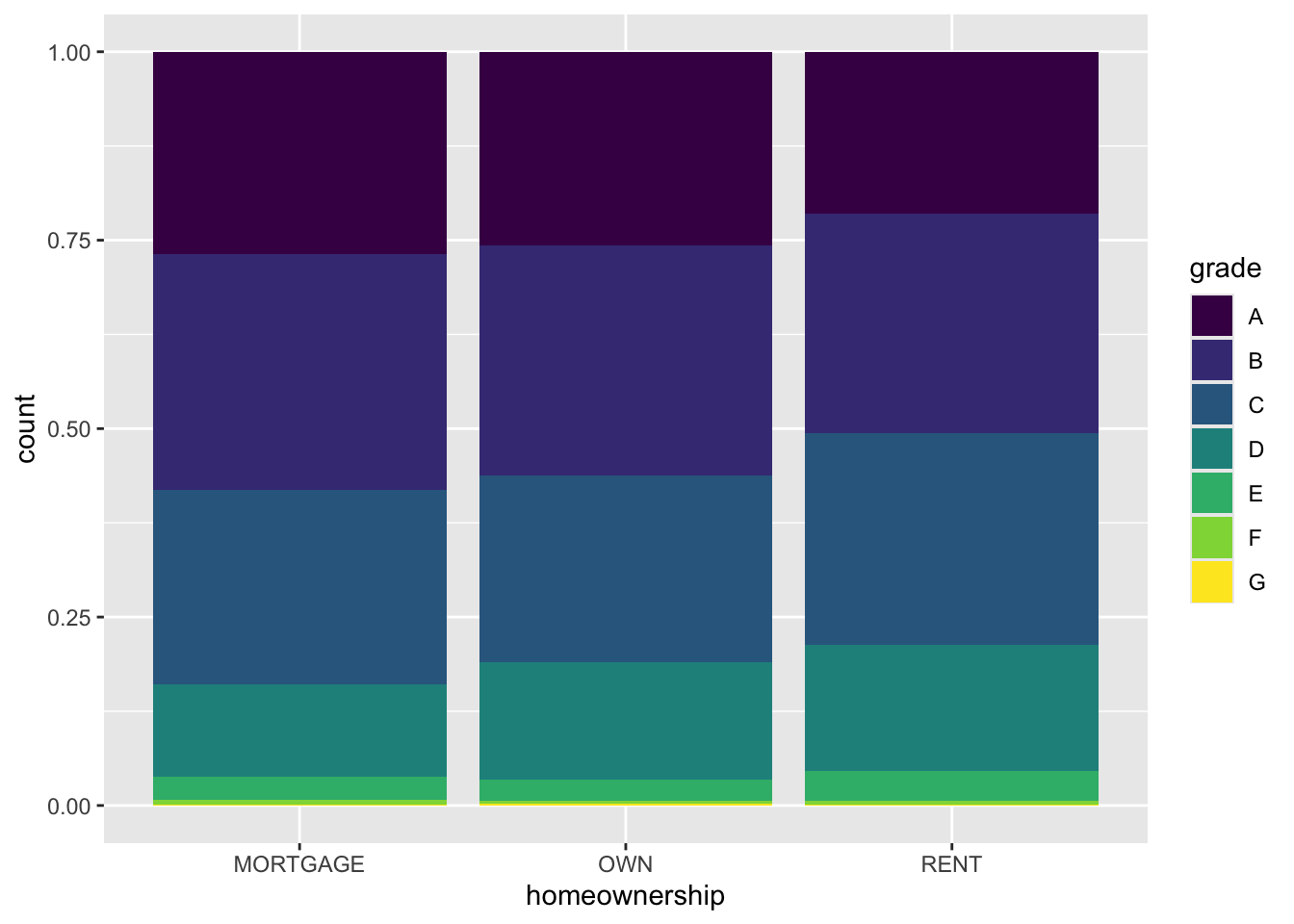

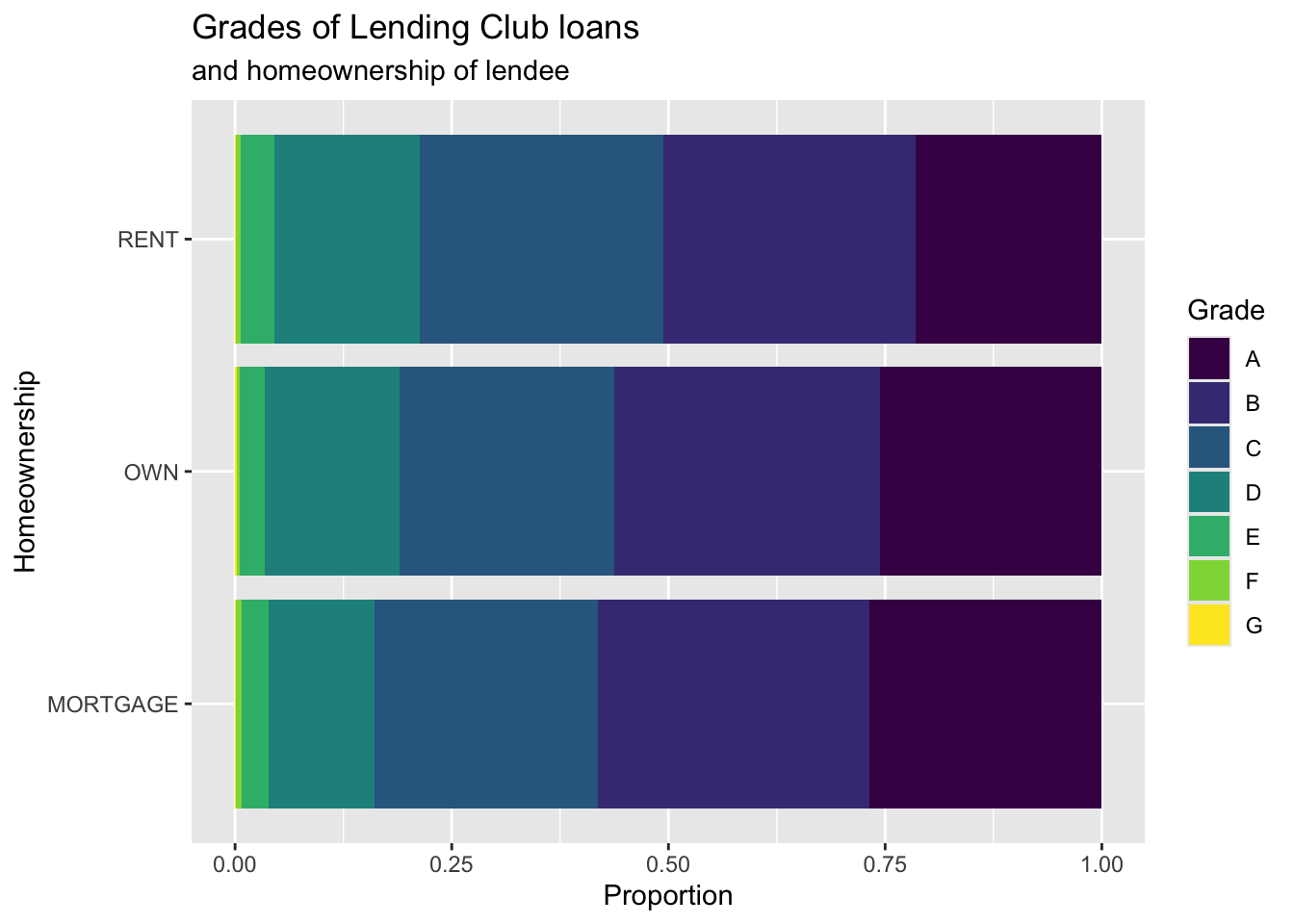

Segmented bar plot

Segmented bar plot

Which bar plot is a more useful representation for visualizing the relationship between homeownership and grade?

Customizing bar plots

Relationships between numerical and categorical variables

Already talked about…

- Colouring and faceting histograms and density plots

- Side-by-side box plots

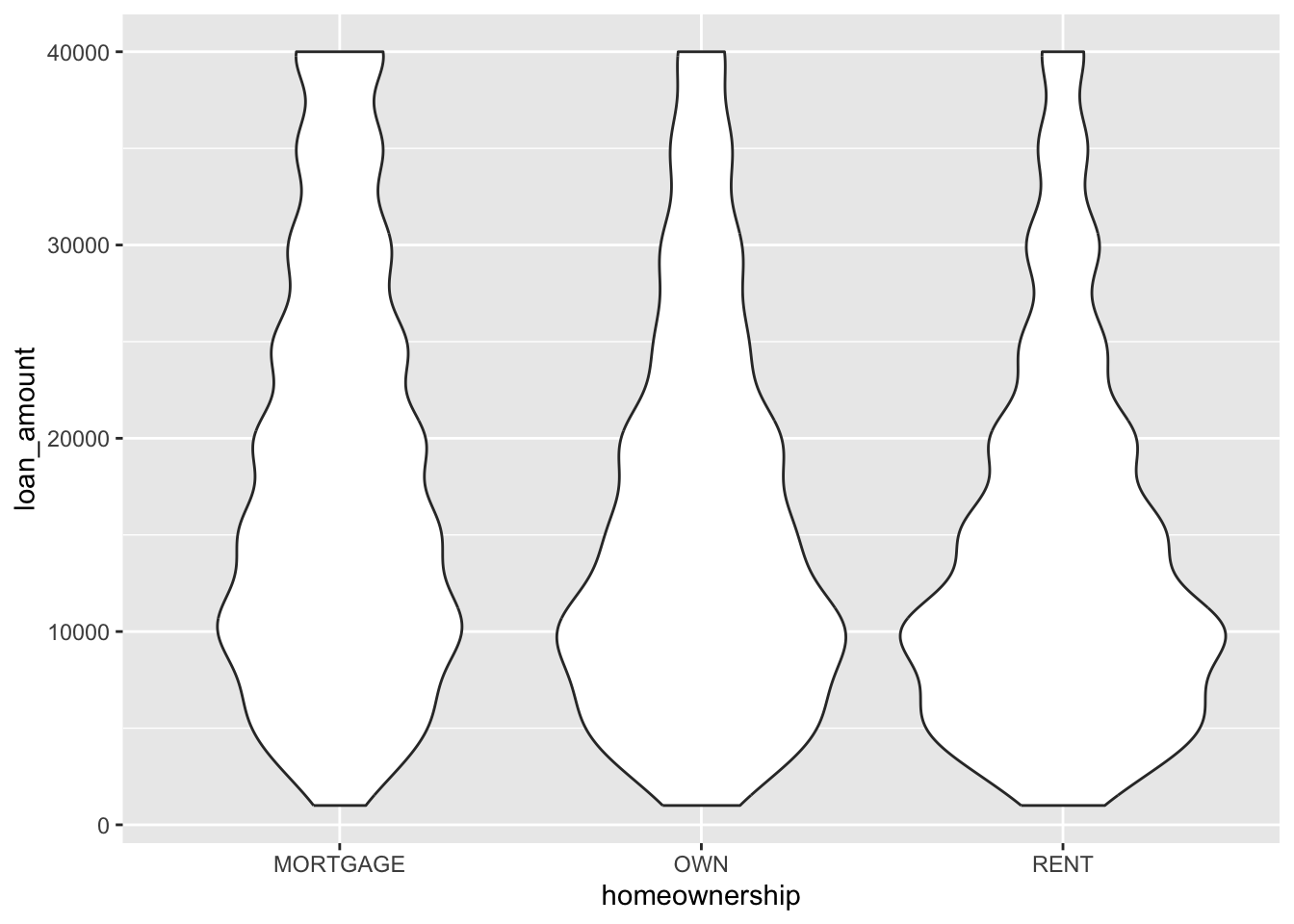

Violin plots

Ridge plots

Designing effective visualizations

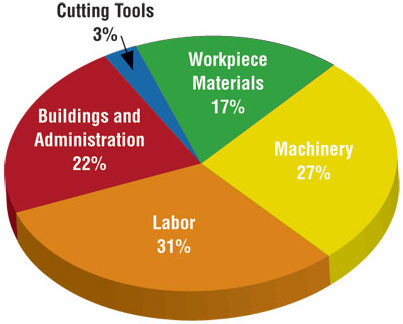

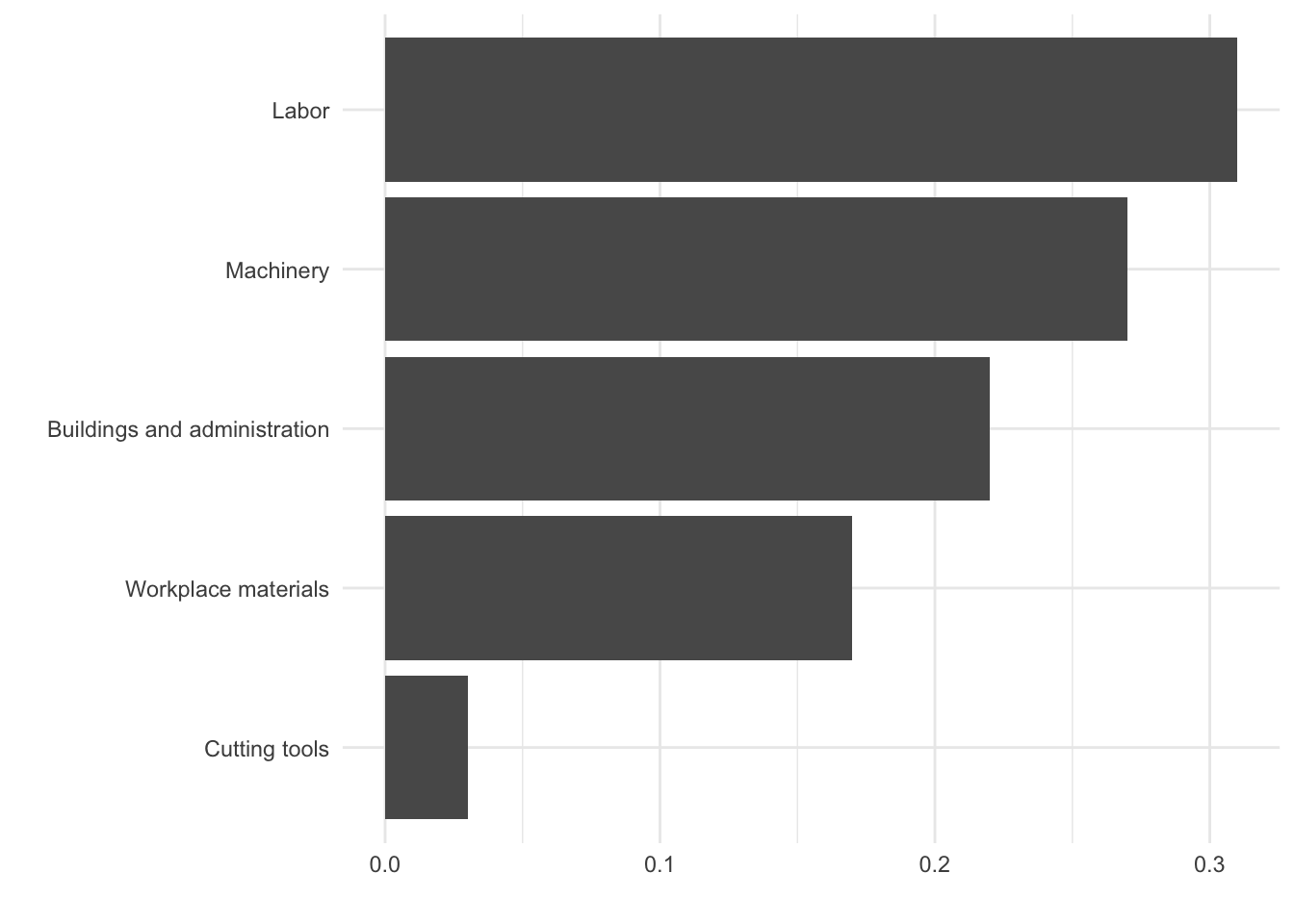

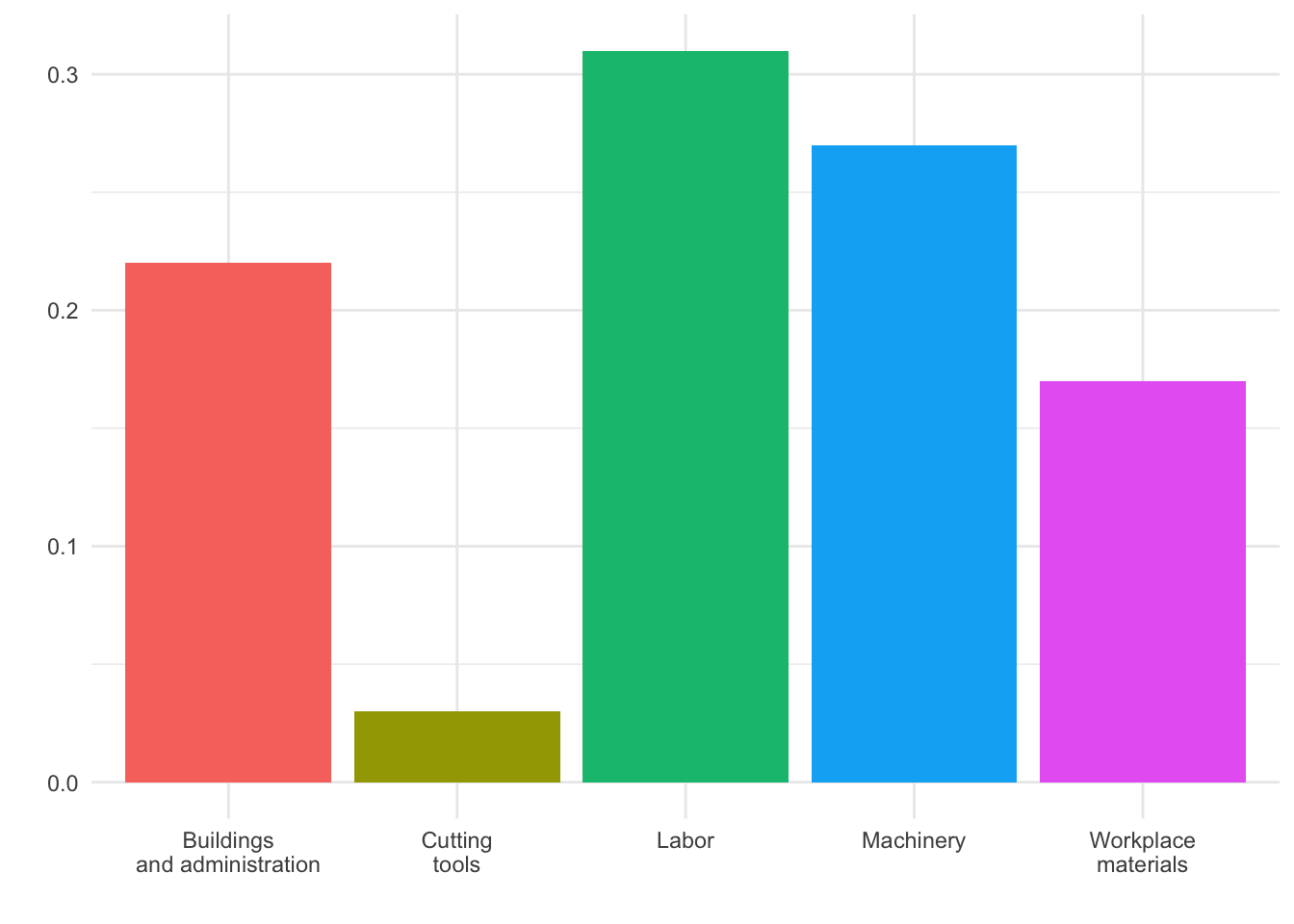

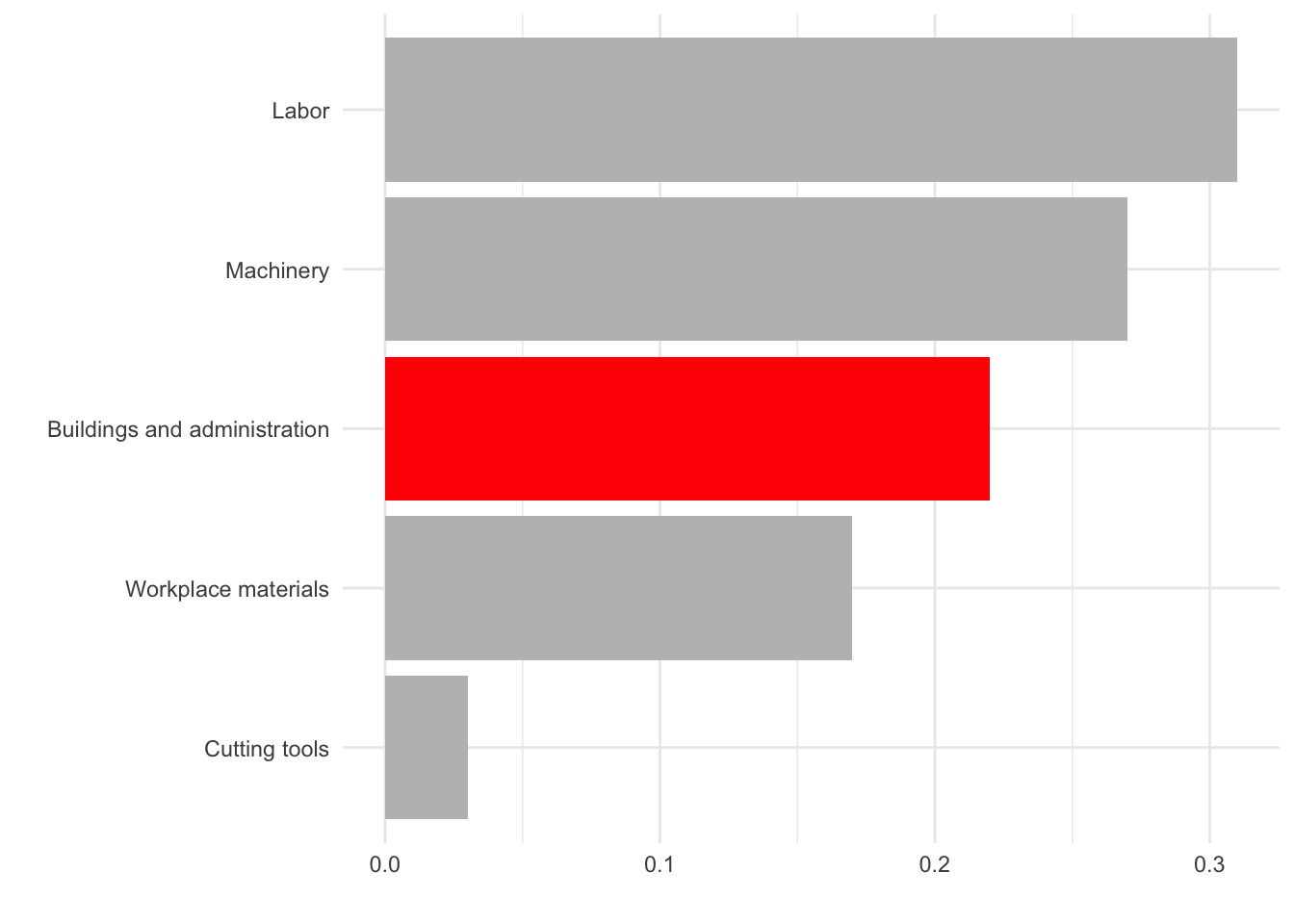

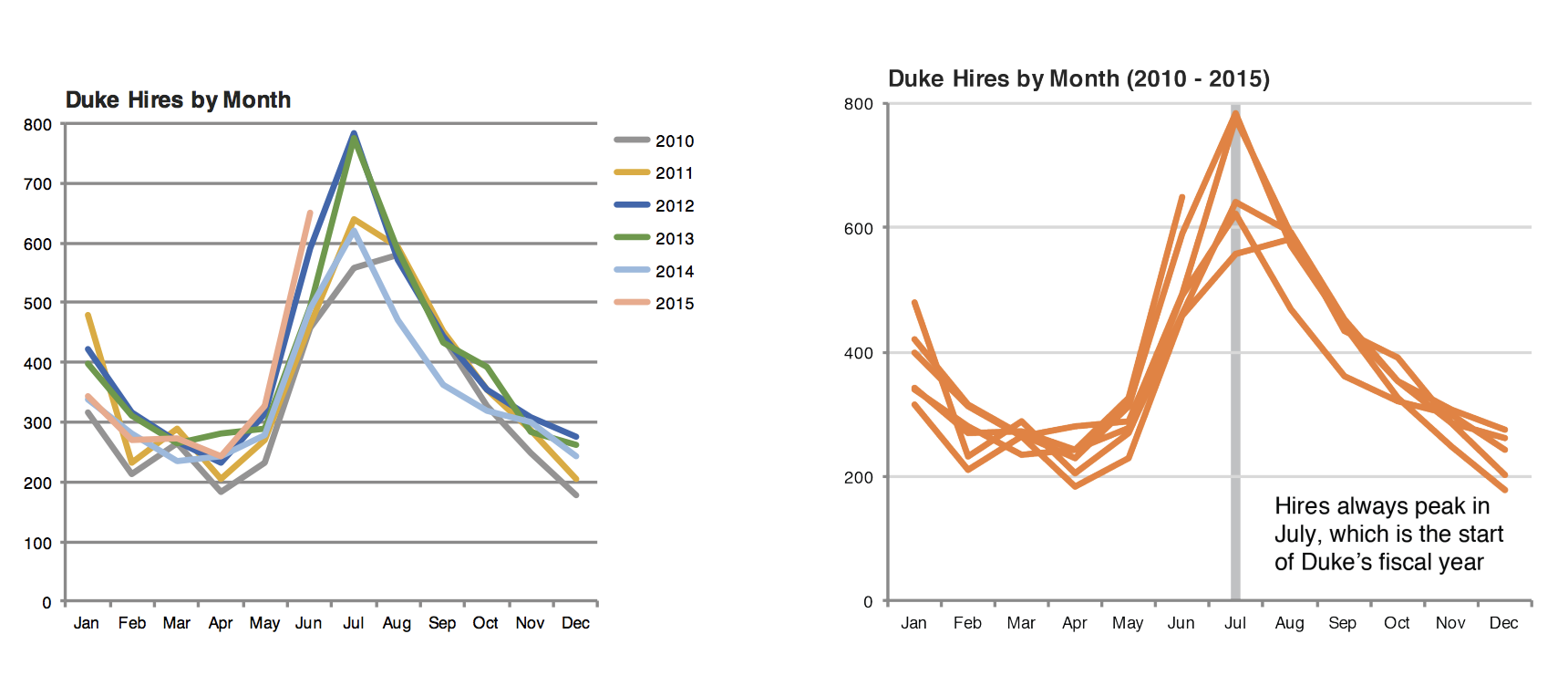

Keep it simple

Use color to draw attention

Tell a story

Credit: Angela Zoss and Eric Monson, Duke DVS

Principles for effective visualizations

Principles for effective visualizations

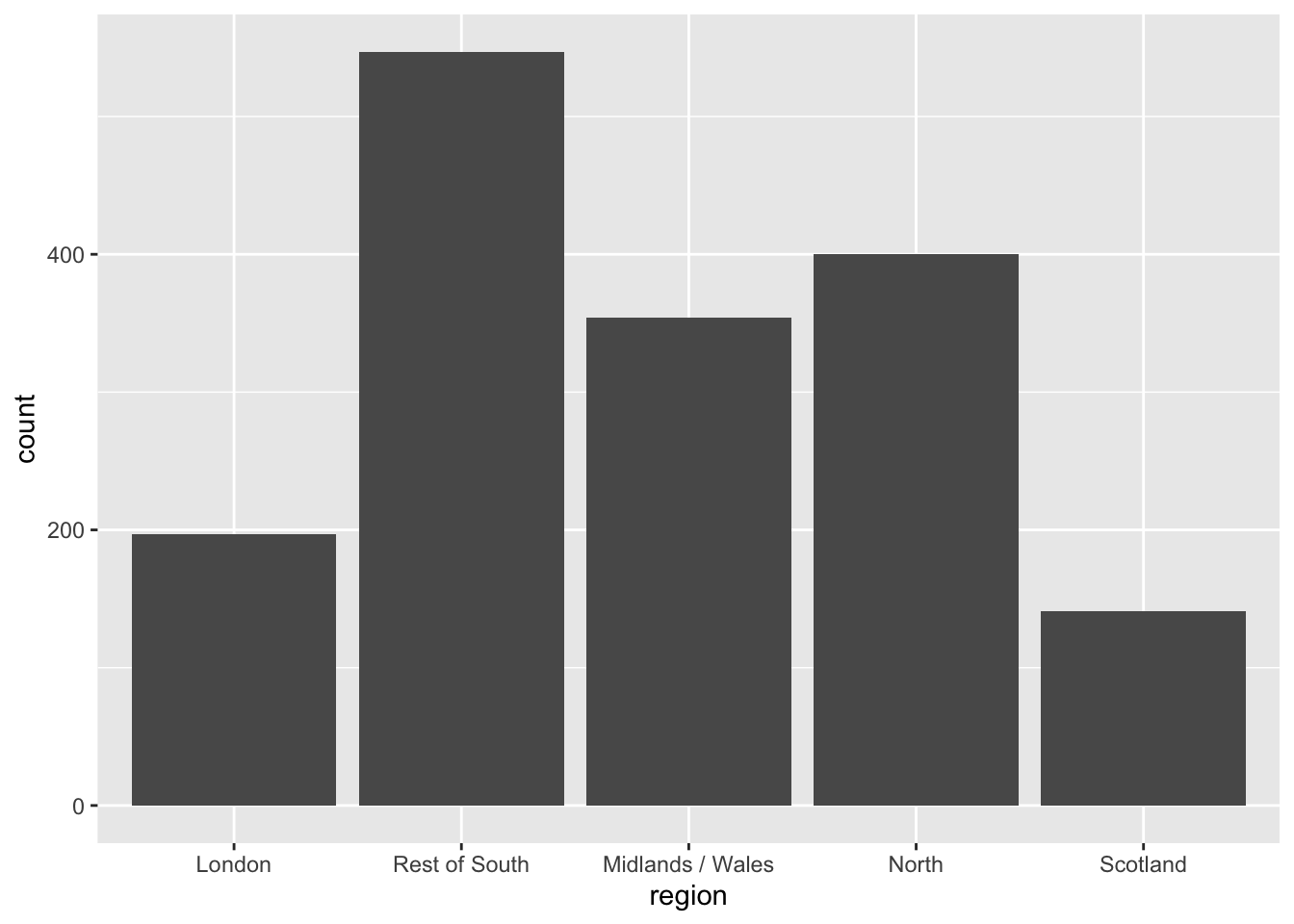

- Order matters

- Put long categories on the y-axis

- Keep scales consistent

- Select meaningful colors

- Use meaningful and nonredundant labels

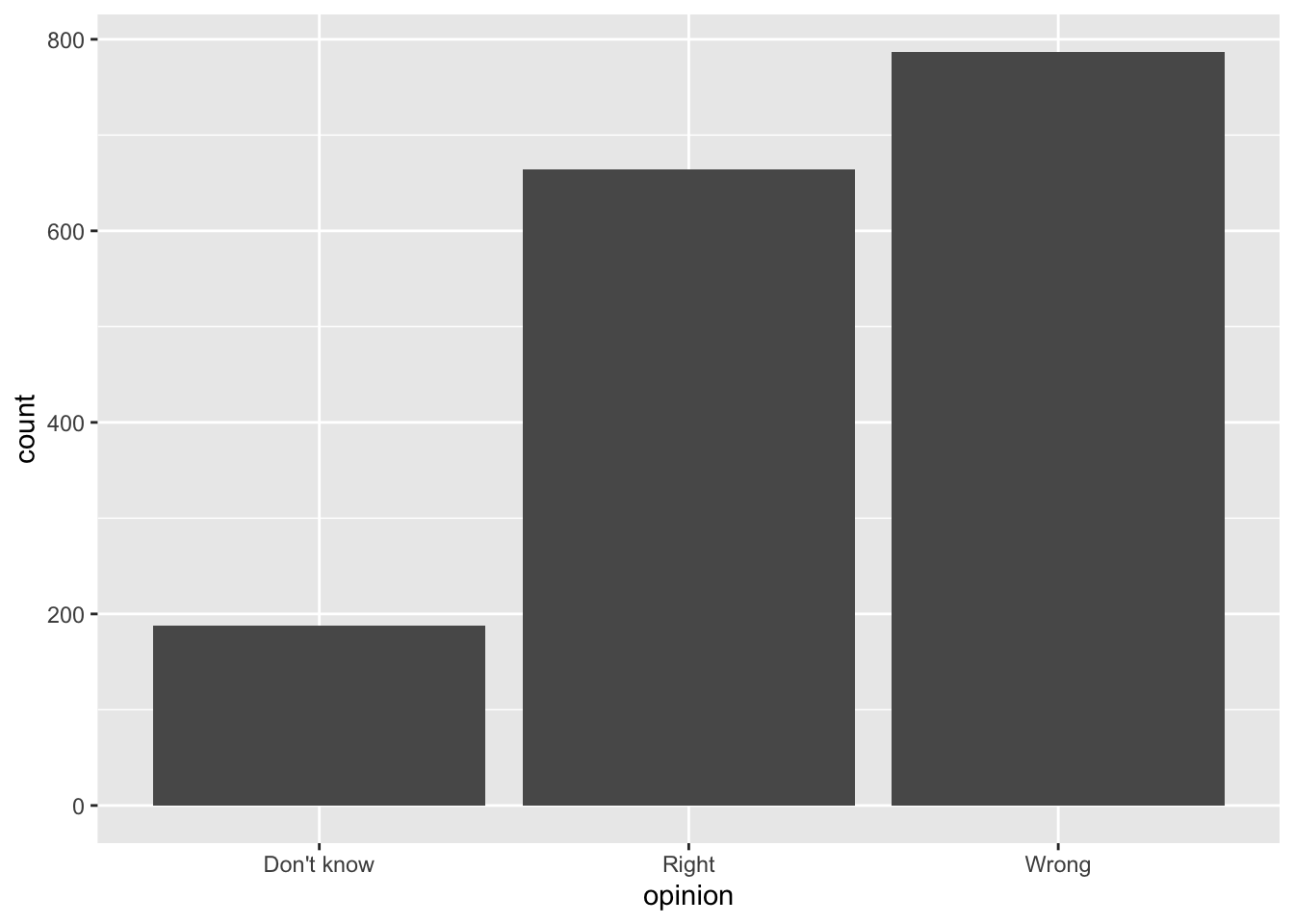

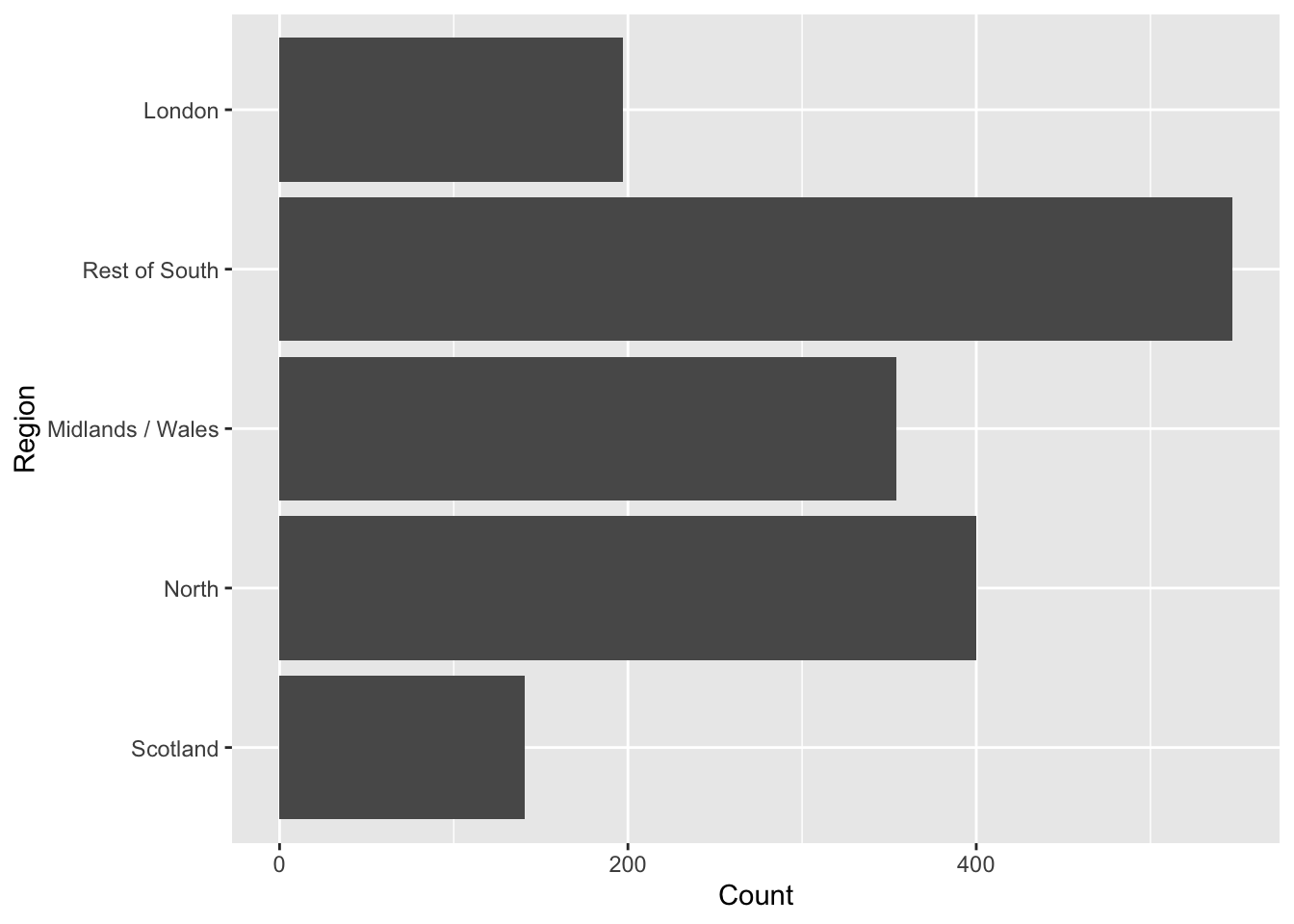

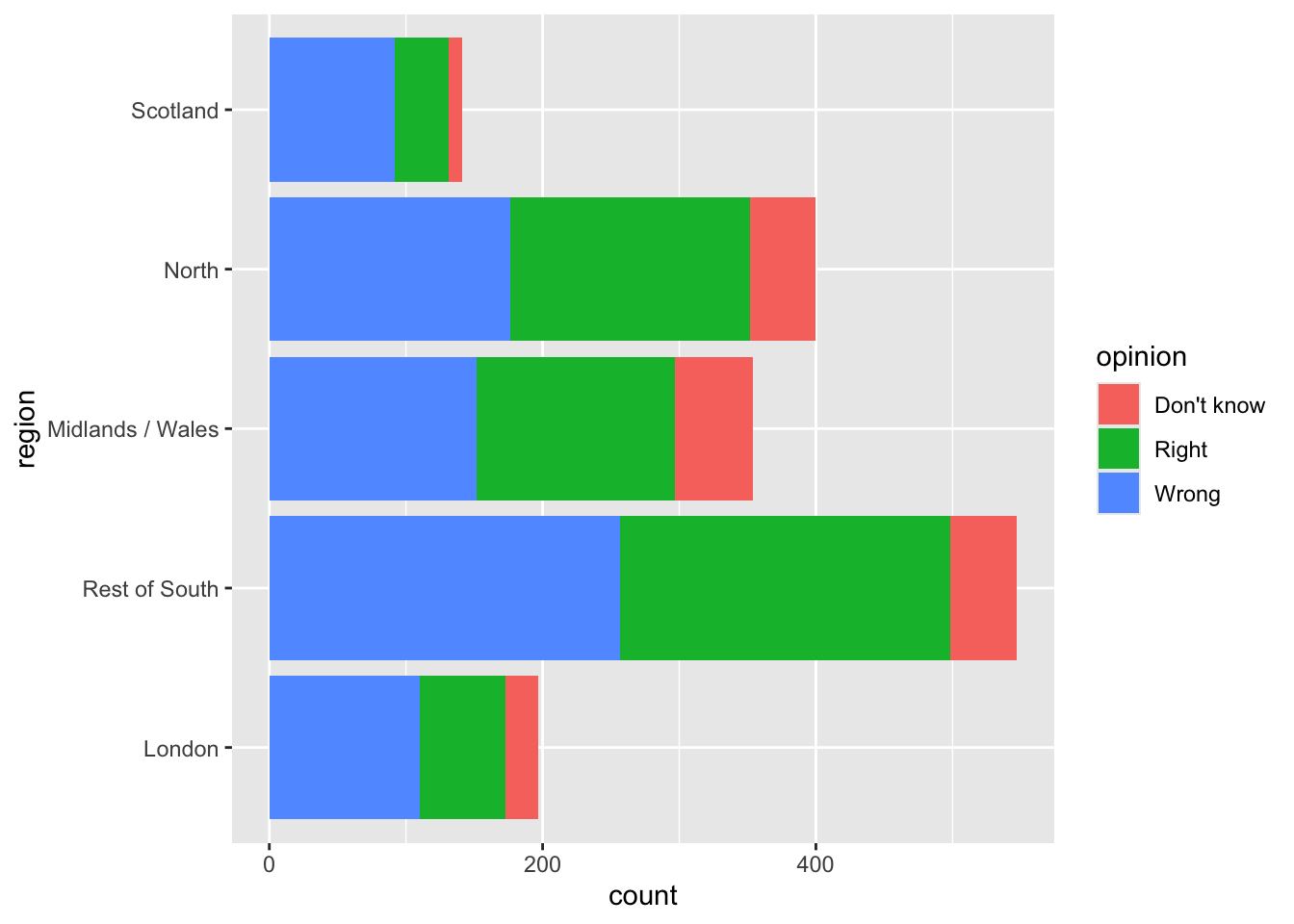

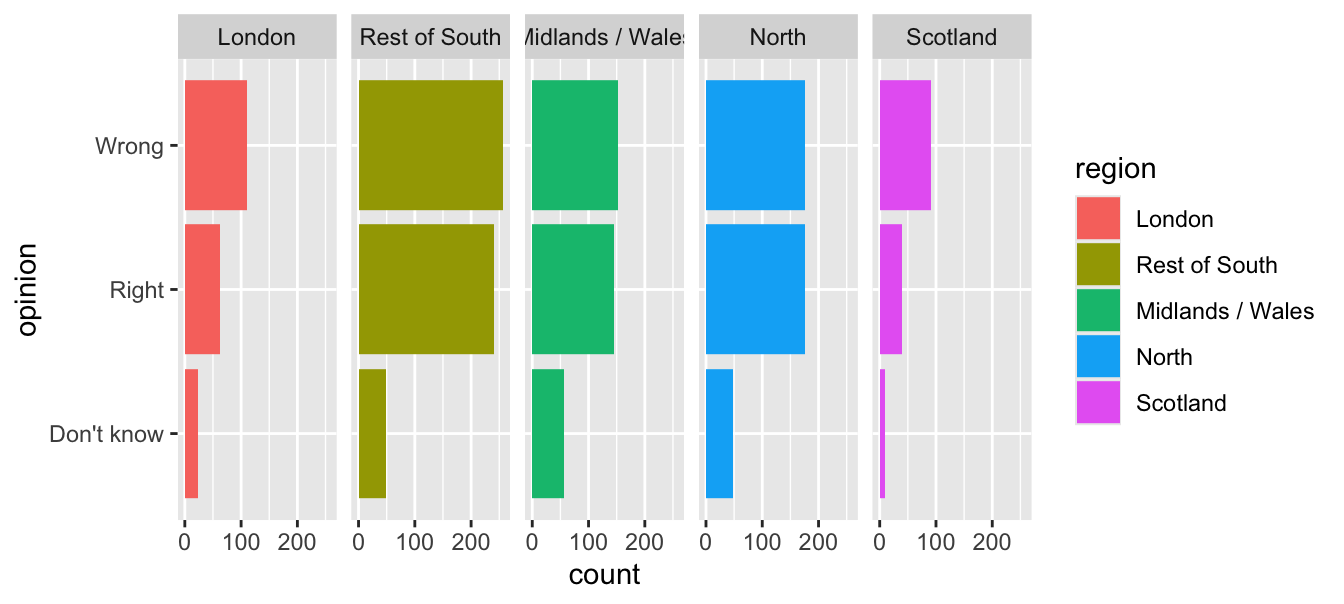

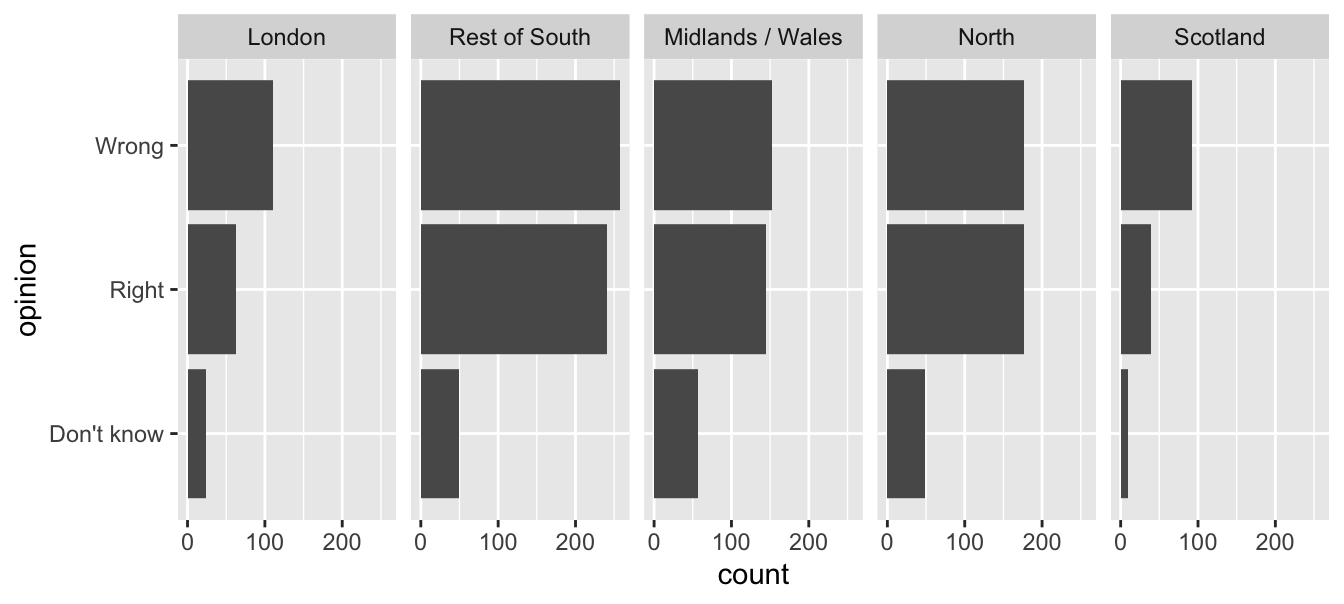

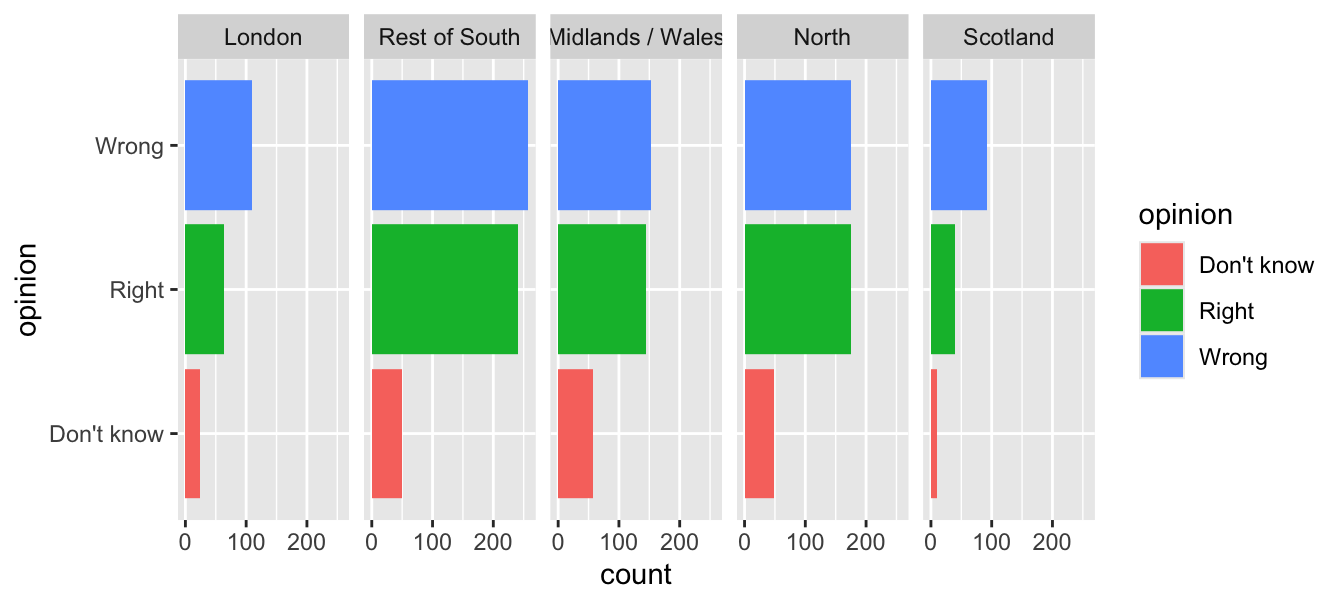

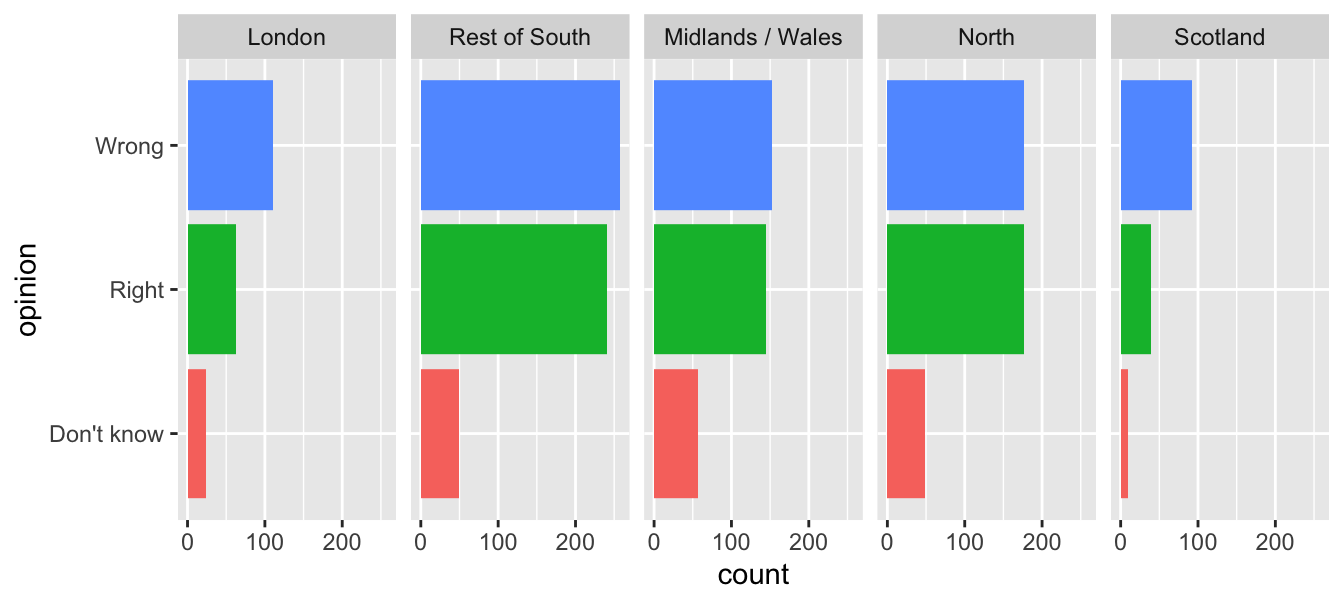

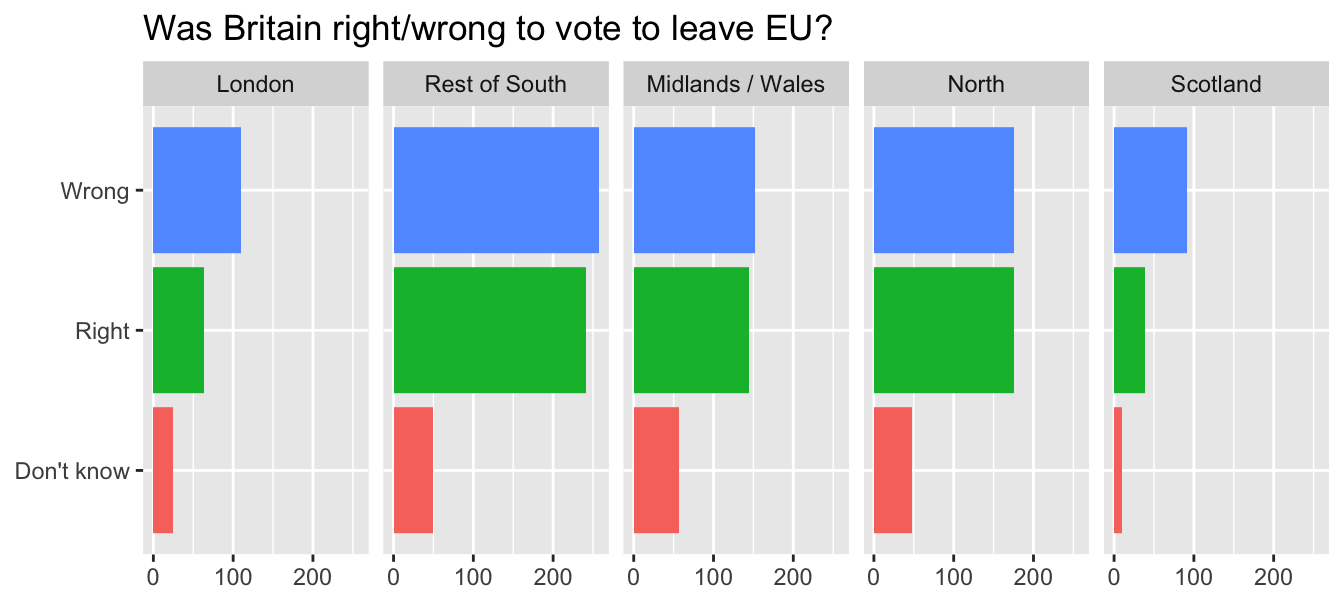

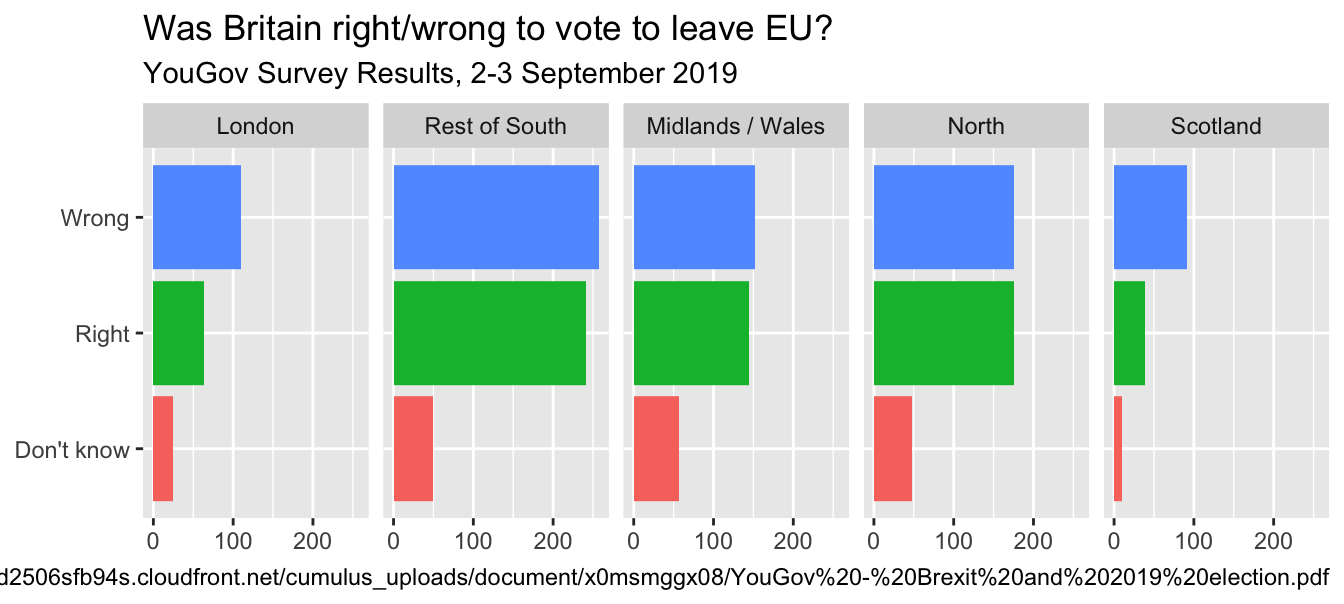

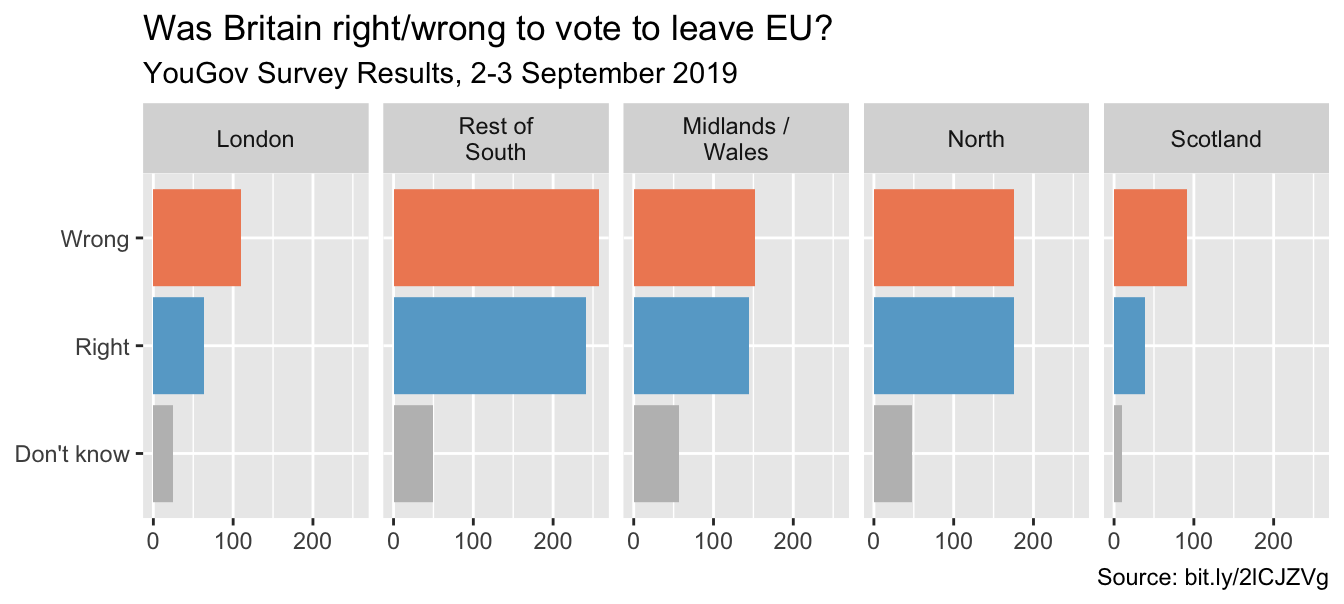

Data

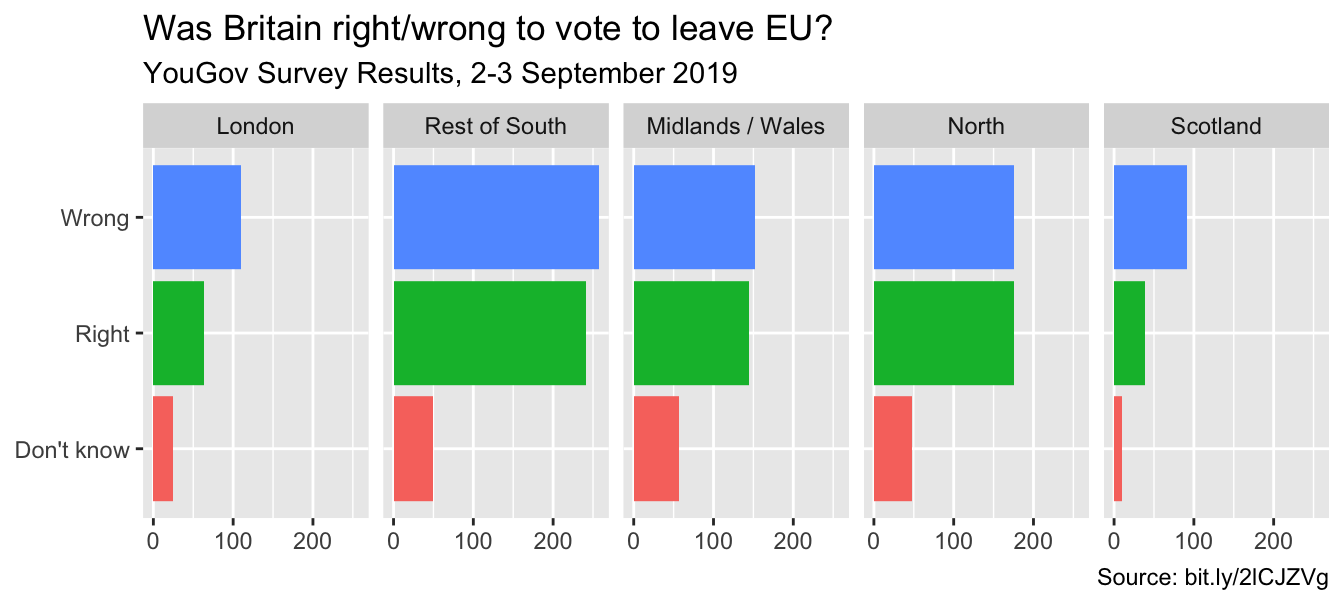

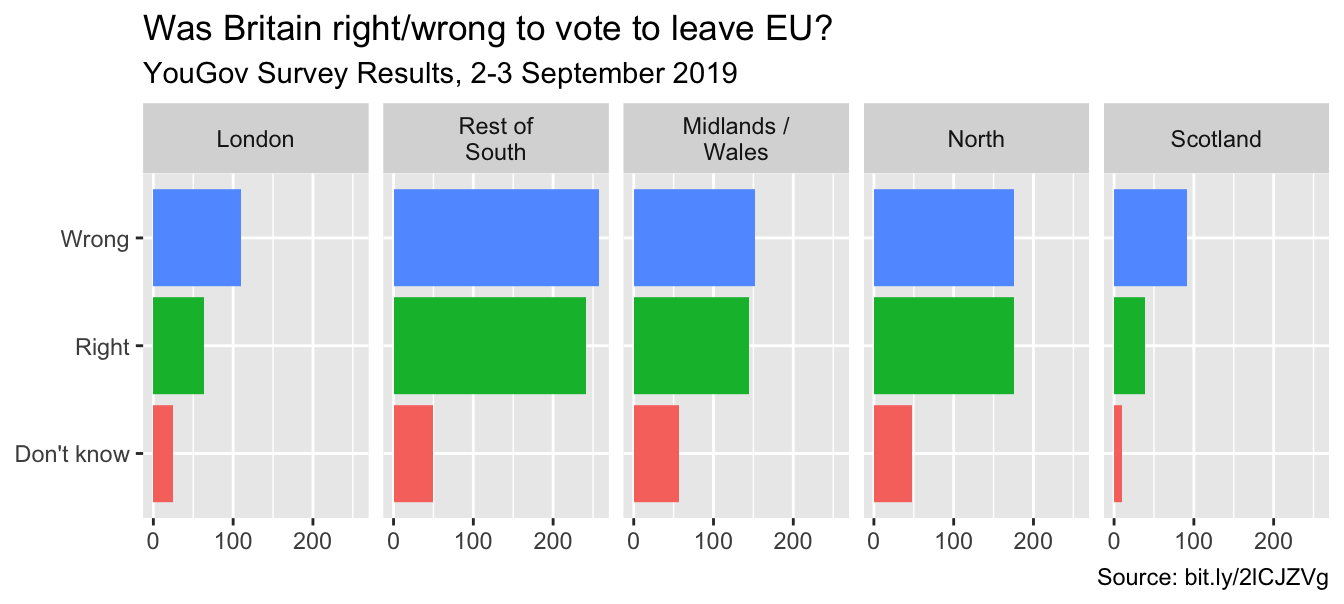

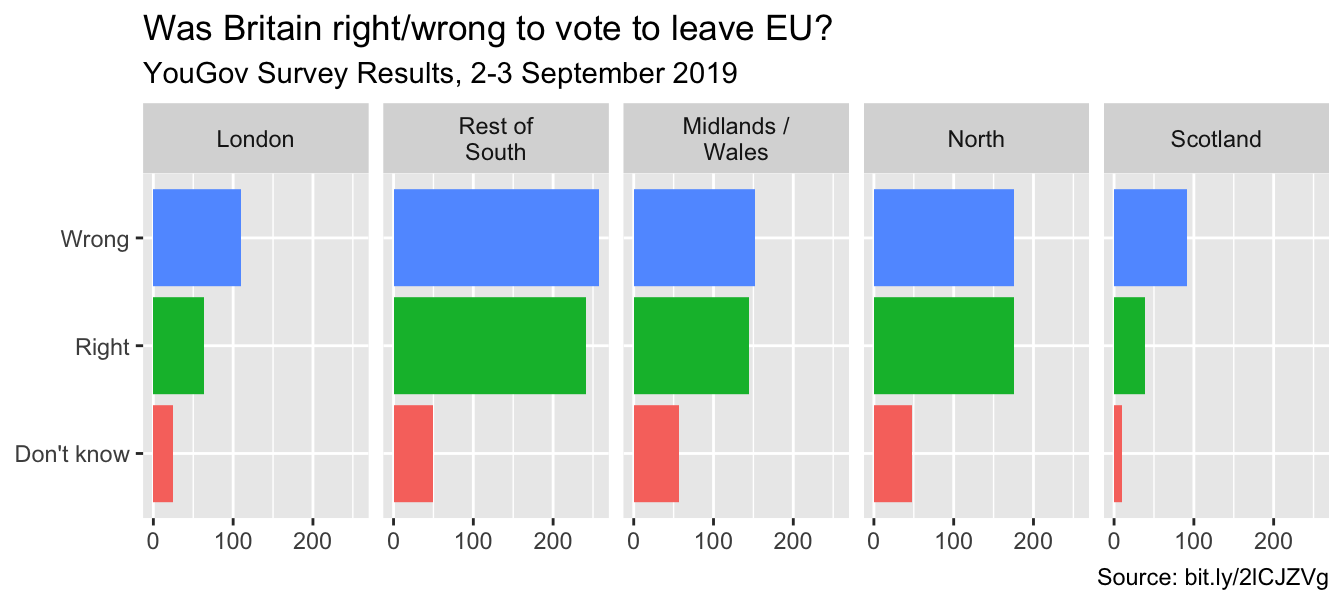

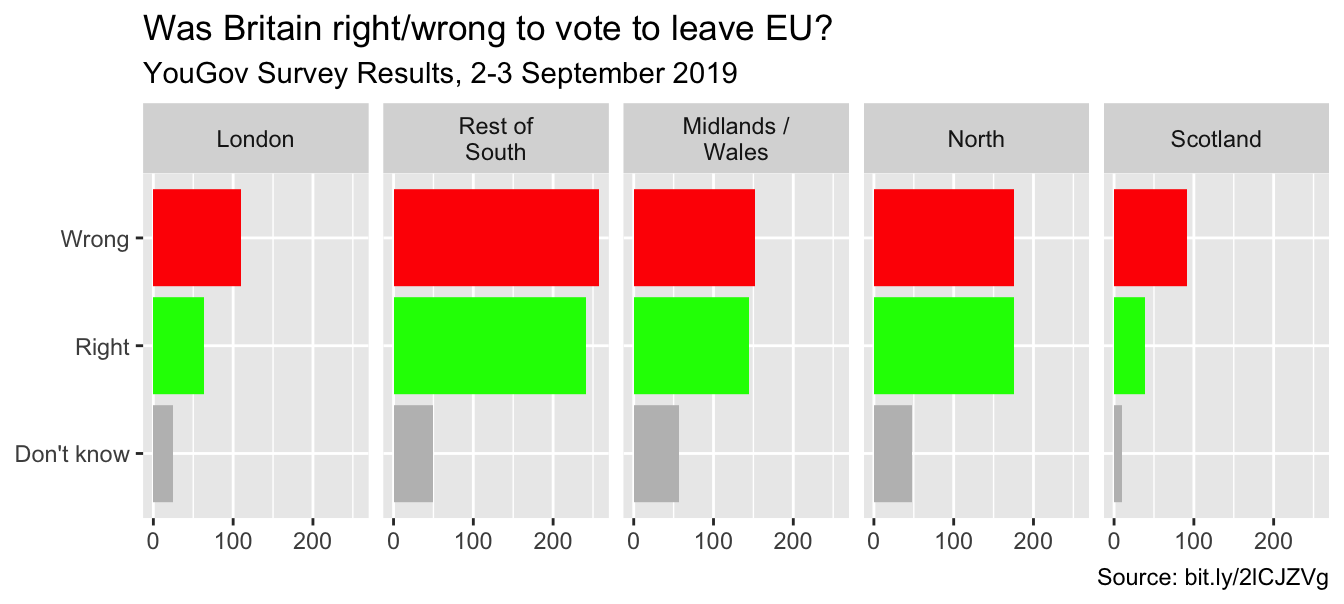

In September 2019, YouGov survey asked 1,639 GB adults the following question:

In hindsight, do you think Britain was right/wrong to vote to leave EU?

- Right to leave

- Wrong to leave

- Don’t know

Source: YouGov Survey Results, retrieved Oct 7, 2019

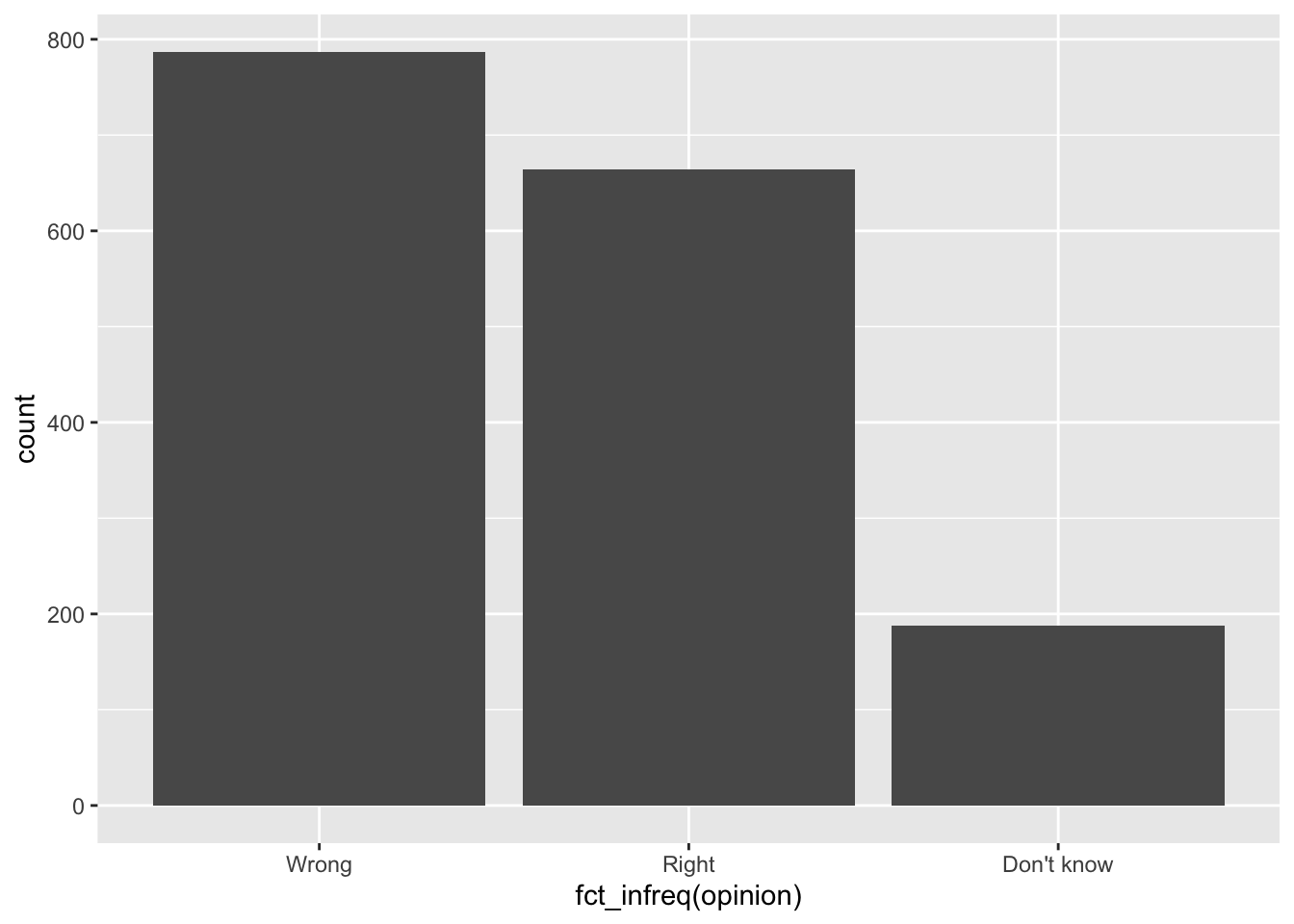

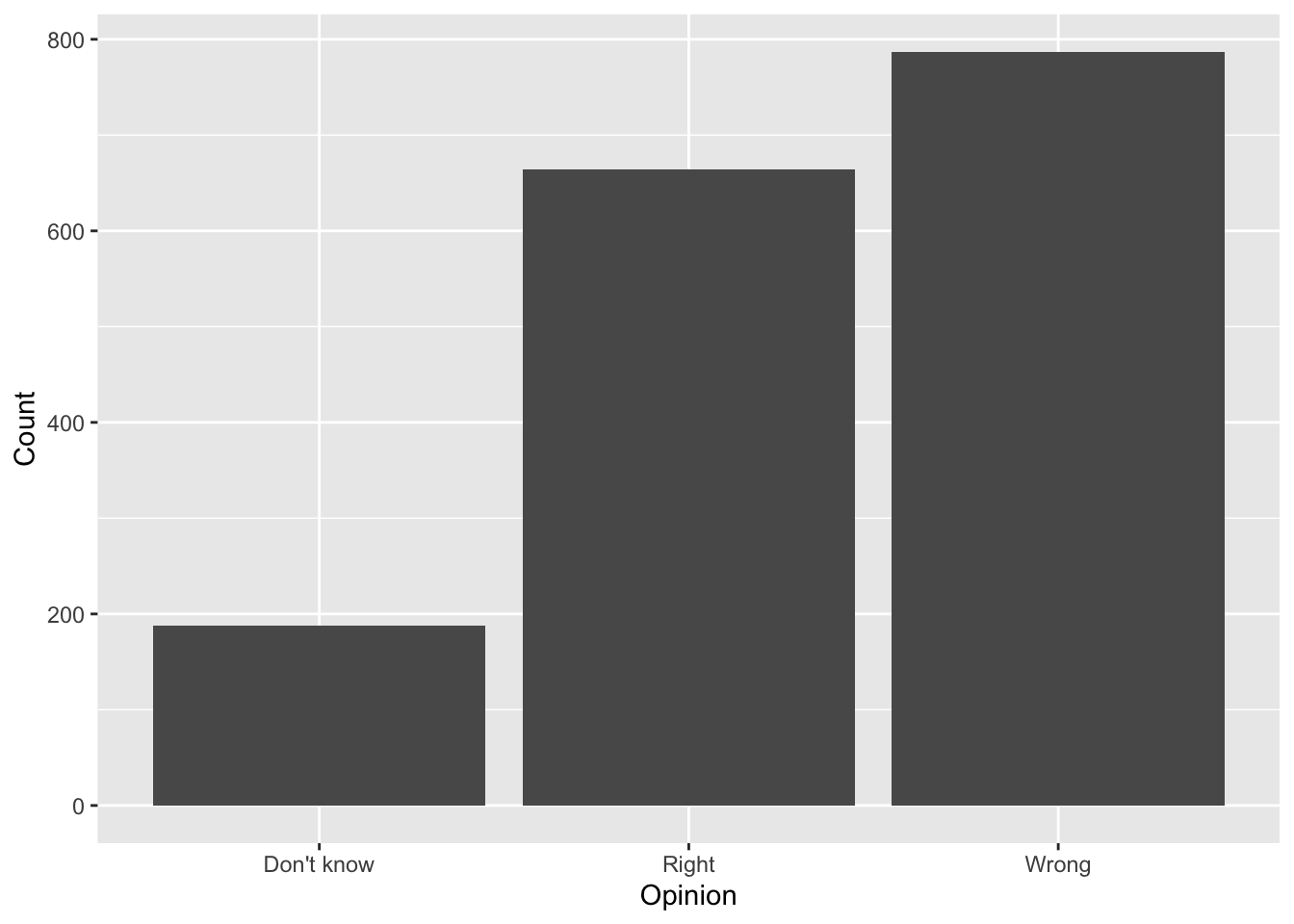

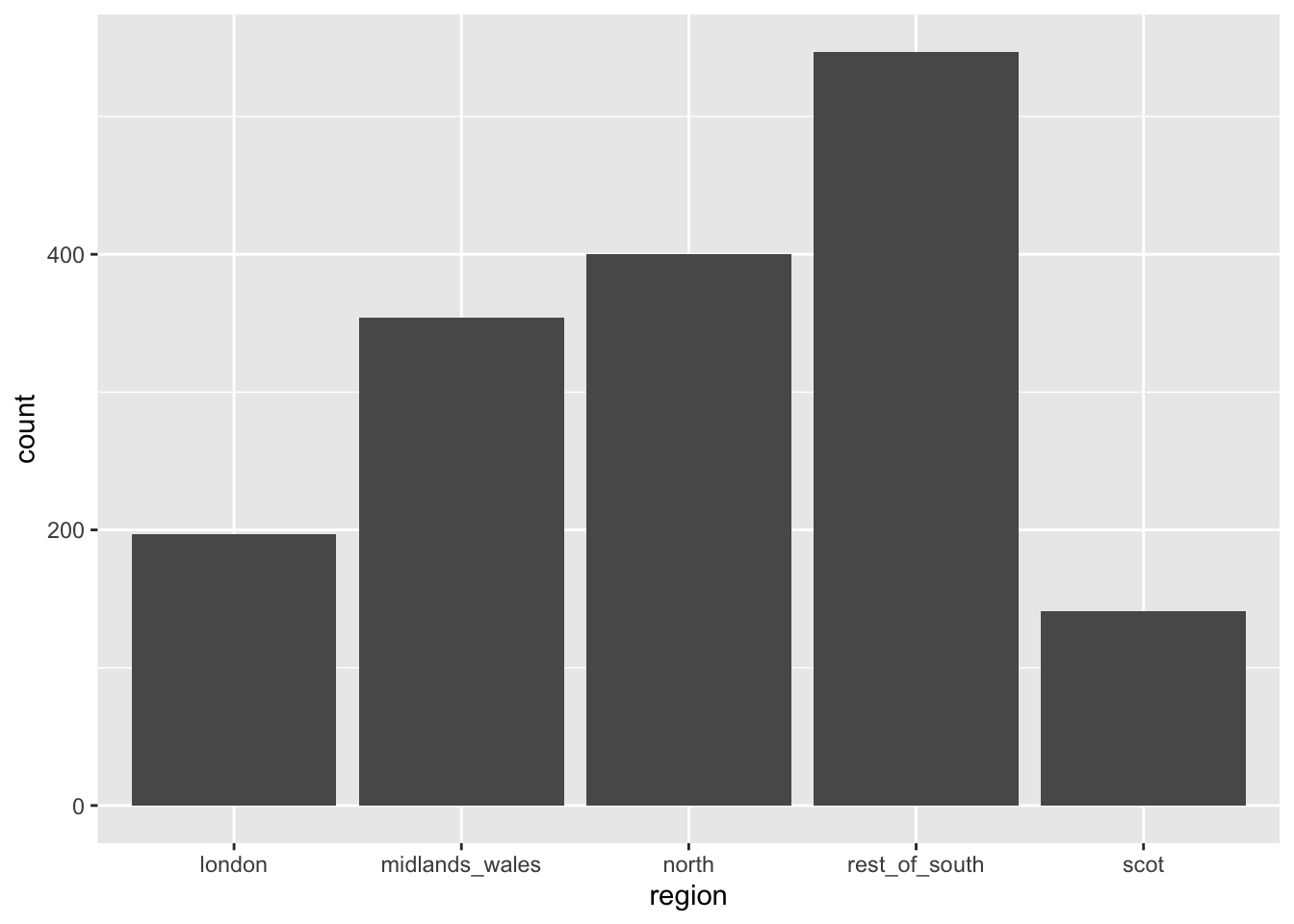

Order matters

Alphabetical order is rarely ideal

Order by frequency

Clean up labels

Alphabetical order is rarely ideal

Use inherent level order

Clean up labels

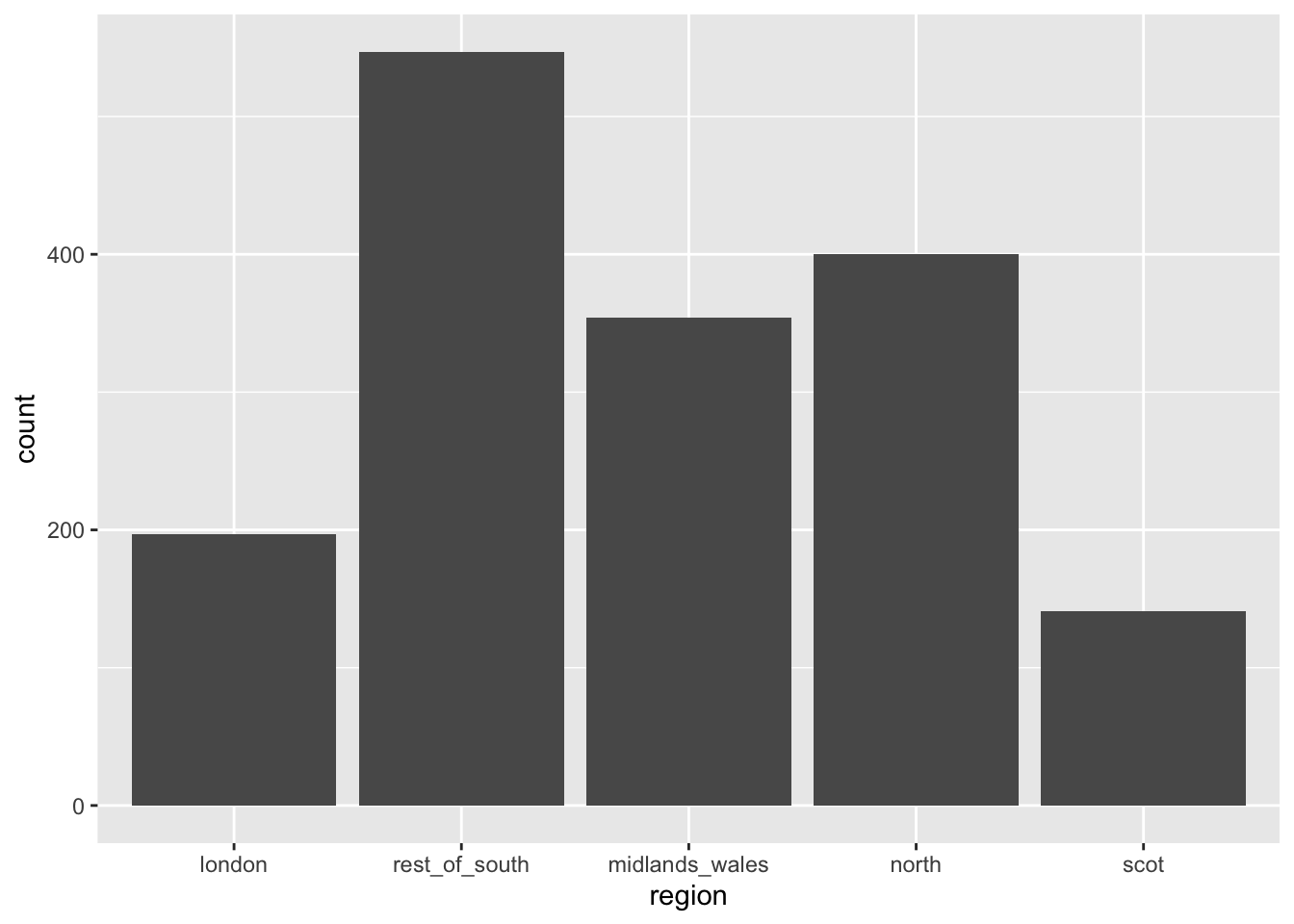

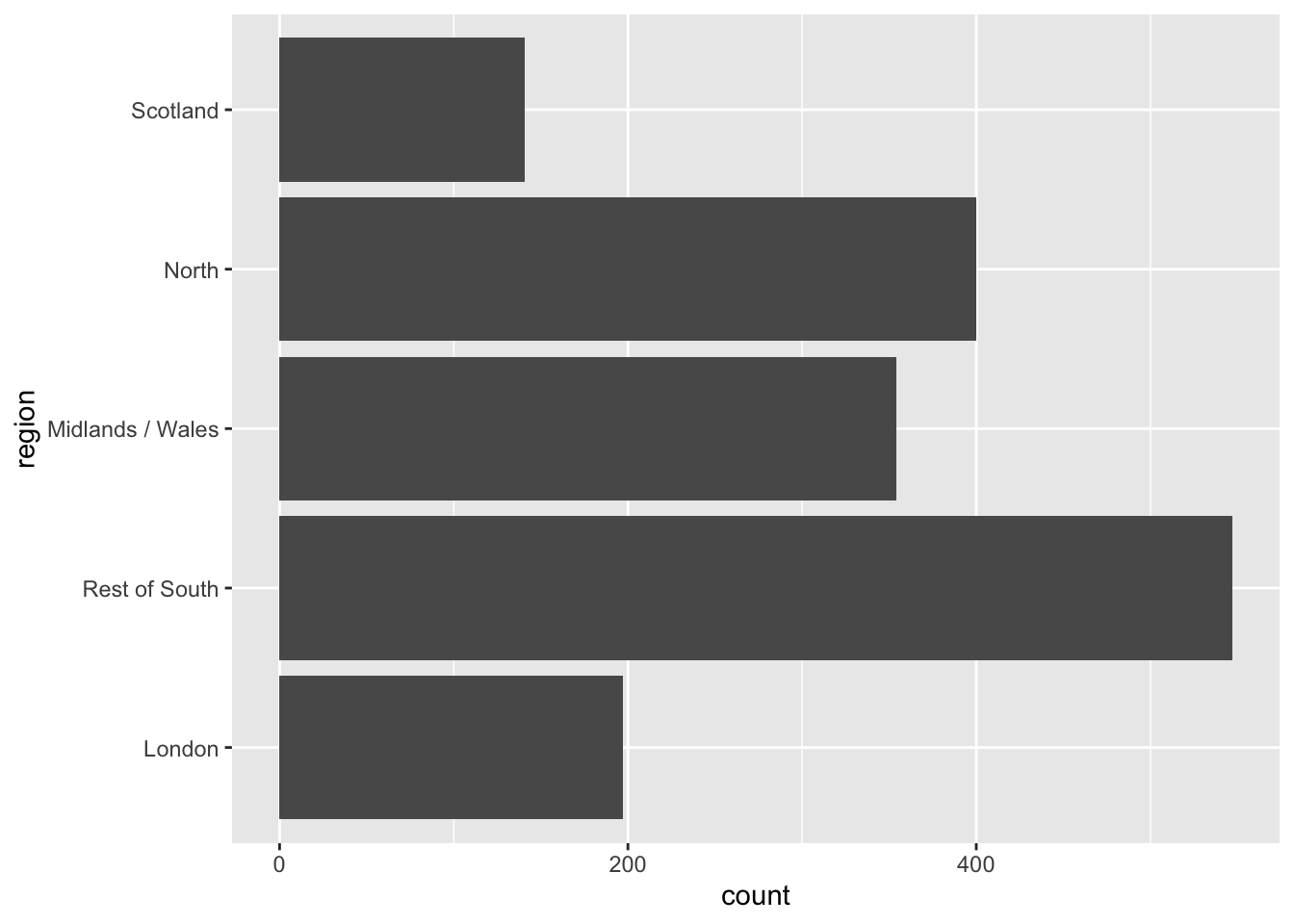

Put long categories on the y-axis

Long categories can be hard to read

Move them to the y-axis

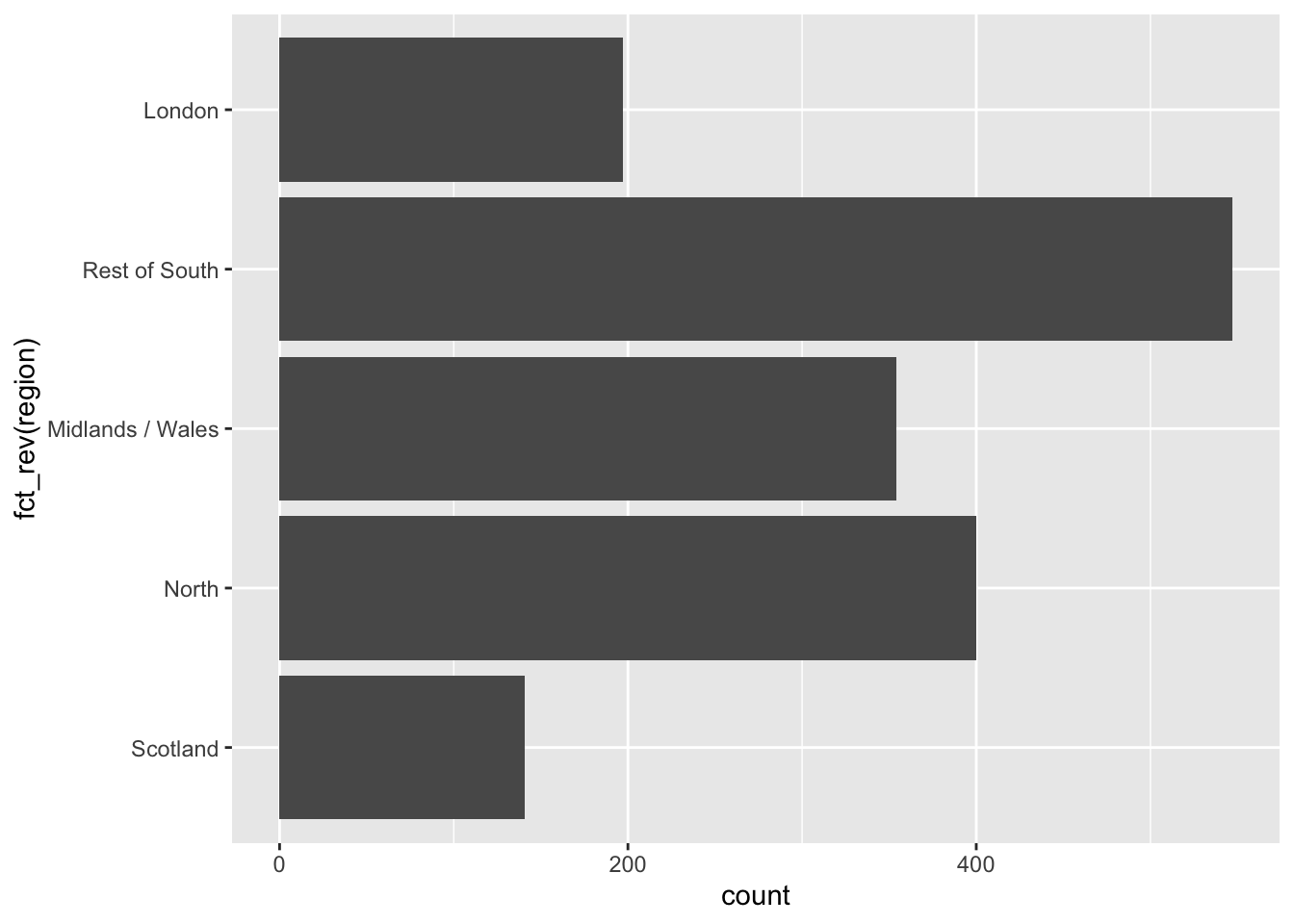

And reverse the order of levels

Clean up labels

Pick a purpose

Segmented bar plots can be hard to read

Use facets

Avoid redundancy?

Redundancy can help tell a story

Be selective with redundancy

Use informative labels

A bit more info

ggplot(brexit, aes(y = opinion, fill = opinion)) +

geom_bar() +

facet_wrap(~region, nrow = 1) +

guides(fill = "none") +

labs(

title = "Was Britain right/wrong to vote to leave EU?",

subtitle = "YouGov Survey Results, 2-3 September 2019", #<<

caption = "Source: https://d25d2506sfb94s.cloudfront.net/cumulus_uploads/document/x0msmggx08/YouGov%20-%20Brexit%20and%202019%20election.pdf", #<<

x = NULL, y = NULL

)Let’s do better

Fix up facet labels

ggplot(brexit, aes(y = opinion, fill = opinion)) +

geom_bar() +

facet_wrap(~region,

nrow = 1,

labeller = label_wrap_gen(width = 12) #<<

) +

guides(fill = "none") +

labs(

title = "Was Britain right/wrong to vote to leave EU?",

subtitle = "YouGov Survey Results, 2-3 September 2019",

caption = "Source: bit.ly/2lCJZVg",

x = NULL, y = NULL

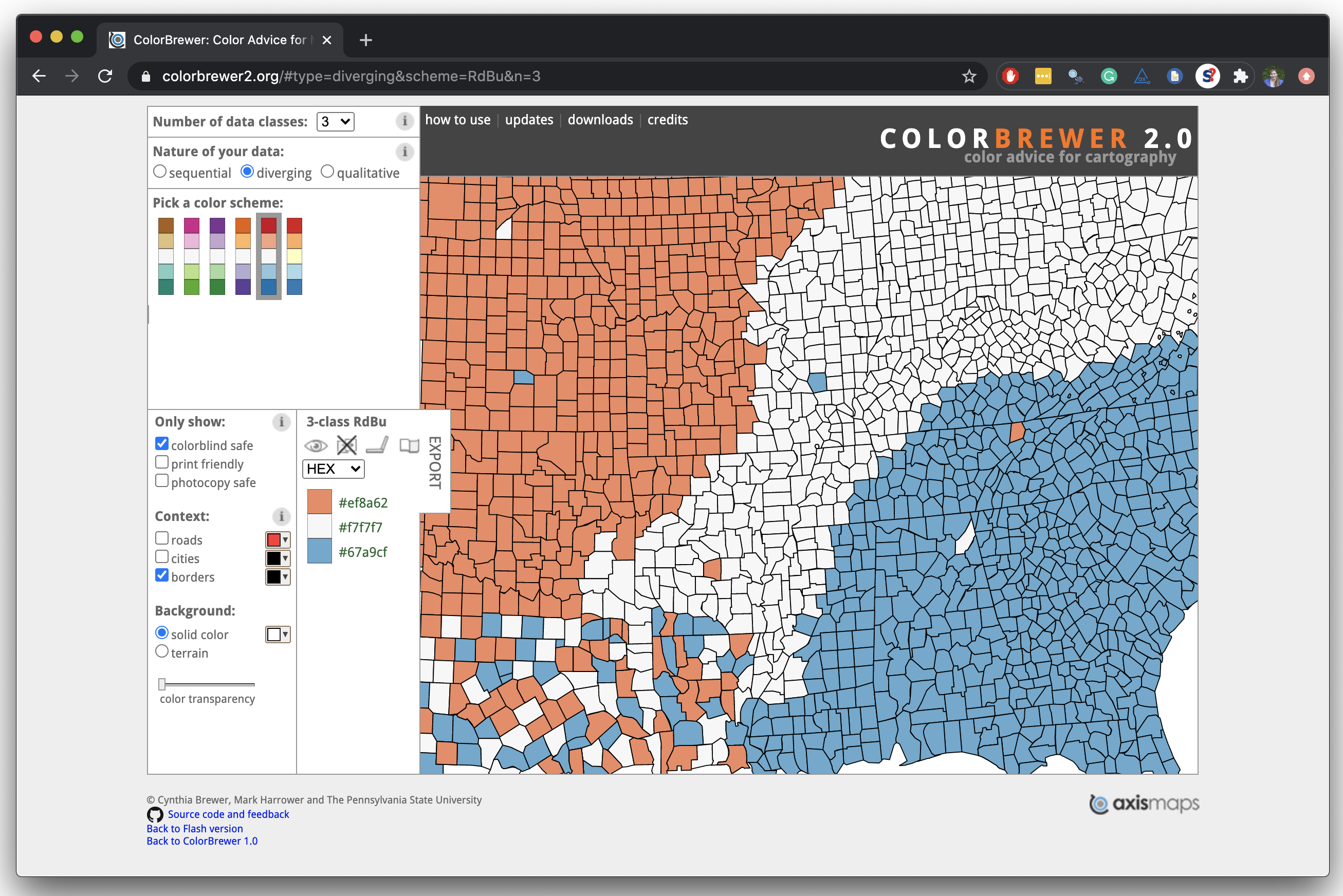

)Select meaningful colors

Rainbow colors not always the right choice

Manually choose colors when needed

ggplot(brexit, aes(y = opinion, fill = opinion)) +

geom_bar() +

facet_wrap(~region, nrow = 1, labeller = label_wrap_gen(width = 12)) +

guides(fill = "none") +

labs(title = "Was Britain right/wrong to vote to leave EU?",

subtitle = "YouGov Survey Results, 2-3 September 2019",

caption = "Source: bit.ly/2lCJZVg",

x = NULL, y = NULL) +

scale_fill_manual(values = c( #<<

"Wrong" = "red", #<<

"Right" = "green", #<<

"Don't know" = "gray" #<<

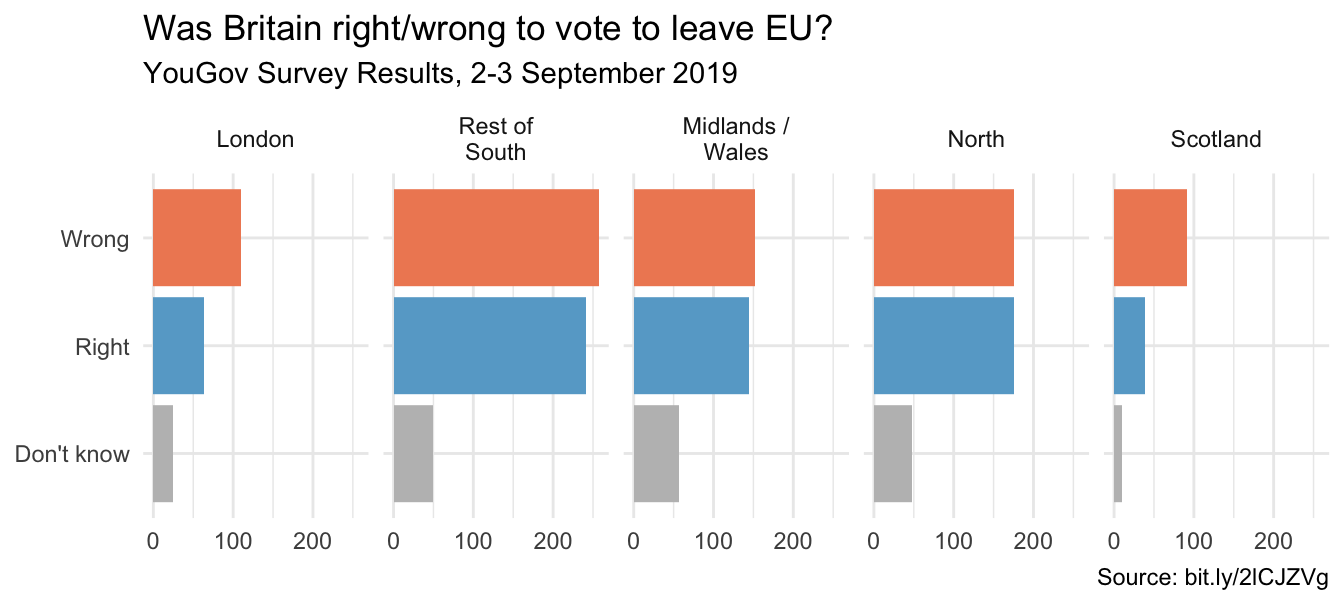

)) #<<Choosing better colors

Use better colors

ggplot(brexit, aes(y = opinion, fill = opinion)) +

geom_bar() +

facet_wrap(~region, nrow = 1, labeller = label_wrap_gen(width = 12)) +

guides(fill = "none") +

labs(title = "Was Britain right/wrong to vote to leave EU?",

subtitle = "YouGov Survey Results, 2-3 September 2019",

caption = "Source: bit.ly/2lCJZVg",

x = NULL, y = NULL) +

scale_fill_manual(values = c(

"Wrong" = "#ef8a62", #<<

"Right" = "#67a9cf", #<<

"Don't know" = "gray" #<<

))Select theme

ggplot(brexit, aes(y = opinion, fill = opinion)) +

geom_bar() +

facet_wrap(~region, nrow = 1, labeller = label_wrap_gen(width = 12)) +

guides(fill = "none") +

labs(title = "Was Britain right/wrong to vote to leave EU?",

subtitle = "YouGov Survey Results, 2-3 September 2019",

caption = "Source: bit.ly/2lCJZVg",

x = NULL, y = NULL) +

scale_fill_manual(values = c("Wrong" = "#ef8a62",

"Right" = "#67a9cf",

"Don't know" = "gray")) +

theme_minimal() #<<